Relationship Between Corporate Governance and Corporate Social Responsibility

Info: 8270 words (33 pages) Dissertation

Published: 22nd Nov 2023

Tagged: CSRCorporate Governance

CHAPTER ONE - INTRODUCTION

1.1 Background of Study

Economic developments, common market formation, and the corporate crisis have led to great interests in corporation’s leadership, internal regulations, risk management, and economic performance reviews term CORPORATE GOVERNANCE (CG). (Mirela-Oana & Melinda-Timea, 2015) CG is made up of the traditions, laws, policies and various institutions that make up the workplace for effective running. (Alam, 2014) Corporate Social Responsibility (CSR) infers the responsibility of the corporation to all its stakeholders.

There has been growing interest in CSR in recent times as the society believes a company should also be judged by their social and environmental impact. (Kathyayini & Carol, 2013) CG and CSR have become two of the most dominant business concepts in the world with a great connection, with CSR regarded as an extension of CG, and both carried out effectively simultaneously make a successful company, and help the society. (Dr. D.P Verma, 2012) This has led to calls from social groups and the public for the government to make strict laws binding corporations to engage in CSR, (Harjoto, 2011) since most corporations are profit-minded and self-centered, without empathy for the society. But, expectation level keeps rising, and dependency on the corporation to deliver social benefits increasing daily. (Jamali, Asem, & Rabbath, 2008) Current trends in globalization have seen CSR take a front position and requiring corporations to readjust and set CSR-based performance standards for long-term sustainability and profitability especially in this new era of fierce market competition. (Mirela-Oana & Melinda-Timea, 2015)

This research presents the in-depth relationship between CG and CSR with focus on the two of the most-developed nations of the world, UK and the US due to having better institutions, well-defined regulations and laws, higher rate of globalization with well-enhanced economies, powerful media, and well-informed social groups. The study revealed that one major problem with the disparity between both concepts is the non-uniform definition of the CG term due to its narrow and broad views which contradict and support CSR respectively. This study also reveals that a positive relationship between CSR engagement and profitability or increased worth/value. While also noting that the overall success of the company is divided into conformance and performance, driven by CG and CSR respectively. More so, CG in this era has been re-evaluated to perform similar internal tasks that intercept CSR mechanisms such as board and employee behavioral appraisal, accountability and so on. Also, governments and several groups have put in place several organizations to help corporations in response to CSR needs. The study also reviewed the response of top companies in both UK and US to CSR participation as further proof of the positive relationship that exists between them.

1.2 Aim and Objectives

This paper aims to explore the relationship between CG and CSR with a special focus on the US and UK. In doing so, the following objectives will be considered;

- Put forward a strong literature review of each concept which will help to explore important characteristics and history of CG and CSR to gain in-depth and fundamental knowledge of the two concepts.

- Put forth research questions which this paper aims to answer.

- Explore corporation sustainability as a link between CG and CSR

- Review case studies in the UK and US to show the link between profitability, value, CSR and CG

- Explore the role of government, social groups, and corporations in making CSR a successful tool in nation building, economic and social development

- Review the impact of the two basic views of CG on its relationship with CSR

- Review the action-response of top companies concerning CSR

1.3 Justification of Study

As CSR awareness keeps increasing, lots of research work are ongoing to uncover more trends in the relationship between CG and CSR. As such, managers, and board of directors of corporations need to keep themselves abreast of these new findings to be able to maximize their resources for a long term sustainable business. This paper will help disseminate information which will guide corporation’s boards, regulatory bodies and legislative arm of government on CG reforms, and making sure there is a well laid out structure in place for corporations and businesses to adopt CSR. This will stir up more research especially qualitative research methods which will involve the collection of accurate data and methods which can be further used to strengthen the positive relationship between CG and CSR.

1.4 Research Questions

This research will aim to answer the following questions:

- How have the views (narrow and broad) of CG impacted on how it relates with CSR?

- What steps have been taken by the government, non-governmental institutions, and social groups to solidify this relationship?

- How does sustainability impact on this relationship?

- Do corporations involved in CSR more profitable than those that do not engage in CSR?

- How has CG evolved in recent times to include CSR mechanisms?

- What are the differences between CG and CSR? And do these differences complement to form the overall success of the company when pursued simultaneously?

- How have the biggest companies been responding to this new dimension of business?

1.5 Project Structure

Chapter two reviews literature including studies on CG theories, the evolution of CG in the countries of study US and UK, and the characteristics, and components of CG needed for better understanding of the concept. The second part reviews CSR literature including the arguments for and against CSR, CSR models, dimensions, and importance. Chapter three discusses the methodology used in this work, the various resources harnessed, project timeframe, and milestones. Chapter four is the main body of the work which explores the relationship between CG and CSR. This chapter is aimed at answering all the research question posed in the previous sub-chapter, highlighting the results from the literature search and discussing this result to establish the relationship between CG and CSR. Chapter five, the concluding chapter and recommendation bring down the curtain on the research by reiterating the main findings and driving home the points of the research by confirming all objectives have been met and the aim of the research achieved.

CHAPTER TWO - LITERATURE REVIEW

2.1 Corporate Governance Literature Review

2.1.1 Introduction to CG

The term Corporate Governance (CG) has been defined from two perspectives, the narrow and the broader perspectives, though both having the same fundamentals of internal control system, board relationships, and satisfying the interest of the shareholders or other stakeholders. (Brikend Aziri, 2014) These views will be studied in-depth in chapter four. Jamali et al in 2008 gave an all-encompassing definition stating that;

“CG thus generally revolves around a set of universal attributes, including ensuring accountability to shareholders and other stakeholders, creating mechanisms to control managerial behavior, ensuring that companies are run according to the laws and answerable to all stakeholder, ensuring that reporting systems are structured in such a way that good governance is facilitated, crafting an effective leadership/strategic management process that incorporates stakeholder value as well as shareholder value, and enhancing accountability and corporate performance. As such, Leadership, direction, control, transparency, and accountability attributes thus lie at the heart of sound and effective CG”. (Pintea, 2015)

CG is more pronounced in developed countries like the UK and US due to better institutions, globalization, regulated securities market, well-developed laws guiding rights of stakeholders and fraud protection, fair treatment of shareholders, effective regulators and auditing sector, and well-regulated disclosure requirements. (Mohamad, 2008) All of this reflects the four components of CG which are fairness, transparency, accountability, and responsibility. (Guo Rui, 2015)

2.1.2 CG Evolution in the U.S and U.K

Three eras are identified in the US CG history. The first era was the managerial capitalism between 1960 and 1970, an era characterized by very strong managers, little power to the owners, and managers commitment to the corporation rather than maximizing wealth for shareholders, and difficult hostile takeovers, with the only Electronic Storage Battery takeover by International Nickel in 1974 the only notable occurrence. The 1980s ushered in a new era where hostile takeovers and investor capitalism became predominant. Manager’s power was challenged by shareholders while gaining more influence. This period saw macro economic growth decline, intense foreign competitions in industries, high-interest rates, and stagnated stock market returns. (Jackson, 2010) U.S companies engaged in debt financing with about $500 billion worth of equity retired, firms borrowed to finance major takeovers which increased leverage ratios due to leverage buyouts as debt levels exceeded 80%of total capital. (Bengt & Steven, 2001) In the 1990s, CG shifted focus to the shareholder’s value and executive defense. Managers gained more control, petitioned the government to make anti-takeover bid to avoid investors take over. (Jackson, 2010) The 1990s saw a fall of giant companies notably the Salomon brothers for violating the treasury rules in 1991 which stated they can’t buy more than 35% of treasury issue at auction. The U.S corporate world was suggested to have squandered its reputational capital and long-term sustainability. (Ronald, 2003) The Sarbanes-Oxley Act of 2002 was put in place to focus on corporation’s internal control, and audit, with costly non-compliance and binds on corporations and those outside affiliated with shareholders or affiliations to the US. (Kai, Kurt, Marylou, & Vinay, 2007)

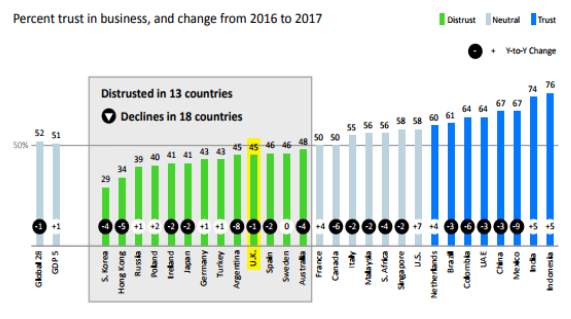

In the last three decades, the revolution of CG has grown well in the UK with the development of CG practices into a daily business routine by developing reports and code of ethics. Sir Adrian Cadbury, founder of Cadbury Company drafted the first CG code in 1992 which became the foundation of the London Stock Exchange (LSE) Code. Recent research shows that the level of trust in the British business is lower than other countries due to perceived unfairness in executive pay rise and tax issues. The recent CG scandals involving big British companies like Tesco, Rolls Royce, BHS, Sports Direct, and BAE Systems, and BHS have not been helpful as well. Figure 1 from the Edelman Trust Barometer 2017 shows the comparison of business trust levels in different countries. (House of Commons, 2017)

Figure 1: Percent Trust in Business, and change from 2016 to 2017 (Source: Edelman Trust Barometer 2017)

The UK CG practice is based on the ‘comply or explain’ procedure to encouraging dialogue between shareholders and board, and accommodate the diverse nature of businesses, ultimately making sure there is proper accountability for actions taken. (Financial Reporting Council, 2016) (Thyil, 2014) There are five major principles within the code which are leadership meaning every company must be headed by a chairman with clear responsibilities; effectiveness in terms of adequate level of skills and knowledge for executives for smooth running of the organization; accountability involving clear and accurate assessment of the company’s position always; remuneration of executive directors must be transparent and the executive cannot be involved in deciding his own remuneration; and, and relations with shareholders in forms of general meetings to pass across vital information. (Financial Reporting Council, 2016) Though, there has been a significant improvement in CG compliance among British business with a report from FRC showing a full compliance level amongst FTSE 350 companies has risen from 57% to 67%, while 90% of all UK companies are reported to have almost full compliance. (Delloitte, 2017)

2.1.3 Theories of CG

There is three theoretical approaches to corporate governance; the agency, stakeholder and stewardship theory. (Bob & Robert, 2012) The three theories are all based on the position and supervision of board managers, with differing levels of responsibility, and the way they go about to achieve corporate goals. While the agency theory has very relevant assumptions till date, the stakeholders and stewardship theory give a better all-around approach of modern day contemporary CG practices. (Tomsic, 2013)

2.1.3.1 Agency Theory

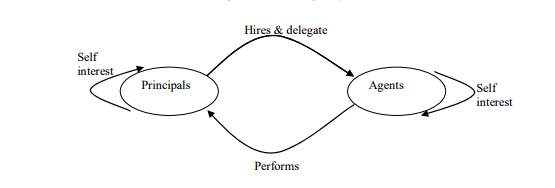

The agency theory is that which a ‘fiduciary mandate’ is conferred on a company’s board by the shareholders to fully manage the business without interference and to act on behalf and in the interest of the shareholders mainly to maximize profit, and report such performance to the shareholders. (Baldo, 2012) It is characterized by the principal (shareholders) -agent (Board) relationship with two main principles which are the concentration of the agent’s attention on the shareholders and economic achievement alone. (Solomon, 2007) In this theory, an agency loss can be claimed if the returns to the principals fall short of what they would have had if they had run the organization themselves. (Donaldson & Davis, 1991) With agents deemed to seek their own self-interest by taking actions advantageous to them alone, (Bob & Robert, 2012) principals introduce incentives such as reduced share price, salary increase, bonuses and long-term rewards for long-term profit maximizations, which in most cases have a negative influence on short-term decisions to be made which inherently harm the corporation’s values. (Geeta & Mishra, 2009) The theory is initially designed to separate ownership and control. Figure 2 shows the relationship between the principals and agents. (Ronald, 2003)

Figure 2: Agency Theory (Source: (Ronald, 2003)

2.1.3.2 Stakeholders Theory

This theory is an improvement of the agency theory which seeks to establish and recognize the impact of the stakeholders on the success of the organization. (Bob & Robert, 2012) Stakeholders are described as ‘those group without whose support the organization ceases to exist.’ (Geeta & Mishra, 2009) As opposed to agency relationship which is built on merit and performance review, stakeholders relationship is mostly based on trust built over an extended period of meeting and exceeding responsibilities. (Dima, 2008) This theory seeks to establish a balance between all actors to achieve economic, social and environmental goals, by treating stakeholders according to the amount of risk they bear; thus, incorporating ethics and equity into company’s strategy. This theory represents the answer to the present and future of CG as it gives way for ethical values to be incorporated into CG. (Baldo, 2012)

2.1.3.3 Stewardship theory

Stewardship theory was defined as one in which “a steward protects and maximizes shareholders wealth through firm performance because by so doing, the steward’s utility functions are maximized”. (Geeta & Mishra, 2009) This theory affirms that stewards (managers) get their motivation and satisfaction from company success and not incentives since they integrate their personal goals along with the company goals. (Bob & Robert, 2012) Stewardship theory works well in structures where the CEO has the autonomy power in a company and he is also the board chairman, i.e. where company power and authority are solely invested in just one person having the dual role. (Donaldson & Davis, 1991) While in agency theory, power is institutional, power is personal in stewardship theory as it is based on authority which is only assumed by a steward. This theory holds well in the US while it is separated powers in the UK. (Baldo, 2012)

2.1.4 Importance and benefits of Effective Corporate Governance

CG compliance increases the level of transparency in transactions and disclosure, better access to capital and financial markets, and aids survival in a competitive market through merging, acquisition, forming of partnership or asset diversification to mitigate against risk. CG provides the best Corporation’s exit policy, smooth transfer of ownership and wealth. Aids better internal control system of the corporation, promoting accountability leading to better profit margins. (Hilal, 2009 ) Good CG helps corporations to be well ahead of regulatory actions, and contribute largely to the long-term sustainability of their environment, thereby increasing its shareholder value. (Pintea, 2015) James D. Wolfensohn, former president of the World Bank said, “the governance of the corporation is now as important in the world economy as the government of countries”. As such there is a greater dependency on private organizations in nation building, meaning a good CG compliance ultimately leads to a stable political system. (Mohamad, 2008) Good CG attracts potential investors due to a good reputation. Arthur Levitt, the former chairman of the US Securities and Exchange Commission stated that;

“If a country does not have a reputation for strong CG practices; investors not confident with the level of disclosure; and if the country opts for lax accounting and reporting standards, capital will flow elsewhere. All enterprises in that country suffer the consequences.” (United Nations Conference on Trade and Development, 2003)

Effective CG helps a corporation channels its resources wisely, which helps to protect scarce resources in meeting the needs of the society, this helps capital cost as investors are confident of their investment. (Mousavi, 2013) (Mohamad, 2008) In December 2004, a study conducted at Georgia State University shows that public companies in the US having an independent board of directors have higher returns on equity, better profit margins, larger stock repurchases and dividend yields. (Brikend Aziri, 2014) Good CG will help the corporation attract better employees, increase staff morale, puts it in a position for better consideration for borrowing from financial institutions. (Almadani, 2014)

2.2 Corporate Social Responsibility (CSR) Literature Review

2.2.1 Corporate Social Responsibility and its Importance

Every organization depends on its stakeholders (owners, customers, employees, and the community they operate in) to develop a good image and goodwill for long-term sustainability. (Pintea, 2015) Corporate sustainability is defined as:

“a business approach that creates long-term shareholder value by embracing opportunities and managing risks deriving from economic, environmental and social developments” (Quest CSR, 2017)

Which means every stakeholder must be well-accounted for; this is where CSR comes into play.

Bowen (1953) defined CSR as;

“the obligations of businessmen to pursue those policies, to make those decisions, or to follow those lines of action which are desirable in terms of the objectives and values of our society”. (Pintea, 2015)

The Parliamentary Joint Committee on corporations and financial services defined CSR as striking a balance and controlling the triple bottom lines of economic, social and environmental impact of the corporation. (Pintea, 2015) Sir Adrian Cadbury, the founder of Cadbury Plc in 2002 encapsulated the whole idea of CSR saying;

“the broadest way of defining social responsibility is to say that the continued existence of companies is based on an implied agreement between business and society’ and that ‘the essence of the contract between society and business is that companies shall not pursue their immediate profit objectives at the expense of the longer-term interests of the community”. (Bob Tricker, 2013)

Friedman in 1970 stated that:

‘‘CSR is to conduct the business in accordance with shareholders’ desires, which generally will be to make as much money as possible while conforming to the basic rules of society, both those embodied in law and those embodied in ethical custom.’’ (Harjoto, 2011)

In general, CSR can be summarized in terms of the expectation of every stakeholder as;

“stockholder claim appropriate returns on their investment; employees seek broadly defined job satisfaction; customers want what they pay for; suppliers seek dependable buyers; government want adherence to legislations; unions seek benefit for their members; competitors want fair competition; local communities want the company to be a responsible citizen; and the public expects the company’s existence to improve the quality of life.” (Ronald, 2003)

It is important for organisation to identify their stakeholders, investigate their demands and merge these into the organization’s strategies and goals.

2.2.2 Importance of CSR

Porter and Kramar in 2006 developed the four-dimensioned CSR model; moral obligation, sustainability, license to operate, and reputation. The moral urges corporations to show they are responsible citizens. The sustainable dimension Is summarized in the word of Norwegian Prime Minister in the 1980s when he said, “meeting the needs of the present without compromising the ability of the future generations to meet their own needs.”. License to operate refers to the express permission of the organization from the state or federal government, their community, and other stakeholders involved to run the business. CSR helps the firm increase brand reputation, thus increasing motivation and the market share price value. (Thyil, 2014)

CSR is a valuable tool for businesses and nation building as it promotes ethical behavior, guidelines to improve the working conditions of organizations. It also helps to build the community in form of building infrastructures, maintaining a clean environment, and economic development. (Pintea, 2015) CSR helps to influence all operational aspects of a company with a mission strategy that unites all stakeholder. And it is no gain-saying that a company that will survive in this new CSR-obsessed generation must be greatly committed to every stakeholder. Carly Fiorina, the CEO of Hewlett-Packard stated that;

“… the winning companies of this century will be those who prove with their actions that they can be profitable and increase social value… companies that both do well and do good, and rewarding those companies that fuel social change through business.” (William & David, 2011)

In 2012, the Reputation Institute conducted a poll in the U.S which showed 42% of people’s opinion about a corporation was merely based on their knowledge of the CSR activities of that corporation, this shows the reputation of the organization is largely attached to CSR participation. (Pacific Continental, 2013)

2.2.2 Arguments for and against CSR

There are two extremes to the view of CSR, people who believe that organizations are mainly to produce make profit, nothing more, and those who believe organizations should only be allowed to do business if and only if they do no harm, and help solve societal problems. (Ronald, 2003)

Arguments against CSR can be seen from the following perspectives: firstly, the cost of corporate responsible actions is exorbitant and is paid for by lower dividends to stockholders, reduced wage for employees and price inflation, which invariably weakens the operating efficiency of the company. Stakeholders mostly have unrealistic expectations which clash with company’s realistic objectives. Corporations are deemed to have so much power, seems unreasonable adding social power to that, as there is a tendency for them to become uncontrollable. (Ronald, 2003) It is also believed that business people are strict professionals in their fields and are not trained to deal with social problems. More so, communities benefit best when corporations efficiently use limited resources, and this is best done when corporations seek their own self-interest. (McCabe, 1992) Many have argued as well that profits of the company belong to the shareholders, and using this for CSR amounts to theft. (Mallen, 2008)

On the other hand, CSR works helps corporations to balance their corporate power with corporate responsibilities, with adequate resources in terms of management, talents, finance; organizations can help the community where the government and other groups are incapacitated; as such help them minimize operational constraint and government or regulatory sanctions, more or less being proactive, more so solve the problems created by the corporations themselves like pollutions. (Ronald, 2003) Corporations have moral obligations of contributing to the well-being and welfare of the community they operate in. In the words of Charles Handy;

“The purpose of business is not to make profit, full stop. It is to make profit so that the business can do something more or better. That ‘something’ becomes the real justification for business. … It is a moral issue. To mistake the means for the end is to be turned in on oneself, which Saint Augustine called one of the greatest sins. … It is salutary to ask about any organization, “if it did not exist, would we invent it?” “only if it could do something better or more useful than anyone else” would have to be the answer, and profit would be the means to that larger end.” (Handy, December)

Paul Drucker in his words share similar sentiments saying;

“Profit for a company is like oxygen for a person. If you don’t have enough of it, you’re out of the game. But if you think your life is all about breathing, you’re really missing something”. (William & David, 2011)

Public support increases for an organization with CSR, with the result showing that 95% of total polls in the 2000 Business Week/Harris Poll in the U.S were in support of CSR inclusion in organizations. (Ronald, 2003) As such CSR helps the company “retain societal legitimacy and maximize its financial viability over the long-term” by gaining more customers, better market share, and attract more efficient employees leading to more productivity and profit while helping to create a better internal environment leading to employee motivation. (William & David, 2011)

CHAPTER THREE - RESEARCH METHODOLOGY

3.1 Research Method Employed and Research Process

(Kothari, 2004) described the four types of research; descriptive/analytical, applied/fundamental, quantitative/qualitative, and empirical/conceptual. Descriptive research entails the use of surveys and investigations, while analytical research, the researcher is only left with already-made information from various materials and resources. Applied research implies finding an immediate solution to a problem facing the society while fundamental research deals with theory formulations and generalizations to add to the existing body of knowledge. Quantitative research talks about measurement or quantity based research while qualitative research refers to research relating to quality like attitude, and opinion. Conceptual research is mostly used by philosophers as it involves abstract and development of ideas from scratch or formulation of a hypothesis, while empirical research is experience or observation based and doesn’t follow theories or rules.

This research follows the analytical research method using ready-made available materials and resources. Descriptive research method which would have involved a survey of corporations, interviews of board members and maybe face to face communications was avoided due to inadequate project time, as travel time, time invested in waiting for responses from board members of companies, or booking face to face interviews would be quite long as most top officials are always very busy, and as such there will be a serious delay to the project, which means it won’t be ready for submission.

In this analytical research, two key databases were used; Business Source Complete (EBSCO) and Proquest Business Collection. Both databases generated lots of journals, books, and articles in descending order of relevance to the searched keyword. Google search and google books were also exploited. The Swansea University library being so well equipped was also on hand to provide books on CG and CSR which were helpful in retrieving adequate information especially in the aspect of the literature review. Major keywords used include Corporate Governance, Corporate social responsibility, the relationship between CG and CSR, institutions, CG and CSR relationship, corporate sustainability, globalization, and CSR.

It took 3months to complete this project, with regular meetings with the supervisor on the progress of the work to make sure the objectives are being met and the milestones are achieved. The work started with general readings in the field of CG and CSR to gain adequate knowledge of the topic and to formulate the research problem and hypothesis.

This is followed by reviewing the literature to access what has been done in the field before and gain a deep understanding of the concepts especially as it regards the UK and the US. Also, this gave good insights into the existing relationships and major talking points in the main body of the work which was then used to draft the research aim and objectives, research questions and justification for the study. The work proceeded to the fourth chapter which is the main body discusses and analyses the relationship between CSR and CG. The conclusions and recommendations were made, and then the introductory part was written, as well as the abstract of the work.

CHAPTER FOUR - THE RELATIONSHIP BETWEEN CORPORATE GOVERNANCE AND CORPORATE SOCIAL RESPONSIBILITY

4.0 Introduction

In this present age, the society has become environmentally conscious with the backings of the media and various CSR-obsessed social groups; the society can challenge the actions of corporations which negate CSR standards. It has been revealed that 90% of the challenges corporations face today are mainly social and ethical issues including insider trading, security frauds, stealing and illegal stock sale, illegal use of company property, environmental pollution through improper toxic waste disposal, selling of quality-exaggerated products, sexual harassment, and so on; all these implicitly links the corporations to the society. (Ronald, 2003) Due to several CG scandals that have rocked several corporations, there has been increased concentration on some new areas to help curb such scandals in recent times, (Brikend Aziri, 2014) such areas include board, manager and employee behavior, corporate ethics, accountability, human and workers’ rights, auditor independence, self-regulated environmental protection, and stakeholder responsibilities. These are dimensions of CSR, as such, it’s just CSR embedded within CG. (Thyil, 2014)

The following sub-chapters will help to answer the research questions and discuss further on the findings made with several case studies from corporations in the United Kingdom (UK) and the United States of America (USA) presented to back each result findings.

4.1 Relationship Based on CG Views (Broad and Narrow Views)

One of the major problems in establishing a positive relationship between CG and CSR is the lack of a uniform definition for CG due to its dual views, the narrow and the broader view depending on who the boards are responsible to. The broader view is related to the stakeholder’s theory regards all stakeholders, while the narrow view related to the agency theory only gives regards to the shareholders. (Pintea, 2015) In the narrow view, Stenberg in 1998 described CG as “ways of ensuring that corporate actions, assets, and agents are directed at achieving the corporate objectives established by the corporation’s shareholders.” This view was also shared by Hess in 1996 when describing the state of CG in the US. This view establishes a negative correlation between CG and CSR. (Udo & Alexander, 2007)

The broader view relates the boards with every stakeholder, thus creating the overlap between CG and CSR since taking care of stakeholders and the environment is what CSR is about. Parliamentary Joint Committee on corporations and financial services in 2006 defined CG as “the company considering, managing and balancing the economic, social and environmental impact of its activities”. (Pintea, 2015) The Organization for Economic Cooperation and Development (OECD) in 2004 defined CG as “a set of relationships between a company’s management, its board, its shareholders and other stakeholders, …” (Hilal, 2009 ) This was also implied in SEC 2003;

“CG is an effective system of corporate governance provides the framework within which board, Management, stakeholders and other stakeholders address their respective responsibilities”. (Mousavi, 2013)

CSR in recent times has also been viewed as an ‘extended CG’, in which CSR extends the responsibility of the boards from the shareholders to all stakeholders. As such proving right, Porter and Kramar model of CSR as a license to operate as stakeholders give the company some degree of legitimacy. (Thyil, 2014)In 1970, Milton Friedman gave the ultimate answer to this dilemma when he said the only social responsibility of the corporation is to increase its profit, though this statement seems more as the narrow view. He later buttressed this to say profit will only be possible when corporations consider all its stakeholders. (Does social responsibility improve corporate?, 2014) With the business world embracing the broader view of CG daily, it shows a positive relationship between CG and CSR.

4.2 CSR and Corporate Profitability

While the definitions might be based on the individual’s perception of what they feel CG should be and entail and how times have changed, it does not necessarily have the best of factual backing that might be needed to make a bold claim of the relationship that exists between CG and CSR. One way to determine this is to ask and answer the most important question anti-CSR campaign groups have been asking. Does CSR improve the value or reputation of the company? Does it mean more profit or just an unnecessary overinvestment?

Barnea and Rubin in 2010 proposed the over-investment theory which opined that if CSR engagements do not translate to value maximization for a firm, the organization has over-invested and wasted resources, and this one of the reasons for CG, to eliminate waste. (Harjoto, 2011) CG and CSR are key in developing guidelines that help a company portray its societal responsibilities through performance. These guidelines help the company to thrive well in competitive markets. And as such, many companies have found CSR as a strategy to achieve company goals and objectives easily and faster. (Alam, 2014) The case studies below will establish the fact that CSR can help increase profitability.

Lush, a UK-based cosmetic firm with 800 stores spread across 40 countries reportedly made £321m worth of sales in 2010/2011 alone after embarking on ethical policies of creative buying of safe, best quality and most suitable products, and effective CSR reporting. (Tom, 2013) Carbon Disclosure Project (CDP), an NGO in September 2014 provided evidence linking business leadership on climate change control and company’s profitability, it stated that S&P 500 corporations that build corporate sustainability into their policies and strategies are more profitable with 18% return on investment higher than those who do not, and about 67% higher than corporations who have refused to disclose their emissions result. (shundarnagin, 2014) In 2010, Pepsi company saved over $60m in its energy use after embarking on an environmental sustainability program to manage carbon and energy assessment. (Tom, 2013) M&S revealed a £50m extra profit from its Plan An eco-program by recycling 92% of its waste in 2010. (Michael, 2011)

Stakeholders demands are a threat to company’s viability and value, as such, it is the responsibility of the company to see the threats as an opportunity to impress its stakeholders and mitigate through CSR. (Elizabeth, Barry, & David, 2008) Professor Henry Peter of the Geneva Law School argued that CSR guideline and laws are soft laws which are in high regard in the society, as such flouting these laws will result in bad reputation, resulting in loss of profit. More so, specialized rating agencies use CSR activities as part of the criteria in rating corporations which serve as standards for the public; a corporation with a low agency rating might have difficulties in accessing certain markets and gaining the right investors, which leads to reduced stock value. Hence why CSR participation and disclosure is paramount to any corporation. (Guo Rui, 2015)

(William & David, 2011) presented the otherwise case of Walmart US, with a record $401 billion in sales in 2009, over 4200 facilities, employing more than 2million people worldwide. With a strategy to minimize cost, offers the most competitive retail price to its customers. It has been criticized for offering low-income jobs, making smaller business to close due to its reduced product prices, and lack of CSR-activities to develop its environment. But Walmart keeps growing stronger each year, as it seems stakeholders such as customers, suppliers and the government do not care as long as they get quality products at a reduced price, supply the biggest company in the world, and get fat taxes respectively. The main question is would Walmart have been more successful if they care about CSR? Maybe? Maybe not, the bottom-line remains that not engaging in serious CSR activities has not had any serious effect on Walmart if any; as its low-income jobs are well-sought after with various job opening seeing over 1000% of applicants than positions available. Though latest reports show that Walmart participated in few minor CSR activities.

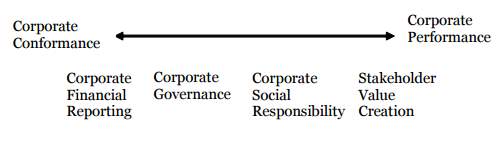

4.3 Differences that Complement; Performance and Conformance

While CSR deals with the external self-regulatory mechanism of the corporation while CG deals with the internal mechanism and regulations which aid the corporation make management decisions; leading to overall company management. (Verma & Kumar, 2012) In terms of risks, both CG and CSR are put in place to mitigate or reduce corporation’s risks, though in diverse ways while employed to achieve the same objectives. CG leads to conformance through reporting company financial activities, while CSR deals with all stakeholder’s demands and needs and evaluates the company’s performance. The sum of the corporate conformance and performance describes a truly successful company, as such a company without CSR is only being half successful. (Pintea, 2015) As such a failed corporation is one that has a failed CG on one-half and a failed CSR on the other side or fails on either side. (Alam, 2014) Figure 3 shows the link between the performance and conformance nature of CG and CSR.

Figure 3: Relationship between CG and CSR, Performance and Conformance (Source: (Pintea, 2015)

4.4 Evidence of relationship in new country corporation’s structures

Various countries are also restructuring to accommodate CSR and to help promote, create awareness, encourage and advise corporations on the need of CSR. The UK in the last 10years has created the CSR minister portfolio to carry out the responsibilities stated above. While also including requirements for reporting the environmental and social issue in the UK Companies Act 2006, these new guidelines also carry severe implications for defaulters. (Alam, 2014) Every sector in the UK has also been assigned a regulatory body to oversee the operations of the organizations in there. (Constantina, 2003) Organizations such as Department for International Development (DFID), The Ethical Trading Initiative (ETI), International Fairtrade Labelling Organization (FLO), Multi-Fibre Arrangement (MFA) Forum, The Medicines Transparency Alliance (MeTA), and other organizations in various fields have also sprung up to help businesses comply with CSR. (HM Government, 2009)

Organizations such as Occupational Safety and Health Administration (OSHA), Equal Employment Opportunity Commission (EEOC), the Consumer Product Safety Commission (CPSC) and the Environmental Protection Agency (EPA) assist corporations to incorporate CSR into their business strategies, maintain the standard, and set thresholds for corporate responsible behaviors such as pollution control, working conditions and consumer protection. The Centre for Corporate Ethics and Fair Labor Association are also important institutions which help company’s ethical culture and labor rights in the U.S. (Alam, 2014)

4.5 Corporations’ Responses so far

Corporation boards and executives are highly intelligent people who know what to do to make a profit. As such yielding to CSR demands will only mean that they see a deep connection between CG and CSR and company growth, long-term sustainability and profit. As such a positive relationship can be established between CG and CSR if it can be established that the biggest companies who have all the resources and power are yielding to the pressure and doing a lot in terms of CSR initiatives. Several case studies will be reviewed to see how the top companies in the UK and US are responding to the new CSR-obsessed era.

Salesforce.com recently started the 1% solution, which means the company will use as philanthropic work 1% of company’s equity, employees’ paid work hours and profits. SAS, a US software maker now encourages and allows its employees to go on paid community work during work hours. Accenture loans its employees at a very small price to NGOs, while Cisco systems place its employees with educated-related organizations for a year of full salary, which is like Pfizer which place its employees on research and training to help NGOs. (William & David, 2011)

In a 2007 survey, the Committee Encouraging Philanthropy (CECP) reported that Fortune 100 companies in the US and UK gave a median amount of $46.31 million, and 71% of the companies gave better than they did in the previous year. In the UK, between 2003 and 2004 alone, publicly traded companies gave a total of $1.6 billion to NGOs. Even Walmart was reported to have collected donations for the victims of Lowa Flood in 2008. (Mark & Archie, 2010) Pornhub, an adult entertaining company worth around $3.46bn officially launched its online free sexual health centers where the public can get information about sexuality and health, relationships therapies from doctors, therapists and community leaders, all free of charge. It also gave $25,000 college scholarship in 2015, while donating 1cent for every video viewed on its site to breast cancer research. (Oliver, 2017) In 2015, EPG, a consulting firm reported that Fortune 500 British and American companies spent a total of $15bn a year on CSR initiatives alone. (Matthew, 2015) General Electric GE reportedly donated $88million to educational and community health projects in 2016. Deloitte allows its employees to take part in pro-bono work which helps them gain skills and job satisfaction. IBM’s World Community Grid in 2016 helped to combine the computing power of several pcs and phones across the worldwide network amounting to 167,000 years’ worth of computing time to help in cancer research and several health projects. 3M Gives initiative donated $67million in 2016 for the community, environmental and educational projects. Apple in its bid to save the planet has now turned to new packaging which will cost more and it’s 99% recyclable. Walt Disney reportedly donated more than $400million to NGOs in 2016 and encourages its employees to donate time to community service which is expected to total 5million hours by 2020. (Nupur, 2017)

It’s simple, if CSR doesn’t add any value in terms of making the corporation more acceptable, legit, profitable, valued, worthy, then this hefty sum of money will not be lavished out on CSR work, and not just by any small company looking for fame, but top organizations in the most developed countries of the world. It means one thing, they have their eyes towards long-term sustainability, and as well as short term rewards in form of profit.

CHAPTER FIVE - CONCLUSION AND RECOMMENDATIONS

5.1 Conclusion

Due to changing needs and expectation in the society, as society tends more and more towards a social responsible obsessive era, it is imperative for corporations to react and adjust accordingly to remain relevant and stay competitive. This work has been able to establish several positive relationships between CG and CSR, including the trending broader definition of CG which directly incorporates CSR into company strategies, as well as the fact that corporations profit when they engage in CSR, though might prove costly at first, but on the long run, it is a profitable business, and that’s what business is all about, to establish strategies and take actions that will ensure its long-term sustainability. Even though there have been few companies who are defying the odd, they are doing really well without any major or serious CSR programs, since they rely on producing quality products at a very reduced price, but only time will tell if they will stand the test of time in this new era. CG and CSR have portrayed as producing the overall success of a company in terms of conformance and performance respectively can be likened unto the two sides of a coin. To be candid, if corporations are going to act humanly, it should not be a big deal to engage in CSR as much as they can afford to, because CSR is nothing short of looking out for others and making sure they are comfortable, in simple language as the bible puts it, “being your brother’s keeper”. While several case studies have shown the link between CSR and profitability, sometimes it is difficult to determine in terms of some other abstract CSR parameters which are difficult to quantify.

5.2 Recommendations

From the various finding in this work, the following recommendations would be made:

- An empirical research analysis would do more justice to this field of study for future research, as it will help keep up-to-date what companies are doing.

- Government and regulators should make legalized laws on CSR which binds on every corporation with hefty fines for non-compliance or false reporting, as was the case with Volkswagen company which gave a false reading of its carbon emission. (Matthew, 2015)

- While paying attention to CSR, CG should also be considered deeply as a company with good CSR but bad CG will only be wasting company resources. Such was the case of Enron which accrued debts worth $31.8bn after bagging several CSR awards. (Smale, 2006)

- More awareness to all stakeholders to fully understand this new trend and make the right decisions when patronizing firms

If you're working on your own dissertation in the field of CSR and looking for assistance, the dissertation writing service provided by ukessays.com will connect you with a professional academic writer specialising in your field.

Cite This Work

To export a reference to this article please select a referencing stye below:

Related Services

View allRelated Content

All TagsContent relating to: "Corporate Governance"

Corporate Governance is a term used to describe the way in which a corporation is governed and how operations are controlled. Corporate Governance covers the processes and procedures that employees must follow during business operations.

Related Articles

DMCA / Removal Request

If you are the original writer of this dissertation and no longer wish to have your work published on the UKDiss.com website then please: