Foreign Direct Investment (FDI) and Economic Growth in Afghanistan

Info: 11295 words (45 pages) Dissertation

Published: 27th Oct 2021

Introduction

This chapter will emphasize on the background of study and will define reason considering selection of topic for thesis. This chapter highlights the background that shows Nexus between Foreign direct investment and Economic growth in Afghan prospective, objective of study, research methodology employed, data sources, relevance of study, limitation and chapter scheme of the thesis. The main motive of this chapter is to provide deeper insights in the study.

1.1 Background of Study

International Business, Foreign Direct investment and Economic growth are of vital importance in regards of Afghanistan Economy. Enormous amount of research has conducted for this specific topic, as Investment in foreign countries are one of the highlights for investors that could lead to them to higher returns. The analysis of such research is fundamental for economic decision making that drives investment and capital. Here International business defined as those activities that includes transfer of goods, services, people idea, resources and technologies across boundaries. Studies based on international business, will affect above-mentioned activities both on domestic and foreign markets, apart from these different countries, government and companies endure these activities. Individuals who tends to be successful in doing business and recognizing opportunities needs to understand the diversity of marketplace and intake risks, uncertainties so that they could make their own place in global market and make a change.

Foreign direct Investment defines to be an investment by an investor in a business from a host country into another country, having control over company acquired. According to the Organization of economic cooperation and development (OECD), companies whom retain 10% or more of business possess “control”. Those companies or businesses that makes foreign direct investment is called as Multinational Corporation (MNC’s) or multinational enterprise. Based on nature of owning a business they have divided MNC’s into different categories such as making new foreign enterprise by direct investment is known Greenfield investment, or acquiring foreign enterprise are known as acquisition or brownfield. “An increase in the capacity of an economy to produce goods and services, compared from one period of time to another” said to be economic growth. More elaboration will be required for thesis topic as there are vast indicators to summarize a country economy and its performance globally.

1.2 Status of Afghan Economy (Macroeconomic Variables)

Afghanistan Economy is one of the developing economies from eras of war and conflict. This economy has remained dependent over foreign aids and investments since 2001 (Taliban regime). A lot of challenges has been faced in post-2014 era regarding transitions into security, economic and political aspects. There has been decline in economy of Afghanistan due to extraction of international troops, assistance and grants. Economy of Afghanistan has struggled since start of 2016 with continuous uncertainty of provinces like Kunduz and Helmand which are key and northern provinces of Afghanistan, which showed progress of Taliban activities in those regions and became headlines hence investments declined and reason for such condition affected investors mind to investment their capitals in Afghanistan resulting extremely poor economy despite of fact that there have been improvements in life expectancy, income and literacy since 2001. Majority of Afghan population lacks housing shortage, clean water, electricity, medical care and unemployment. These factors cause Afghanistan living standard to be lowest in world among other countries. Resulting weak infrastructure, governance, insecurity, corruption, and government laws of country makes it hard and pose difficulties to future economic growth. Currently Afghanistan economy is dependent upon agriculture sector which covers an important portion of gross domestic product (GDP). And in year 2016 they had low harvests mainly of cereals. Due to instable security conditions weather has been aggravated causing diseases and constrained agriculture productions. The Warsaw and Brussels conferences were crucial to ensure a continued support until 2020.Afghanistan’s development partners pledged security grants of $4.5 billion and development support of $3.8 billion annually.

1.3 Macroeconomic Background

Import has been a significant variable for Afghanistan Economy, as domestic demands in all sectors of economy are being supported by imports. This factor causes Afghanistan own monetary policy to be dependent upon inflationary pressures. In 2003-2008 it showed an average inflation of 13 percent, in 2009 declined to 10 percent and reason for decline was mainly due to decrease in prices of commodities imported from trading partners, as well as good agricultural harvest in Afghanistan. Where as in 2012 and 2013 the prices remained at 5.8 and 7.2 percent respectively. The IMF states that decrease is due to political uncertainty in the country, and reforms in taxation, investment procedures, growing income, infrastructure, better communication and size of market can be reasons for growth. Enoma and Mustapha (2010) conducted research on factors impacting investment decisions in Nigeria. The paper’s findings included that political, economic, social, environmental and religious factors have significant impact on investment decisions. Similarly, IMF states that there was decline to 18.6 and 18 percent in 2012 and 2013 in investment respectively. The cause for less growth in investment was elections and the pull-out of US combat forces from Afghanistan by the end of 2014. From all above statement we can conclude that imports significantly is declining in Afghanistan as compared to year 2013. And exports in volume remained below USD 1 billion and it showed insignificant increase as compared to 2012 and 2013, due to declining levels of trade in carpet, and dry and fresh fruit.

Unemployment yet another factor regarding 2017 reports can also be creating challenges for Afghanistan. There are few projects like Citizen Charter and Traditional Quick which could find apprenticeship and internship programs funded by donors but if government is not willing to take some exceptional steps to improve security, budgeting and political situations they may face hurdles for upcoming years for providing jobs to qualified candidates.

1.4 FDI in Afghanistan

Afghanistan government encourages FDI focused on improving infrastructure, pursing engagement in bilateral and multilateral trade agreements and trade related reforms in construction, telecommunication, and transport and logistic. FDI investments decreased from 2005 to 2013 in Afghanistan due to lack of rule of law. Afghanistan ranks last globally and regionally on the strength of investor protection in World Bank doing business 2012 report.

The major sector attracting FDI in Afghanistan was the service sector 89% while manufacturing attracted 10% and agriculture 1%, this information is taken by AISA. Afghanistan has perceived major accomplishments in terms of regional integration, economic cooperation, and infrastructure development when its concerned with FDI. Certain studies show that there was a decline in FDI in year 2011 till now, but the new strategies are projected to boost investors for investing that billions of dollars in foreign direct investment (FDI) and aid assistance, both foreigners and Afghan, to invest money into the economy. FDI in Afghan economy is covering 43% of country GDP as there has been more than $83 million of foreign direct investment. Some of the FDI projects implemented in Afghanistan in year 2016, are described below, briefly:

- In May, Afghanistan, Iran, and India signed the Chabahar port agreement. The arrival of first freight train in Afghanistan’s Hairatan port from China via Kazakhstan and Uzbekistan

- In November inauguration of the Turkmen part of trilateral railway in Turkmenistan, which connected Afghanistan to an international railway network, were other significant steps in the right direction.

- In the same context, another important achievement was Afghanistan’s formal admission to the World Trade Organization (WTO) in July

- In another achievement, the Salma Dam, which was inaugurated in June by Indian and Afghan leaders, was an important breakthrough in energy infrastructure development in Afghanistan. This project can produce 42 megawatts of electricity and irrigate 80,000 hectares of farmland.

- There has been made 200$ million Investment in telecommunication sector more specifically Roshan wireless company by Agha khan foundation.

- Another investment is made for an amount of 150$ million in Afghan wireless company by US based telephone International company.

- Huge investment of Habib Gulzar company, whom invested in owning patents for bottling plant (Coca-cola) and PepsiCo is competing against Alokozay bottling plant.

- These developments in Afghan economy will ensure consistency, cost-effective trade and transit opportunities in the region. Hopefully there will be expected gains of these projects will not be realized in short term.

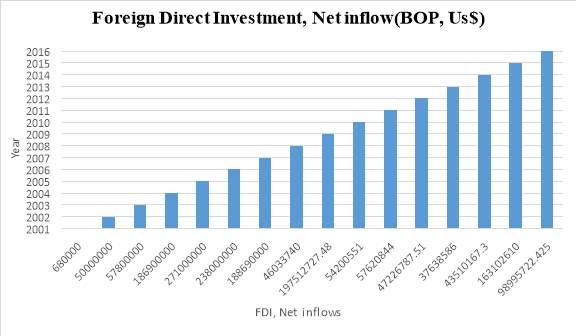

Figure 1.1 Shows Total FDI net inflow (BOP, Us$) in Afghanistan

Data Source: The World Bank

This figure illustrates the graph for year 2001-2016 that shows total FDI on GDP, here we see increase in year 2001-2004, whereas year 2005 in graph is showing on its highest peak

1.5 Types of FDI

There are countless groups that can be utilized to categorize FDI. It can be categorized from the motive of direct investors that leads them to go in homeland enterprise, while entrance of investing firms, from the shares of assets they control, from types of industries in investing firm’s setup production facilities, etc. Intention for this study is to know to various types of FDI;

Table 1.1

| Types of FDI | Characteristics |

| Greenfield investment |

|

| Brownfield investment |

|

| Mergers and Acquisition |

|

| Join Venture |

|

| vertical |

|

| Horizontal |

|

| Platform |

|

| Backward |

|

Sometimes it is hard to understand the precise kind of FDI. For example, across the privatization of firms in 1990s in transition economies of Central and Eastern Europe it was usual that after mergers and acquisitions, firms made comprehensive investments into enlargement or rearrange (brownfield FDI) or even into constructing new abilities (greenfield FDI).

Table 1.2

| Impact of FDI | |

| Positive impact | Negative impact |

|

|

1.6 Economic growth of Afghanistan

Afghanistan has shown progressive economy in past years and has improved its rank among countries but stays stagnant on poverty, discrimination, gender, illiteracy, and income. According to world business survey conducted it showed that Afghanistan has ranked 168 out of 189 economies. There are certain factors which brings life stability to individuals, enabling them to fulfill their life desire. Two important factors are social and economic development that could lead people towards their capabilities and efficiencies. When individuals can acquire primary needs of their social life it becomes easy for them. Every nation, every community stands to bring changes, make new start, innovates in their society to make desirable living standards. When people of a community recognizes developmental factors they begin to spot, share and integrate data which they need. There are certain facts which are barriers to power brokers and officials to reach towards developmental and goal achievements which are Religion and Ethnicity. Afghanistan larger workforce is covered by their agriculture sector, and there lies fact that economy of a country is prevails in their agricultural sectors. This nation copes with difficulties for creation of employment and jobs due to lack of resources and economic conditions. Its configured that 36.5% of Afghan population is living under national poverty line and differences has been notified between living standard of rural and urban areas. Another issue which leads to low economy is that due to man dominant nature, women are not allowed to be educated or work outside their homes and figures show that 15.7% of women are covering labor market where as men are covering remaining 80.3% of labor market. If we see through vast scope, women are given less seat in politics compared to men, acquiring 27.6. The rural areas of this nation cover only 19% of household facilities with basic needs like access to water, electricity and urban areas show 58%. The capital city Kabul province has poverty rate of 29%, while south provinces like Paktia has 79% poverty rate. Other factors like illiteracy, Income inequality, also shows variations based on rural and urban areas and also gender. Apart from mentioned obstacles, Afghan nation also goes through another hurdle which is safety of food, there are no rules or laws accordingly applied for using preservatives in keeping good hygiene of food materials.

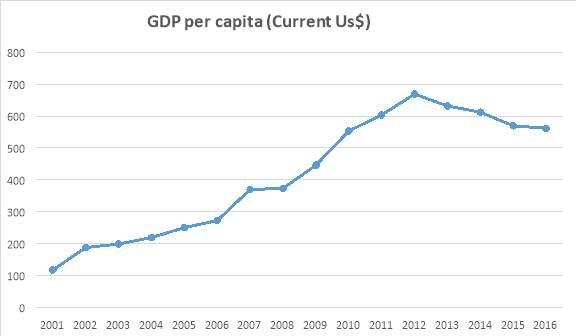

Figure 1.2 shows Total Gross Domestic Product for Afghanistan

Data Source: The World Bank

This figure explains the graph which is showing total GDP of products. It identifies consistent increase in GDP from year (2001-2012)

1.7 History

Afghanistan history deals with decades of war with different troops such as Taliban regime and Al-Qaeda, people started to migrate to different neighboring and other countries searching for peace and life stability. Ages passed and power of Taliban regime were rising and taking over almost all the provinces of Afghanistan and implementing their government, since then it was time that the United States of American took initiative and proclaimed war against Taliban and their elimination, as so they got victory in battleship with these troops and introduced this country towards harmony, constancy and progress. International aids and investments started taking place for the amount of billions of dollars but no economic progress was seen, but only poverty. Apart from all these investments made there were no shades of life getting normal for people of this nation. Influences for such weaken condition are many but here we will highlight few of it; government is taking no responsibility to bring change and work for their people, weak security, official or administrations which are following corruption and bribe, all of these points only lead this country towards deprived economy. These are reasons due to which public show detestation toward government and regulation. This only results in poor economy, shattered hopes and poor living standards in this country. Over 10 years of struggle in this country regarding politics, security, education, equality, stability but yet again the people is facing underprivileged existing. Interferences of global programs, countries from all over the world bringing assistance but people are hopeless, because the nation stands with poverty and they have no reliance in government and global enterprise operating here. Failure to address the Afghan people’s basic needs and build strong foundations for sustainable social and economic development which states that “We see the country lost for another generation”.

1.8 Economic growth Determinants

Research study needs to elaborate over various elements which could impact progress in economy. Studies have always shown that determinants are correlated affecting high rate of GDP. Here we will briefly discuss six important determinants naming two major ones; Supply factors, demand factor and efficiency factor;

Supply factor: It identifies the importance of services and goods within an economy.

Natural Resource: Natural existences of goods that possesses monetary value is called natural resources. It can be calculated as increase in rate of economic growth on increase in quality and quantity of natural resources. Few examples that could best explain natural resource are fossil fuels, oceans, wild life, precious stones, precious metals and etc.

Human Resource: It includes workforces of both skilled and unskilled human resources. If there is increase in quantity and quality of workforce, then there be an increase in economic growth.

Capital Good: Plants and Machineries are tangible assets which refers to tangible assets and results in production of goods and services. Huge investments in capital goods can result into higher production of goods and services and economic growth increase for future.

Technology: It helps in advancement of system with a country. More technology means more advanced software which could ease work of individuals. It can be invented or current systems can be used for efficient use and brings variations. Better techniques will lead towards fast production increasing development in economy.

Demand Factor: It is also explained by an equation which states increased supply of goods and services results in increased demand of goods and services which is caused by supply factors.

Efficiency Factor: The equation shown as “output to input ratio”, illustrating that if there is high efficiency in any field regarding employment, education or income there will be higher economic growth.

1.9 Importance of Economic Growth & FDI

Every nation of globe realizes the significance regarding FDI encompassing developed countries as well as developing countries. Growing marketplaces and growing states are in demand of funds The Afghan government is encouraging Foreign Direct Investment, in fact the Embassy of Afghanistan in Washington, DC, offers this enticement to investors: “Your decision to consider investing in Afghanistan is a smart one. There is no region in the world with greater untapped economic potential than Central Asia. As an area rich in human and natural resources, profitable investment opportunities abound.” and resources to continue their development and progress for which they propose better returns.

As financier in the developed countries, invest their capital in developing countries on the exception of lofty profits. So this movement of wealth is advantageous and healthy for both of them. It is pointed out that return on the investment is on the higher side while GDP is on the lower level i.e. deprived host country suggests that these countries obtaining low per capita GDP are appropriate targets for higher returns of FDI.

Countries and investors overseas usually show their interest towards investment in developing countries because it can assist them both in terms of infrastructures and promising polices to invest. If a country possesses attractive and solid policy, it can circulate foreign investment with great desirability. Yet major reason of investment in developing country is their comparatively young and inexpensive human resources.

1.10 Linkage between Economic Growth & FDI

The research topic here signifies importance for many researchers and scholars and yet a lot of work has been taken place to know Nexus between FDI and Economic growth regarding countries which are established and those ones which are establishing. Plenty of arguments are identified which states that FDI might have negative or positive influence on economic growth but our main concern is to know relationship between the two important aspects. Hence we will use some of researches work to have more elaboration to this topic, showing that productivity is highly related with economic growth. When there happens inflow of FDI, it can positively affect economy keeping other factors in mind too, different countries have different approaches and mindsets towards FDI which could either get them good or bad outcomes. Since FDI contributes to expansion of economy it has become a key prospective to all researches to know more about its affects, its implications and its reliability. In either way could be good or bad there is relation among these two variables (FDI & economic growth). Here to make our study arguments stronger we will elaborate on some of researcher works as (Mahmoud and Fatima,2007), according to them recently there has been restored attention in development of determinants and the considering research study on externality-led growth, with the endogenous growth theories, which has made it believable to suggest that FDI is one of the factors for economic growth. If we study FDI we conclude that it is one investors most interest to invest or start their companies in another country with more profit and less regulations. We can say that FDI is capital inflow, merger of expertise, more advanced technology and creation of beautiful infrastructure into host country. From sources that we have concluded in this study, (The World bank, 1996) defines FDI as an investment made to acquire a lasting management interesting having 10% voting rights in an enterprise operating in another country. Investments made by investors could be following different types of investment either greenfield, merger or acquisition and etc.

Foreign investments could impact nation development in two ways: Direct or Indirect. The direct foreign investment result in increased employment and production of goods and services including value and export. Automatically these factors will increase GDP, we can say that it increases employment level which will increase income level and this income will increase GDP. Similarly indirect FDI can also increase GDP, for example transition of technology, knowledge, imitation and job trainings. Apart from mentioned factors, there are human capital, techonology spillovers, productivity that could indirectly increase GDP in an economy. Chakrabarti (2001) and Borensztein, De Gregorio, and Lee (1998).

When nationally there is enhancement in production of technology then products are supplied with higher quality and low cost, increasing per capita output and national production. Hence it is said that technology is the probable source of productivity profit to domestic enterprises. Borensztein et al (1998) has proved showing differences in human capital regarding different countries that impacts attraction of technology which would contribute to economic growth.

Scope of the Study

The study emphasis is to represent the Nexus between FDI and Economic growth in Afghanistan. Moreover, it is believed to be one of the growing marketplaces on basis of crucial significance in Afghanistan. The location, usual resources, pro-business minded features favors FDI inflows.

Relevance of the Study

The Research study effort is to entirely understand the Nexus between FDI and economic growth concerning following significant objectives; Afghanistan economy necessitates to know the relationship among FDI and economic growth due to quantity of its contribution in capital and technological scarce. Studies show that FDI has been always playing an enormous role in development of a nation. Understanding for attraction of larger number of FDI and how capitals inflows could substitute for supplementary forms of capital and how that capital could best be related to desirable developmental outcomes will be a critical question area for Afghanistan.

Objectives

- Analyzing FDI trends and patterns in Afghan Economy

- To examine the relationship between FDI and Economic growth in Afghanistan

- To suggest some policy implications and recommendations.

Data Sources

The research study sources of data are collected from various published sources based on secondary data. In this research study we will be following a descriptive survey research design. The data has been extracted from following sources (journals, working papers and certain books) and statistical data is taken from World bank website and UNCTAD.

Research Methodology

For this research study we will be analyzing data for time period of 2005-2016 using time series data, method which will be used is multiple regression analysis and below is mentioned variables shown in Theoretical Framework. This research will be using secondary sources of data from different bases i.e World Development Indicators (WDI), database published by World bank and UNCTAD.

Economic Growth

GDP

(I.V)

FDI,

Exchange Rate,

Inflation Rate,

Interest Rate

(D.V)

Limitation of the Study

The limitations for this study are given below;

- Lack of data availability

- Secondary source data has been utilized for this research

- For time series data we need minimum 15 to 25 years of data, hence Afghanistan is warzone country we couldn’t find data for more than 10 or 11 years.

- Due to lack of data we had to exclude other economic variables which could affect FDI

- Gap between studies on showing relationship between FDI and economic growth in Afghanistan.

The major limitations are lack of adequate data on a Foreign direct investment (FDI) in Afghanistan. Therefore, study couldn’t precisely examine all the variables related to Foreign direct investment (FDI).

Chapter Scheme

Chapter One: Chapter 1 includes background of the study, scope of the study, relevance to study, objectives, data sources, Research Methodology, Limitation of study and Chapter scheme.

Chapter Two: Chapter 2 embodies all research studies based on related field or semi related field within the country.

Chapter Three: This chapter is based on analysis of Research Methodology being used, that gives demonstration of techniques used for showing Nexus between FDI and Economic growth.

Chapter Four: Chapter 4 gives review based on results & analysis which are obtained after implementing research methods and techniques. It is one of the most important sections of research study which illustrates their research outcomes. Data obtained is based on secondary sources which are articles, books, journals and websites.

Chapter Five: This chapter mainly focuses on research recommendations and conclusions which follows its scope for further researches to be held.

Literature Review

A research study support can be resilient when researcher justifies it by consuming great effort initiated by others. This literature study will signify the relationship or impact of FDI and economic growth regarding different countries and from these research studies we would be able to elaborate more over Afghanistan prospective to be more specific. From different potential of researchers, we would endorse that FDI is contributing to economy of a country or it is not. A lot of research has been conducted on various dimension that could best describe direct or indirect FDI with an increase or decrease of an economy.

Wani and Rehman (2017)

These researchers have conducted their study on determinants of FDI in Afghanistan showing their capital inflow. They have also investigated about the impact of FDI in Afghanistan economy in particular. Their Research is supported by OLS method, for year (2005-2015) result of their study showed relation of FDI with determinant positive excluding inflation rate which showed negative impact.

Muhammad et al. (2013)

This study showed nexus between interest rate and investment from Pakistan prospective. These researchers have showed impact of interest rate for an investor, investing within country. They have used this method for year (1964-2012). The results of this study was that investment is one of the key determinants for GDP and it can cause an increased economy. They concluded that interest rate and investment are directly related to one another, hence fluctuation in interest rate would either cause loss in investment or saving for Pakistan economy.

Ahmad (2013)

This research in particular was carried regarding Pakistan economy which shows that exchange rate is highly associated with growth rate. The result & analysis for this research study were that Pakistan occupies greater import balances than exports balances, which lacks improvements in goods that are being exported. The research concluded that there is difference between balance of payments and trade balance and therefore the economy shows negative result and growth rate remains low.

Zilinske (2010)

Researcher conducted this study to show that both ways for foreign direct investments. He said that there can be positive as well negative influence of FDI within a country. According to his research Greenfield FDI showed positive outcomes in a nation where as Merger & acquisition showed negative impact on economic growth of Host country.

Har Wai Mun et al (2008)

This research is specifically to know the relationship of FDI and economic growth in Malaysia. They have used year (1970-2005) using OLS method. Result & analysis are such that FDI is a good source of economy for Malaysia, as it attracts more FDI inflows, employment, technology and competitive goods.

Lee and Tcha (2004)

They have also concluded from their research paper that FDI is a moderating engine for economic growth and has considered as the only source which can bring growth and modernization for the countries with weak and low economies

Buckley et al. (2002) and De Mello (1999)

This paper is based on China, they have used data for year 1996,1999, 2000,2001 based on researcher findings. A lot other research was conducted which said FDI has positive or negative impact. After this research it was debatable topic, because they concluded we cannot entirely say FDI has positive or negative on a economy. So they articulated it as conflicting findings. They say countries who possess that FDI has positive impact bring them capital inflow, job creation, increase in income level and many other aspects. They conclude that FDI is dependent on the social, economic, political, technology aspects or conditions of Host country whether they can support FDI or not. It entirely depends on capacity of host country to attract FDI.

Malik and Chaodhry (2001)

These two researchers conducted their study for four Asian countries namely; India, Pakistan, Sri Lanka and Bangladesh. They wanted to examine the long run positive relationship with economies of these countries. This study used co-integration and error correction model. Hence according to their results they said that there exists relationship between GDP growth rate and Inflation rate among all these four countries showing that a moderate inflation rate could lead to positive impact on economy.

Hanson (2001)

Hanson outraged his study paper on china to examine outward foreign direct investment (OFDI). His conclusions are that china has strong effects of rising exports due to OFDI. He recommended that china should be focusing more to dual effects of exporting and support platform for OFDI. Moreover, government should be supporting implementation of mixed inter-trade and strategies for investments, which could give opportunities for overseas investments.

Borensztein, E., De Gregorio, J., & Lee, J. W. (1998)

They issued a paper on Journal of International Economics which has stated about cross country regression framework, taking data from 69 developing countries from previous two decades. They concluded that FDI is an important vehicle for transmission of technology which contributes more to economic growth than domestic investment. They also determined that if a host country possesses sufficient advance technological capabilities they can attract FDI from other countries.

Balasubramanym et al (1996)

They have examined the impact of FDI on developing economies. They have utilized OLS method and cross section method. Researcher also followed Durham (2004) whose study research conducted effects of FDI on economic growth of 80 developing countries, which suggested that FDI has and adverse effect dependent on the absorptive capacity of host country. According to their research countries whom possess outward oriented trade policy can attract more FDI and have positive impact rather than countries having inward trade policy. From all research study it is staid that FDI is vehicle of economic growth to host countries, but if they are able to take benefit from inflows and transfer new technological aspects to host country.

So, the effects of foreign direct investment on economy of the host countries is yet debatable. A massive number of studies possess to find out the results of FDI on the economy but there is no agreement. Few of studies came up alongside the findings that FDI possesses positive affect on the economy as others conclude negative impact. Some studies discovered that the influence of FDI depends on the absorptive capacity of the host country that includes governmental, economic and technology condition. Based on all above research we would also conclude our bases and more specifically to know FDI relationship in economic growth in Afghanistan.

Research and Methodology

3.1 Data

In this study research, main motive was to know the Nexus between FDI and Economic growth in Afghanistan. So specifically for this reason, our study will be depending on secondary data sources for both dependent and independent variables. This study is using time series period over 2005-2016 for following variables; FDI, inflation rate, exchange rate & interest rate. Secondary data is using the following sources; the world development indicators (WDI), the World Bank, UNCTAD and Global Economy.

3.2 Methodology

To analyze the relationship between FDI and economic growth in Afghanistan for this research study we will be using Multiple regression analysis among variables both dependent and independent variables. We would like to define multiple regression analysis, as “It is a model that shows the relationship between two or more explanatory variable and a response variable by fitting a linear equation to observed data”. For this model, value of independent variable X is associated with value of dependent variable. This model was discovered by Galton in late 1860s, Galton worked has been identified in various dimensions such as conceiving standard deviation. He also created concept of statistical correlation and found the properties of bivariate normal distribution and its relationship to regression analysis. Galton invented the use of regression line (Bulmer 2003,p.184). Galton also described and explained the basic phenomenon of regression towards the mean. His first experiment conducted was on the size of seeds that showed successive generations of sweet peas.

Here we would like to address work of Adrien-Marie Legendre (18 September 1752-10 January 1833). His background is that he belongs to France and his profession was a mathematician. His work has been always considered of great importance regarding statistics, theories, abstract algebra and mathematical analysis. In linear regression analysis he contributed by developing least square method, signal processing and curve fitting.

Here we will describe the regression model specifications as follows;

Y= α+β1×1+β2×2+β3×3+β4γ4+ε

We will illustrate this equation as;

Y= GDP (Gross domestic product) representing (Dependent Variable)

X1= FDI

X2= Inflation rate

X3= Exchange rate

X4= Interest rate

Whereas, β= coefficient of independent variables, α= constant and ε= error term

3.3 Dependent & Independent Variables

There are different research studies taken place which has utilized different variables that could influence economic growth of Afghanistan, few research shows their relationship, few their effectiveness and few their implications. Here we are using important variables for our research that represents independent variable i.e. FDI, exchange rate, inflation rate and interest rate and dependent variable representing GDP. We will demonstrate briefly over mentioned variable;

Economic growth

The sum gross value added by all resident producers in economy plus any product taxes and minus any subsides which are not include in the value of the products is GDP. It can be calculated without deduction of depreciation of fabricated assets, depletion and degradation of natural resources (World Bank).

Foreign Direct Investment (FDI)

FDI can be defined asan investment in a business by investor from another country to host country for which foreign investors will have control over the company purchase

Inflation rate

Inflation rate measures consumer price index reflecting the annual percentage change in the cost to average consumer of acquiring goods and services that maybe fixed or changed at specific interval, such as annually.

Exchange rate

The price unit that expresses domestic currency into foreign currency. Exchange rate has two workings that are domestic currency and foreign currency. These two components can be quoted directly or indirectly.

Interest rate

The rate at which interest is paid by borrower (debtor) for use of money that they borrow from a lender (creditor). They are usually noted on annual basis.

Result & Analysis

This chapter will provide the result and analysis that is regarding Nexus between FDI and economic growth using multiple regression analysis for year 2005-2016. For below mentioned variables;

Economic Growth

GDP

(I.V)

FDI,

Exchange Rate,

Inflation Rate,

Interest Rate

(D.V)

4.1 Model specification

For determination of relationship between dependent and independent variables, for this study we will be conducting multiple regression analysis for above-mentioned variables, model are given as;

Y= α+β1×1+β2×2+β3×3+β4γ4+ε

We will illustrate this equation as;

Y= GDP (Gross domestic product) representing (Dependent Variable)

X1= FDI

X2= Inflation rate

X3= Exchange rate

X4= Interest rate

Whereas, β= coefficient of independent variables, α= constant and ε= error term

4.2 Multiple Regression Assumptions

To clarify and identify results we need to apply six different assumptions of multiple regression, the reasons for applying these assumption are;

- Firstly, its usage is for identification of strength of the affects that independent variables possesses on dependent variables.

- Secondly, its usage is to forecast effects or impact of changes. Multiple regression analysis modifies that how much changes occur in independent variables with change in dependent variables.

- Thirdly, this regression model can be used to predict trends and future values. It also helps to get some estimates

For applying multiple regression analysis, the necessary assumptions of the model needs to be checked like linearity in the data, homoscedasticity, mulitcollinearity and Durbin Watson.

4.3 Assumption. 1 (Linearity between dependent and independent variable)

First assumption indicates the linearity relationship between dependent variable and independent variables. Following this assumption, we would individually know the linear relationship of dependent variable with independent variables.

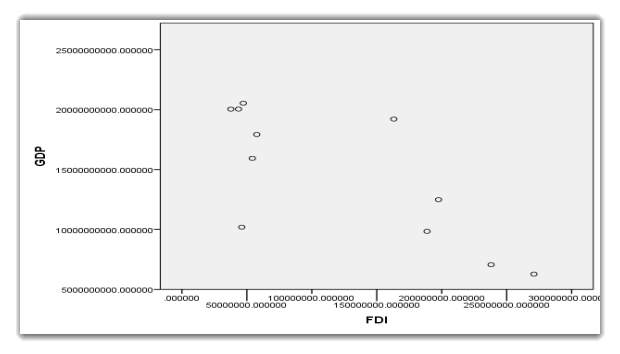

GDP and FDI

Figure 4.1

Interpretation: – Here in this table we have added DV which is GDP onto X-axis and IV which is FDI onto Y-axis. The scatterplot graph here shows linear relationship between GDP and FDI. If the scatter dots are placed closer to each other its shows more accuracy for relationship. If we see vertical distance and gap between dots, then that represents “residual” showing error in our model.

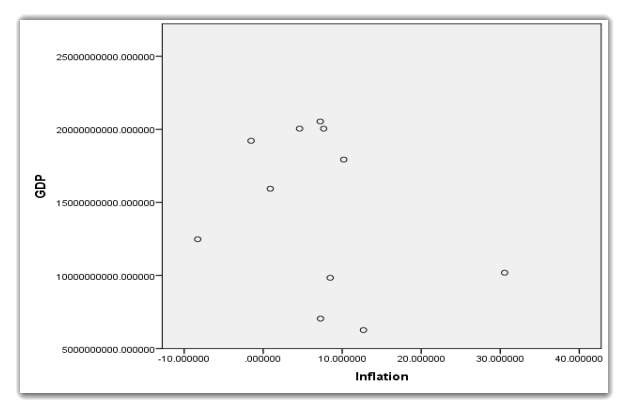

GDP and Inflation Rate

Figure 4.2

Interpretation: – Here the scatter dots are placed closer to each other its shows more accuracy for relationship between GDP and inflation rate.

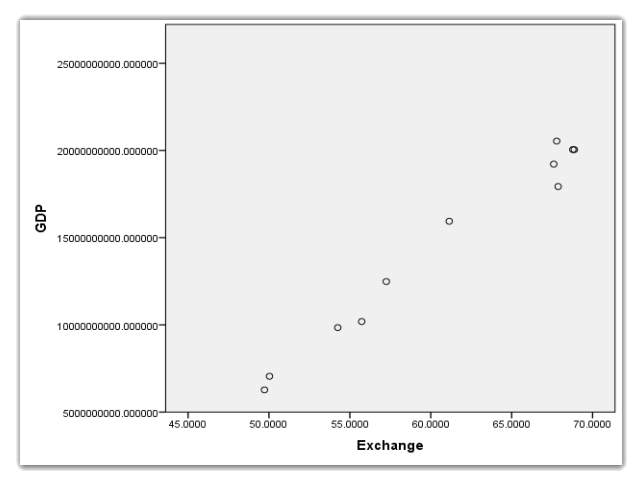

GDP and Exchange Rate

Figure 4.3

Interpretation: – The scatter dots are placed closer to each other which shows more accuracy and linearity for relationship between GDP and Exchange rate.

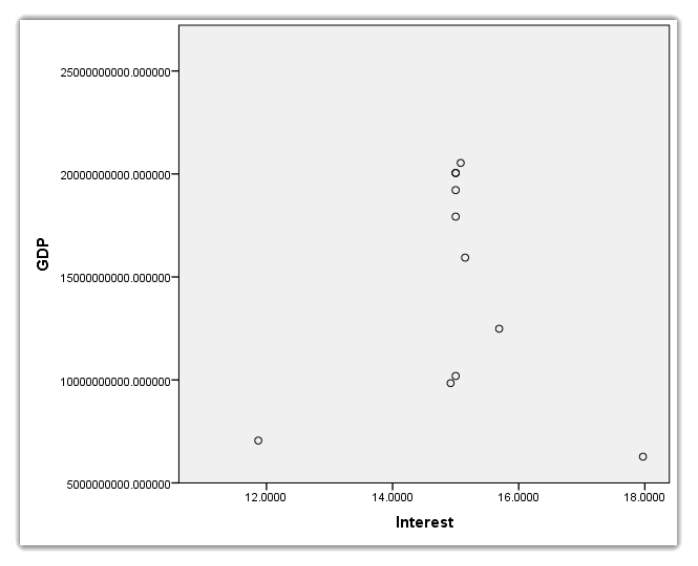

GDP and Interest rate

Figure 4.4

Interpretation: – The above scatter dots are placed closer to each other its shows more accuracy and linearity for relationship between GDP and Interest rate.

4.4 Assumption 2 (Multicollinearity)

Second assumption indication is essential for Multicollinearity that represents that variables are not too highly related with one another.

Table 4.1 Descriptive Statistics

| Descriptive Statistics | |||

| Mean | Std. Deviation | N | |

| GDP | 14506332450.90909000 | 5490134721.248654000 | 11 |

| FDI | 122230546.66454545 | 89931316.558628840 | 11 |

| Inflation | 7.24847042 | 9.741249591 | 11 |

| Exchange | 60.820000 | 7.7060431 | 11 |

| Interest | 15.061818 | 1.3815630 | 11 |

Table 4.2 Collinearity Diagnostics

| Collinearity Diagnostics | ||||||||

| Model | Dimension | Eigenvalue | Condition Index | Variance Proportions | ||||

| (Constant) | FDI | Inflation | Exchange | Interest | ||||

| 1 | 1 | 4.100 | 1.000 | .00 | .00 | .01 | .00 | .00 |

| 2 | .636 | 2.538 | .00 | .02 | .40 | .00 | .00 | |

| 3 | .257 | 3.990 | .00 | .18 | .11 | .00 | .00 | |

| 4 | .005 | 27.846 | .03 | .12 | .07 | .13 | .96 | |

| 5 | .001 | 55.194 | .97 | .67 | .41 | .86 | .04 | |

| a. Dependent Variable: GDP | ||||||||

| Table 4.3 | |||

| Model | Collinearity Statistics | ||

| Tolerance | VIF | ||

| 1 | (Constant) | ||

| FDI | .228 | 4.377 | |

| Inflation | .509 | 1.964 | |

| Exchange | .228 | 4.393 | |

| Interest | .958 | 1.044 | |

Interpretations: – Its statistical representation showing that If VIF in table is equal to 1, then there is no multicollinearity shown. Other assumption is that if VIF value is greater than 1, then it is said that variables could be highly related. In our case inflation rate and interest rate shows value larger than 1 displaying reasonable correlation to constant. VIF that has value between 5 & 10 shows high correlation that could be difficult. VIF above 10 shows variables are poorly related. This assumption displays if VIF is to below 10, and tolerance score above 0.2 then they are collinearity. Here all our variables are below than 10, and tolerance scores are above 0.2.

4.5 Assumption 3 (Durbin Watson)

This assumption will show that the values of residuals are independent. It will show that the variables are independent and not related to each other

Table 4.4 “Durbin Watson”

| Model | R | R Square | adjusted R square | Std. error of the estimate | Durbin-watson |

| 1 | .995a | .990 | .983 | 716724294.865190600 | 3.043 |

Interpretation: Durbin Watson, here statistics can vary from 0 to 4, value should be close to 2. Values below 1 and 3 and cause of concern and may render analysis to be invalid. Our result here shows 3.043 which states that our analysis is valid.

4.6 Assumptions 4 (Homoscedasticity)

This assumption is known as “Homoscedasticity” which shows variance of residuals is constant.

Table4.5

| Coefficient | ||||||||

| Model | Unstandardized Coefficient | Standardized Coefficient | t | Sig. | Collinearity Statistics | |||

| B | Std. error | Beta | Tolerance | VIF | ||||

| 1 | (Constant) | -20830797552.470 | 4727625642.125 | -4.406 | .005 | |||

| FDI | -8.435 | 5.273 | -.138 | -1.600 | .161 | .228 | 4.377 | |

| Inflation | -78221361.468 | 32608754.952 | -.139 | -2.399 | .053 | .509 | 1.964 | |

| Exchange | 605578090.297 | 61645601.258 | .850 | 9.824 | .000 | .228 | 4.393 | |

| Interest | 6892861.370 | 167604450.425 | .002 | .041 | .969 | .958 | 1.044 | |

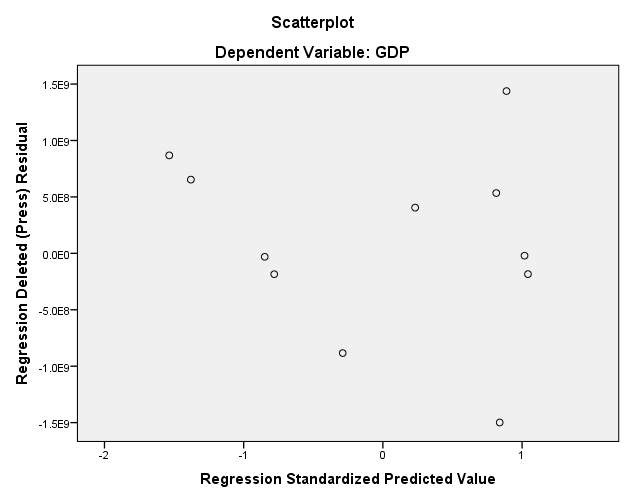

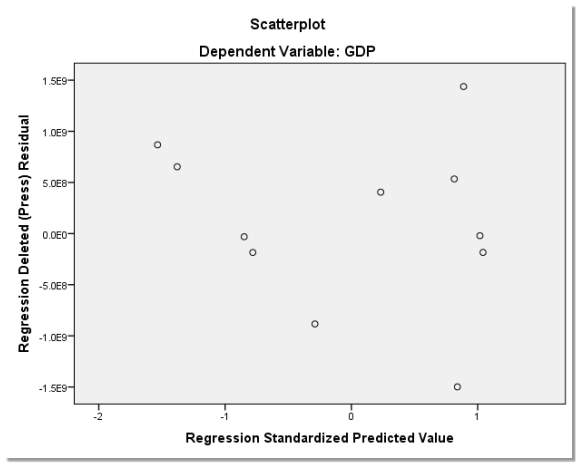

Figure 4. 5

Interpretation: –Graphical representation of standardized Residuals V/s standardized Predicted plot value showing no apparent sign of funneling, which suggests that homoscedasticity has been met here.

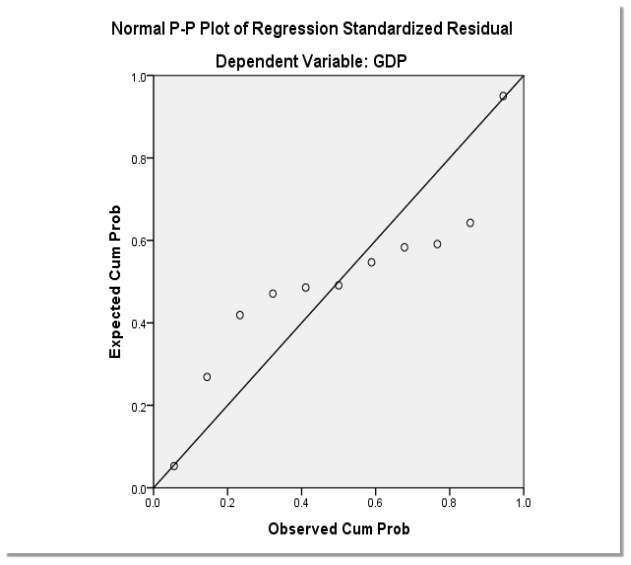

4.7 Assumption 5 (Normal probability plot)

This assumption indicates that there is normal distribution of residual values.

Figure 4.7

Interpretation: – This scatterplot for model suggests assumptions of normality of residuals have been violated slightly. Our results here show that there are extreme deviations from normality which emphasizes that results are probably valid.

4.8 Assumption 6 (Cook’s Distance)

This assumption will focus on Influential cases biasing regression model.

Table 4.6

| Residuals Statistics | |||||

| Minimum | Maximum | Mean | Std. Deviation | N | |

| Predicted Value | 6124301824.00000000 | 20197109760.00000000 | 14506332450.90909600 | 5461992587.742146000 | 11 |

| Std. predicted Value | -1.535 | 1.042 | .000 | 1.000 | 11 |

| Standard error of predicted Value | 293155808.000 | 668795904.000 | 462287952.977 | 147531999.275 | 11 |

| Adjusted predicted value | 5407099392.00000000 | 20234205184.00000000 | 14406672748.51591900 | 5618448302.345560000 | 11 |

| Residuals | -1158945664.000000000 | 1180273024.000000000 | -.000006676 | 555172251.567020700 | 11 |

| Std. residual | -1.617 | 1.647 | .000 | .775 | 11 |

| Stud. Residual | -1.839 | 1.817 | .035 | .909 | 11 |

| Deleted residual | -1498912000.000000000 | 1437665280.000000000 | 99659702.393169880 | 817532942.399612000 | 11 |

| Stud. deleted residual | -2.541 | 2.475 | .025 | 1.184 | 11 |

| Mahal. distance | .764 | 7.798 | 3.636 | 2.715 | 11 |

| Cook’s distance | .000 | .242 | .090 | .089 | 11 |

| Centered leverage value | .076 | .780 | .364 | .272 | 11 |

Interpretation: –Cook distances values signifies that they are below value 1, that recommends specific variables overly had influence over the model.

4.9 Multiple Regression Analysis Result

Results after running figures in SPSS software using multiple regression analysis are given below;

Table4.7

| model summary | ||||

| model | R | R square | Adjusted R square | Std. error of the estimate |

| 1 | .995a | .990 | .983 | 716724294.865190600 |

| a. Predictors: (Constant), Interest, Exchange, Inflation, FDI | ||||

| b. Dependent Variable: GDP | ||||

Interpretations: – All above mentioned independent variables, inflation rate, exchange rate, FDI and interest rate indicates 99% of variance in Economic growth in Afghanistan which is represented by R2. We can also conclude that variables which were not included in this study contributes 1% of variance on dependent variable.

| Table 4. 8 ANOVa | ||||||

| model | Sum of squares | Degree of freedom (df) | Mean Square | F | Sig. | |

| 1 | regression | 298333630285500400000.000 | 4 | 74583407571375100000.000 | 145.190 | 0.000 |

| residual | 3082162289100027900.000 | 6 | 513693714850004670.000 | |||

| Total | 301415792574600400000.000 | 10 | ||||

Interpretations: – In ANOVA table, results show its significance level less than 0.05, indicating that model is statistically significant stating that all variables affect GDP in Afghanistan. The value of F calculated here shows higher level than F critical possessing that model is of significance.

| Table 4.9 Coefficients | ||||||

| Model | Unstandardized coefficient | Standardized coefficient | t | Sig | ||

| B | Std. Error | Beta | ||||

| 1 | (Constant) | -20830797552.470 | 4727625642.125 | -4.406 | .005 | |

| FDI | -8.435 | 5.273 | -.138 | -1.600 | .161 | |

| Inflation | -78221361.468 | 32608754.952 | -.139 | -2.399 | .053 | |

| Exchange | 605578090.297 | 61645601.258 | .850 | 9.824 | .000 | |

| Interest | 6892861.370 | 167604450.425 | .002 | .041 | .969 | |

Hence here we will modify our model from above findings;

Y= α+β1×1+β2×2+β3×3+β4γ4+ε

Giving it a review and putting above values of table in given equation, we get;

= -20830797552.470+-8.435 1 +-78221361.468 2 +605578090.297 3 −6892861.370 4+e Equation shows Y as GDP (Dependent variable), x1 is FDI, x2 is inflation rate, x3 is exchange rate and x4 shows interest rate.

The equations shows that by enduring all independent variables constant at zero, GDP will become 20830797552.470. Findings for both table and equations reveals that if there is a unit decrease in FDI for value of -8.435 then there is decline in GDP, unit on decrease in inflation rate -78221361.468 will decline GDP, however a unit rise in exchange rate will rise 605578090.297 in GDP, and 6892861.370 unit rise will increase GDP.

Significance level showing 5% and 95% level of Confidence show that this model has run successfully in SPPS. Different variables have shown different level of significance;

- FDI 1.61 (Level of Sig)

- Inflation .053

- Exchange .000

- Interest .966

We briefly showed level of Sig for independent variables. Our model shows that two of variables, FDI and Inflation has showed negative impact on Economic growth in Afghanistan, there could be various reasons for our outcome, firstly it can be because of lack of data, also we have selected time series for our data but we couldn’t find figures for 25 years, so we included 11 years of data which were valid.

Conclusions and Recommendation

Research study conducted was based on investigating the relationship of FDI and economic growth in Afghanistan (2005- 2016). This study examines relationship of foreign Direct Investment (FDI) on Gross Domestic products (GDP) of Afghanistan. FDI is considered to be a direct investment into production or enterprise within a country by an investor or enterprise of another country by buying a company in targeted country or by expansion of operations of active business in that country. GDP is the total market value of goods and service produced in host country by another nation. Other variables are also explained here to know their importance over economic growth in Afghanistan.

Inflation rate

Inflation rate measures consumer price index reflecting the annual percentage change in the cost to average consumer of acquiring goods and services that maybe fixed or changed at specific interval, such as annually.

Exchange rate

The price unit that expresses domestic currency into foreign currency. Exchange rate has two workings that are domestic currency and foreign currency. These two components can be quoted directly or indirectly.

Interest rate

The rate at which interest is paid by borrower (debtor) for use of money that they borrow from a lender (creditor). They are usually noted on annual basis.

5.1 Conclusions

The result of our model shows that Model summary R square (R2) represents 0.99, which means that there is 99% of variation by independent variables (inflation, exchange, interest and FDI) showing strong relationship with dependent variable (GDP). Co-efficient here shows -20830797552.470 showing that each unit rise there will be decrease in variable.

Based on our findings we concluded negative relationship of GDP and FDI, GDP and inflation rate, whereas GDP and interest rate, GDP & exchanged rate showed positive impact in Afghanistan.

An overview for selection of this topic was my personal interest and also valid information regarding FDI, which states that in 2001 there were less amount of investment for $120 per capita in Afghanistan showing slight increased investment. By governance of new government and support of international investments which made billions of dollars get invested or in form of aid, hence we can say FDI has contributed in economic growth of Afghanistan since periods. Based on research we implemented shows that FDI showed in 2001 with 0.68$ million has increased to amount of $271 million in 2005 and had its peak in sector of investment in telecommunication sectors. Afterwards 2005 there has been decline of FDI with abstraction of NATO/ISAF troops from Afghanistan.

We conclude that role of government is extremely important here considering strategy, strategy conception and implementation for providing enthusiasm or effecting foreign investments and possessing long lasting contract. However, according to our results it showed negative relationship between FDI and economic growth in Afghanistan.

5.2 Recommendations

Based on our research study we say that two of variables have direct or positive relationship with GDP so it is recommended that government and policy makers should stabilize and promote more investments towards Afghanistan. Whereas two of other variables showed negative impact with FDI and inflation. Our suggestions shows that FDI negatively impacts economic growth. Empowerment of economy can be affected by other variables and there should be more focus. Beside that we would like to suggest contribution to FDI is significant, therefore policies must be coined to promote US (FDI).

However, the results declared previously recommend that the strategies in Afghanistan must take into attention both the stability in degree of exchange rate and interest rate. Government should most likely emphasize on impact of the exchange stability on each macroeconomic variable in implementation of trade policies in Afghanistan, so it is very clear that higher foreign direct investment and higher volumes of trades can be attracted. As (FDI) has a direct impact on employment sector, so stable exchange rate will attract Foreign Direct Investment FDI and hence will remedy Unemployment. Stability in the economy must be enhanced for stable exchange rate, therefore government policies need a revisit regarding macro stability. The study suggested that there is need of stabilization in exchange rate and consider the Foreign Direct Investment (FDI) as source of economic growth and make best policy for attracted of Foreign Direct Investment (FDI).

Following all of the above mentioned points we would like to make few suggestions

- Overall, macroeconomic variables are of great importance to increase economic stability within a country. Afghan or International economist should make strategies that could support these variables.

- More opportunities should be make available for investors, so that they could investment in Afghanistan causing more job creation, infrastructure, income level, transmission of advanced techonology.

- Afghan government should take initiative regarding judiciary activities because mostly countries wanted to aid or assist countries with stronger judiciary systems.

- Afghanistan legal system should be supported to shield investors property rights and contract legislation.

- More over the problems that were faced were lack of data, Ministry of Finance should take responsibility for providing data on timely basis for research studies so that researchers could provide them with better strategy implementation, after conducting time consuming research.

Cite This Work

To export a reference to this article please select a referencing stye below:

Related Services

View allRelated Content

All TagsContent relating to: "Investment"

An investment is an asset or item that is acquired in exchange for money or capital with the aim of the asset producing an income and/or appreciating in value so that it may be sold at a future date for a higher price.

Related Articles

DMCA / Removal Request

If you are the original writer of this dissertation and no longer wish to have your work published on the UKDiss.com website then please: