Managing Financial Resources in Health and Social Care

Info: 8082 words (32 pages) Dissertation

Published: 9th Dec 2019

Tagged: FinanceHealth and Social Care

Introduction

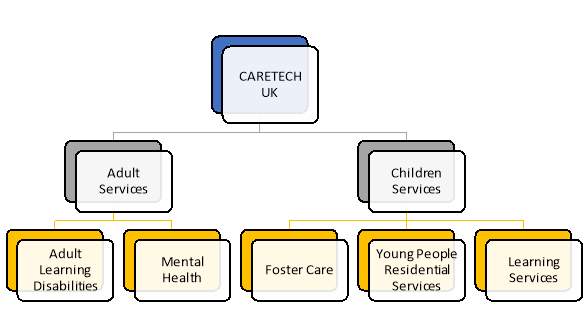

This report based on the financial report of CareTech Holdings PLC dated 30 September 2016. CareTech Holdings PLC is a Healthcare organisation that provides two main services namely;

Adult Services: This includes adult learning Disabilities (Residential Care, Independent supported living, Community support service) and Mental Health (Residential care, Independent supported living and Community Outreach.

Children Services: This includes Foster Care (Fostering and family assessment in the home), Young people Residential services (Residential care of children and young people, education services for children and young people) and Learning Services (Pre-employment programmes, Development programmes, Apprenticeship).

This report will explain the principles of costing and business control systems, regulatory requirements for managing financial resources, budgeting, source of income, the report explores short falls, the causes of shortfalls and how they can be managed. The report will then conclude by identifying data required for financial decision making relating to Health and Social Care services and suggests ways to improve on health and social care services through changes to financials systems and processes.

- Explain the principles of costing and business control systems that may be adopted in CareTech Holdings Plc.

Costing is an approach to gaging the overall costs that are associated with carrying out a business. It is one of the tools that managers use to ascertain type of expenses and how much expenses are involved with maintaining the current Business model. Principles of costing can be used to plan changes to these costs if specific changes are implemented.

According to Online Business Dictionary, Costing is system of computing cost of production or cost of running a business by allocating expenditure to various stages of production or operation of an organisation.

The role of costing in a business or an organisation includes inventory valuation, cost recording, product/services pricing and decision making.

Application of costing principles to the costing and collection processes will permit a true and fair view of what it costs to deliver patient care in a care organisation like CareTech. The costing principles offer a sense check to help health and Social care Organisations prioritise where to invest effort in improving costing and decide how much time to invest in that improvement.

There are six principles of costing approved by the NHS Costing Guidance (2013) and these are bind for all care organisations like CareTech Holdings PLC to follow. These principles are shown in the table below

Principles of NHS Costing enacted from table 3 of Monitor (February 2016)

| Principles | Summary |

| Principle 1: Stakeholder engagement | Effective costing requires input from a wide range of stakeholders, including frontline clinical staff and departments providing clinical support services such as pathology |

| Principle 2: Consistency | A consistent approach to costing is required across and within organisations |

| Principle 3: Data accuracy | Accurate costing relies on the quality and coverage of the underlying data input |

| Principle 4: Materiality | Costing effort should focus on material costs and activities |

| Principle 5: Causality and objectivity | Costing should be based on an understanding of how resources are used during the patient care pathway, to minimise subjectivity |

| Principle 6: Transparency | Costing processes and outputs should be transparent and auditable |

Stakeholder Engagement: A stakeholder can be any person, organization, contemporaries, or society at large that has a vital interest in a business or its activities. Thus, stakeholders can be internal (Managers, Employees), External (Government, pressure group) or Connected (Shareholders, Clients, Consultants, Financiers) to the business. It can include ownership and property interests, legal interests and responsibilities, and ethical rights. A legal responsibility may be the duty to pay wages or to honour contracts. An ethical right may include the right of a service user not to be intentionally harmed by care activities. Stakeholders can affect a business, be affected by a business or be both affected by a business and affect a business. CareTech stakeholders may include carers, consultants, nursing staff, Operational Managers and the public who have interest in the organization. Hence, engaging these people in defining the costs will be very appropriate.

Data Accuracy: Precise costs can only be calculated if the data used are accurate. Accurate costing depends on the quality and coverage of the underlying data input. Complex costing exercises, such as reference costs, Service user-level costing or service-line reporting, need data from many different sources like accounting data (general ledger, trial balance), service user-level activity data (admissions, lengths of stay, care plan), staff activity data (time spent in different service user care settings, carers job plans), care coding etc. This information is classically logged on a variety of systems, such as the accounting system, patient administration system and so on. All this information must be gathered for use in the costing process. Good quality and good coverage of the input data are vital to the quality and accuracy of the final costing outputs.

Transparency: It is imperative to clearly document the costing process. This might include recording all the activities involved in delivering an element of patient care. Clear documentation should identify: data source documents, cost classification, the cause-and-effect relationship between resource costs and activities, any assumptions used for cost allocation and costing procedures used in the costing process. It is recommended by Monitor (2016) that health and social organisations such as Caretech should have and keep a costing processes manual specific to the organisation, that shows in detail all the costing processes the organisation used to produce its costing information. This manual will ensure the organisation retains costing data and knowledge when costing accountants are changed or replaced. It will also support the reliability of approach in line with costing Principle of Consistency. Transparency will allow CareTech to prepare their financial statements in a way that present the true and fair view of the organisation’s financial position and sustainability.

Business control system as explained by Anthony and Young (1999), ensure that organisation carries out its strategy; in making sure that resources are obtained and used efficiently. Also, it offers a framework of processes and activities intended to reduce the risk of error or fraud e.g Budgetary Controls, Bank and Cash Controls, Expenditure and Purchasing Controls, Payroll and Personnel Control, Cost Control, Internal Control and Audit etc.

Bank and Cash Control: Cash at hand or bank is part of an organisations current (liquid/ easily assessable) asset. In an organisation, there must be a set limit of amount of cash that should be available i.e. petty cash and all cash spent or received must be properly recorded with receipts filed as source document. There should be a segregation of duty with regards to the banking activity of an organisation and necessary controls put in place for issuing of cheque and payment runs.

Internal Control and Audit: The internal audit is a means to provide independent assurance to management that an organisation’s risk management, governance and internal control processes are suitably designed and operating effectively. Internal Control is a processwithin an organisation set to provide reasonable guarantee that corporate objectives like reliability and integrity of information, compliance with policies, plans, procedures, laws and regulations, the safeguarding of assets and efficient use of resources are being achieved. Internal Control and Audit allows check and balances within an organisation and prevents or reduces theft and fraud risks.

- Identify the information needed to manage financial resource for CareTech Holdings Plc in financial ending.

The effective management of financial resources of any organisation involves informed decision making which is reliant on precise understanding and interpretation of financial data. Management need to have some avenue to gain knowledge of what is happening with respect to their financial resources if they are to make informed management decisions. Also, the organization is accountable to funding partners as they are expected to report income and revenue, expenditure, investment and balance/profit.

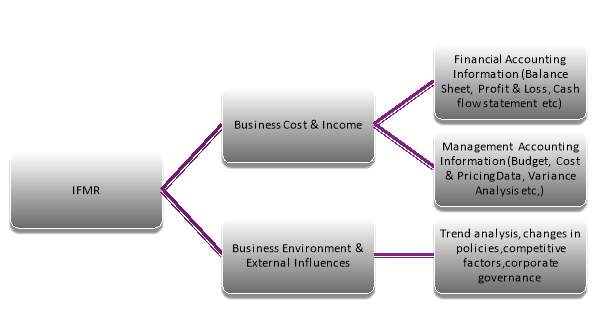

Information required for effective management of financial resources can be grouped into two: Business Cost & Income (Balance Sheet, Profit & Loss, Cashflow statement, Budget, Cost & pricing data, variance analysis etc) and Business Environment & External Influences (trend analysis, changes in policies etc).

Balance Sheet: Also referred to as Statement of Financial Position, is great means to analyse a company’s financial state or position. The analysis of how well a company is performing, how liquid or solvent and efficient a company is can be reached using the balance sheet (through the calculation of financial ratios). Simply put, it gives a full picture of a company’s well-being and health. The balance sheet is created on the core equation: Assets = Liabilities + Equity.

As at 30th Sept. 2016, CareTech’s Total Asset is 378,301 = Total Liabilities £226,634 + Total Equity £151,667 (all in £000’s).

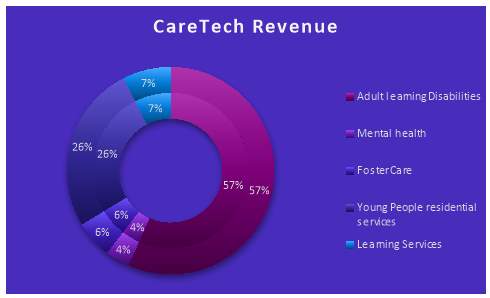

Profit and Loss: This is also known as Income Statement is one of a company’s main financial statements as it shows their profit and loss over a period of time. Profit or Loss is ascertained by deducting all expenses (from operating and non-operating activities) from all revenue (sales of product and services, rent of buildings and equipment, grant,funds, interest earned from investments, dividends from shares held in other companies and donations etc). CareTech generates revenue from five different services: Adult learning siabilities, Mental health, Foster care, Young people residential and learning services with adult learning disabilities as the highest revenue generator.

| CareTech Revenue Sources | 2016

£000

|

2015

£000 |

% increase or decrease |

| Adult learning Disabilities | 84,400 | 75,700 | 11.49% |

| Mental health | 5,700 | 6,400 | -10.94% |

| Foster Care | 8,700 | 9,800 | -12.64% |

| Young People residential services | 39,000 | 22,400 | 74.11% |

| Learning Services | 11,200 | 10,000 | 12.00% |

| Total Revenue | 148,600 | 124,300 | 19.55% |

CareTech’s financial performance as at 30th September 2016 got better compared to 2015. Revenue increased by almost 20% £148.9m (2015: £124.3m), profit after tax grew to almost three times £22.8m (2015: £7.9m).

- Explain the regulatory requirements need to be satisfied while managing financial resources in CareTech Holdings Plc.

Managing Financial resources is key, and companies must meet some statutory requirements relevant to the type of industry they operate. In the Care industry where CareTech operates, some of the regulators includes:

Care Quality Commision (CQC) is a non-departmental public body which regulates all health and social care services in England to ensure quality and safety of care in hospitals, dentists, care homes etc this body is sponsored by Department of Health and Social Care.

Companies House: incorporate and dissolve limited companies, register company information and make it accessible to the public. It is an executive agency sponsored by Department for Business,Energy & Industrial Strategy.

HM revenue and Customs (HMRC): This is a non-ministerial arm of the UK Government responsible for the collection of taxes, payment of some forms of state support and administration of regulatory regimes which includes the national minimum wage.

Companies are liable for different taxes and the commonest one is Corporation Tax, PAYE, VAT, National insurance etc. As at 30th Sept. 2016, CareTech’s Corporation Tax liability as stated in their P&L is £336,000

Monitor established as part of NHS Improvements with the core duty of regulating healthcare providers, prices for care services, address restriction on competition that act against care service user’s interests, supports the delivery of of integrated services for patients to improve quality and efficiency of care. To support its function, Monitor operates a licensing regime.

Financial Reporting council (FRC): The FRC promote transparency and integrity in business. These are keystones to generating public trust and attracting investment in sustainable, successful companies that provide jobs, create prosperity and generate economic growth. This is done by regulating accountants, auditors and actuaries, and by operating the UK’s corporate governance system.

CareTech’s Financial Statement was prepared in accordance International Financial Reporting Standards (IFRS) developed to bring transparency, accountability, and efficiency to financial markets around the world. Applying IFRS enables CareTech to be transparent in the publish of their accounts and allows comparability between other companies that operate in the same sector as them.

1.4 Evaluate the systems for managing financial resources in CareTech Holdings Plc.

In Health and Social Care industry, managing financial resources is key as it allows management to make informed decision about service users interest and their own long-term goals. Systems set by government, management and regulators to manage financial resources in the company and ensure efficient and effective running of the organisation includes:

In an organisation like Caretech, budgets are set by Directors following fundamental principles set to guide public/private organisations. Budget should be in alignment with caretech’s roles and responsibilities, full financial implications of budget should be shown, budget approach must be determined, and all projections must be realistic.

A system should be in place for good recording and book-keeping to produce financial report that are published in accordance with current legislation and standards, for external users through books of accounts and Information technology systems (IT). This system should track financial activities (sales, cost of sales), payments, cost and, management accounts, governance and risk management. Some commonly used IT Software includes Sage, Oracle, SAP ERP, QuickBooks, Project management systems (Microsoft project, Prince2), Data management and analysis system (Microsoft Excel) etc.

Sources of Revenue (from operating and non-operating activities) should be identified, budget variations should be prepared to understand where budget is favourable or adverse to companies finance and effective cost management can be done through Activity based Costing using appropriate cost pools and cost drivers.

A system such as fixed asset register should be in place to record cost of asset, date of purchase, depreciation method, years of depreciation, amortisation, sale of asset etc. This will also reduce risk of fraud or theft of assets. Also, organisations liabilities must be well recorded and controlled.

Checks and balance should be in place for cash management and segregation of duty in terms of issuing checks (account signatories) and payment run.

Financial resources management should be independently examined by internal and external auditors to ensure that financial statements are prepared to give true and fair view of the organisation

2.1 Discuss the diverse sources of income available to CareTech PLC in the financial year in 2016

Income is the earnings a company receives from the sales of its goods and or services, returns on investments and sales of assets. It is used to fund company’s daily expenses. CareTech’s main stream of income is from providing high quality support and care for individuals who often have complex needs. Adult learning disabilities service is the highest income generator, generating 57% of the total income.

CareTech is a big company and raises revenue from sales of share on London Stock exchange, over £81m was realised in 2016 while retained earnings is over £66m and merger reserve over £9m. The company is exposed to long and short-term loans and borrowings as well as shown in their Balance sheet. Long term loans & borrowing as at Sept. 2016 is over £150m compared to over £160m in 2015 and short-term loans & borrowing as at sept. 2016 over £6m compared to over £1m in 2015. These borrowing figures shows that creditors willingness to trust the company with more short-term loan could be because of them managing their long-term loans and borrowings well i.e. fulfilling their agreed credit terms with their creditors.

CareTech Balance sheet shows they have property, plant and equipment worth over £267m, rent income can be generated from renting out spare rooms (CareTech raised £30m in Feb.2016 from ground rent to support its growth strategy), plant and equipment. Another source of income could be grant from local authorities, interests received on bank deposit.

Caretech’s retained earnings is over £66m and merger reserve over £9m

2.2 Analyse the factors that may influence the availability of financial resources in CareTech Plc

Financial Resources is the fund available to a business for use in carrying out business activities in the form of money (cash and cash equivalents or bank deposit), shares, bonds, debentures, cheques and credit lines. Various factors can influence the availability of financial resources to CareTech, this includes: Type of services provided, size of the organisation, geographical location, type of business ownership, funding priorities, local authority policies, local agreements (local authority and care home service contracts) and so on.

Geographical Location and the population condensation may affect may affect funding availability for instance, individuals in London (being a capital city) may receive a level of funding compared to people based in Coventry or Ascot. From the CareTech’s service (Adult learning disabilities) that generated highest revenue 57% in 2016 shows that CareTech operates in locations where that service is in high demand.

Type of Services Provided: CareTech delivers innovative social care on behalf of local authority and health service commissioners throughout the UK and has a long-established reputation as a provider of high quality and safe services which allows for public funding from government bodies such as NHS and being a public liability company allows it to sell shares in the stock exchange market.

The amount of revenue (£149m) generated in 2016 financial year shows that Caretech can be classified as a large sized company and the value and amount of the fixed assets they own provides attractive collaterals to obtain loans from lenders and financial institutions. Also, being a large company and making profit year in and out is one of the strong points of CareTech to convince lenders and creditors of their ability to meet or settle their liabilities in a timely manner.

2.3 Reviewdifferent types of budget expenditure in CareTech Plc.

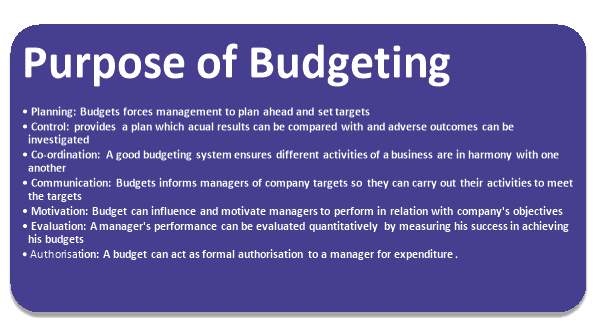

A budget estimates the financial outcomes and financial position of an organisation or business for one or more future periods. A budget is used for planning and performance measurement purposes, which can involve acquisition of fixed assets, launching new products, employee training, setting up bonus plans, controlling operations, etc. It is a plan that looks to use and/or achieve prediction of future outcome i.e. forecast.

Budgeting is a quantitative or financial plan that relates to the future. It can be for the whole organisation or departments or functions or resources like cash, labour, materials etc. It is usually for a year or less (Business Analysis, Kaplan 2014, pg 506).

Purpose of Budgeting

Master Budget is a comprehensive projection that brings together the activity budgets for the departments or responsibility centres within the organisation or business. (Business Analysis, Kaplan 2014, pg 509). It also includes the financial planning, cash-flow forecast and budgeted profit & loss account and balance sheet of the business.

Master budget involves preparing several functional budgets such as: sales Budget, Production budget, capital asset acquisition budget and cashflow budget. On the completion of these budgets, budgeted income statement and budgeted balance sheet can be prepared.

Sales Budget: Budget for future sales can be expressed in terms of revenue and/or units of sales. Some of the factors to be considered when preparing sales budget are market demand estimate, industry analysis, current supply facility, production capacity etc.

Production Budget: This follows on from sales budget because sales volume drives production volume. However, production volume varies from sales volume by the set increase or decrease in inventories (finished goods or work in progress).

Master Budget is advantageous to a business because it serves as motivation tool to employees as actual performance can be compared with budgeted performance, an avenue for advance or future planning and a platform for continuous improvement. However, it can be rigid and difficult to modify or update as it involves a lot of departments.

An error in preparation of any budget will lead to an error in master budget. Thus, as a financial manager in Caretech, I must ensure that budgets prepared are feasible, achievable and not over ambitious.

- Evaluate how decisions about expenditure could be made in CareTech Plc.

Various things like Environmental Analysis, Focus on Priorities, Eliminating Emotionalism, Providing Balance, adjusting strategies, built-in growth and accountabilities which should be put into consideration when making decision about expenditure. Before decisions about expenditure are reached, Caretech managers can use strategic analysis tools like SWOT (strength, weakness, opportunities and threats) analysis and PESTLE (political, economic, social, technological, legal and environment) to gain understanding of the external influences on the organization i.e. environmental analysis.

Caretech as a healthcare service provider will focus on priorities such as computers with required updated software, equipment needed for manual handling and safety of service users, personal protection equipment (PPE) such as gloves and aprons etc. over home staff having television and things that won’t enhance the service they provide.

As a manager in Caretech, I will adopt the cost analysis technique before investing in any project to estimate total cost of the project, project returns, payback period and risk assessment. Expenditure limit should be set regardless of how much return a project will bring to avoid over spending, monitor budget and avoid incurring losses in the long run.

3.1 Assuming there was financial shortfall in CareTech PLC; explain how this situation could be managed.

A shortfall is an amount by which a financial obligation or liability exceeds the amount of cash that is available. A shortfall can be temporary, arising out of a unique set of circumstances, or it can be persistent, in which case it may indicate poor financial management practices. Notwithstanding the nature of a shortfall, it is a significant cause for alarm for any organisation and ought to be corrected promptly whether by short-term loans or equity injections. (Investopedia, 2018).

Financial shortfall occurrence can be due to decrease in cash and or revenue, increase in expenses and unforeseen events. In Caretech, service users can experience financial shortfall due to inconsistency in social care system means testing, long assessment process, inavailability of readily available funds etc. The current situation in the health care sector in the UK is increasing demand in the need for health and social care services which also requires increase in financial resources versus restricted budget leading to lack of enough financial resources to meet increase in demand, hence, financial shortfall. Financial shortfall can lead to late fee charges, finance charges, sever relationships with suppliers and contractors etc.

Financial shortfalls in Caretech can be managed, controlled or reduced through some of the following processes: Priorities, Virement, Reserve Funds, controlling in-flow and out-flow of cash (cash flow management), market analysis, equity injection, credit facility management, negotiating longer payment term with supplier and shorter payment term with customers etc.

Priorities: In Caretech, Capital Intensive projects or investments should be properly appraised and only the most important projects should be embarked on whilst less important ones are forgone to cut unnecessary spending and save other financial resources.

Cash Flow management: As a manager in Caretech, I must ensure that expenditure does not exceed earnings or revenue, make use of accounting softwares that have built-in reporting features that make cashflow analysis easy. Equity financing (less risky as money received from investors can only be repaid in the event of the business succeeding) can be introduced where investors become part owners of the business in exchange for their investment in the business. Also, where possible, arrange longer payment term with creditors and ensure debtors are paying the business on shorter payment term.

3.2 Explain what action you would take if you suspect occurrence of financial fraud in your organisation.

Fraud is an act or course of deception, an intentional concealment, omission, or perversion of truth, to gain unlawful or unfair advantage, induce another to part with some valuable item or surrender a legal right, or inflict injury in some manner. (Business Dictionary, 2018).

Fraud Act 2006 classifies fraud into abuse of position, false representation and failure to disclose information. Fraud poses a threat to an organisation as Caretech and as negative impact on management, staff and service users. So therefore, there should be in place a robust fraud management control system to prevent and detect fraud.

Red flags (signals that suggest fraud or fraudulent act) in caretech may include: transactions taking place at odd times to odd recipients, frequent changes in bank account, inconsistencies in accounting records, missing source (original) documents, missing inventories or physical assets, lack of segregation of duties, an employees on reluctance to take time off work etc.

Caretech should have a strong fraud detection policy that outlines procedures set for reporting irregularities and this must be clearly communicated to all staffs and also, this policy should be reviewed at intervals to ensure they are still up-to-date and relevant.

In a situation where a staff is suspected of fraud such as misappropriation of funds, theft of asset etc; it has to be reported to the appropriate manager who will in turn investigate further by identifying inherent fraud risk, assess the materiality of the fraud to the organisation, note details and deal with matters promptly. Proper investigation should be carried out following the Caretech set procedure and genuine evidence collated. Further action to be taking if employee is found guilty can include displinary action, referring matters to the police or both depending on how serious the effect of the crime is.

As a manager in caretech, I will handle the allegation without sentiments or bias, follow company’s set procedure, take measure to correct risk and set controls that can prevent future fraud risks such as ensuring no staff is in full control of a process e.g, the same staff in charge of supplier invoices should not be the one to approve payments, ensure there are more than one signatories to accounts etc.

3.3 Evaluate budget monitoring arrangements in CareTech Plc.

Budgetary control is the process of making plans and budgets and then monitoring actual expenses incurred/income received. In the event of a variance between actual and budgeted, then proper corrective measures should be taken.

Budget monitoring is therefore an integral aspect of the budgetary control process. It’s main purpose in health and social care service providing organisation like Caretech is to ensure that total revenue and expenditure budget for a period is strictly followed. This process aims at improving the success and efficiency of financial resources management through evaluation of actual result against approved budget; thus, creating a guide for current and future decision making that provides managers with the essential information required for a more accountable performance. In return, managers provide feedback about underlying reasons for variance in budget and actions planned to control variance.

Budget monitoring tools includes: cash flow figures, usage of spreadsheet data and cost control training for managers.

Adrian Waite (2010) concluded in his briefing paper that Budgetary Control and Monitoring are achieved through linking budgets to business plans, preparing management accounts, having effective financial regulations and standing orders and allowing appropriate virement to take place.

Therfore, as a manager in Caretech, it is very important that budget monitoring reports are produced on a monthly or quarterly basis; this report should include variance analysis that compares actual revenue and expenditure against the budgeted revenue and expenditure for the period. Where variance result is adverse, corrective actions should be taken to find out the reason for that, impact of the result on the business and how it can be controlled for future budgets. I must also ensure that company budgets are realistic and feasible in line with current market prices.

4.1 Identify information required to make financial decisions relating to CareTech Plc.

In an organisation like CareTech, decision making takes place daily and at all levels and these decisions are imperative for the achievement of organisational goals.

The board of directors and senior management may make tactical decisions about long and short-term investments, how to finance investments, distribution of profit to investors (dividends) and how much profit should be retained in the business. The Board of directors are the highest governing body of an organisationthat makes tactical decision about investmentand direction of organisation’s future expansion. This includes executive directors, non-executive directors and independent directors.

Managers on the other hand, make strategic decisions on to run their department to contribute effectively and achieve business goals. Examples Chief Nursing officer, Chief medical officer, General managers (Finance, Qualiy Control, Public relations, Human Resources) etc.

Employees make decisions on how to carry out their duties in the best interest of the company. This includes Nurses, Accountants, Carers, Administrators, Cleaner, hospitality staffs etc.

The management is faced with several decisions to make which includes Capital investment, company performance and risk management decision; to make these decisions, information such as cost, pricing, income, type of services to offer, location, new strategy development etc are needed for easier decision making. Also, each decision requires different techniques and tools.

- Capital Investment Techniques: Payback Period which measures how long it will take for an investment to start yielding returns.

- Company Performance Techniques: Profitability ratios (gross profit margin, net profit margin and net asset turnover). To calculate these ratios, understanding offinancial statements and financial database is required.

- Risk management Techniques: Sensitivity, Probability,simulation and scenario analysis.

Cashflow analysis allows managers in Caretech to understand the cash movement (inflow & outflow) in the business and how much is available for future investments. Performance analysis gives understanding of departments or area of business that is underperforming. To make good decisions, management need to be well informed, have good understanding of and be able to interpret financial data from the financial statements, cashflow, sales and purchase ledger, budget and inventory.

4.2 Analyse the relationship between care service delivered and ‘costs and expenditure’.

The general assumption is that having more money equals getting the best value but in health and social care, this is not always the case. Therefore, service users’ need to be aware and encouraged to combine data and cost when selecting health providers and plans.

Research show that spending more money may not certainly give a better quality of care. (Appleby-Kingsfund); nevertheless, how quality is measured depends on individual.

In healthcare setting like Caretech, quality can be defined as the degree to which a health care service or product meets or surpasses anticipated result.

As identified by National Health performance committee, a care service is classified as a quality care if it is accessible, effective, appropriate, safe, efficient, responsive, sustainable, capable and continuous.

Cost can either be the amount paid to receive a product /service or amount incurred to make a product and or deliver a service while the economic cost that a business incurs through its operations to generate revenue are referred to as expenses.

Other factors aside cost that influence quality of care includes dedication and effort of staffs, staff supervision and support, improved staff training in relevant areas, user contribution in care package etc.

Although cost and quality are interwoven, for cost to lead to improve quality care; as a manager in Caretech, I must ensure that clients’ needs are well understood & documented, pay attention to staff development and training through regular performance evaluation, the availability of necessary equipment required, that there is adequate staff supervision and monitoring.

4.3 Evaluate how financial considerations impact upon a service user.

Financial consideration (or economic indices) in the health and social sector like Caretech are the factors that influence the kind and level of access and support an individual gets from the health system. These indices are set by: The central government (eligibility, mean testing etc.), the individual health organisational (total quality management, competence of staffs etc.) and by the individual themselves (affordable private care etc.).

To obtain services from the central government, individuals are assessed to know their needs and evaluate risks of independence. When individual need for care is ascertain, then the government decides if individual is eligible for support from social care and their priority category. Fair Access to care services (FCAS) guides the eligibility criteria which has four bands – critical, substantial, moderate and low. An individual need assessed to be substantial gives room for individual to be allocated social care services. However, inadequate funding has led to the introduction of thresholds.

As a manager in CareTech, I must ensure that care is person centred and that ensure that our staff are competent and have access necessary training.

4.4 Suggest ways to improve the care service provided by CareTech Plc. through changes to its financial systems and processes.

In CareTech plc, understanding the financial system and process will assist the organisation to make changes to the system and improve quality and effectiveness of service.

Gurusamy (2008) explain that financial system is made up of inter-relationship between all financial institutions and their process, e.g. shareholders, creditors, banks, accounting bodies etc.

The following are the recommended ways of improving the quality of health and social care, payment by results, benefit cap, identifying overseas visitors and charging them accordingly, Equity and Excellence; liberating the NHS etc. Payment by results is a government policy that transfers the risk and responsibility from the government to the healthcare providers. It motivates healthcare providers to improve their services to attain excellent value for money. Because of the PRB systems, Caretech will ensure that all services provided meet required standards and anticipated results, user get value for money and satisfactions with the service.

As a manager in Caretech, I would train an existing staff instead of recruiting a new one to reduce cost and retain skilled and experienced staff.

Conclusion

Financial systems should be used effectively by organisations to avoid financial short fall and to carry out informed decision about the organisation, hence, improved standard, enough cashflow and tactical investments.

References

Costing (Definition) http://www.businessdictionary.com/definition/costing.html accessed 26/06/18

NHS Improvement (2018) ‘The Costing Principles’ Publication code: CG 31/18

https://improvement.nhs.uk/documents/2358/The_costing_principles.pdf accessed 27/06/18

Monitor (February 2016) Publication code: IRG 05/16

Shawn Grimsley ‘Definition of Stakeholder’

https://study.com/academy/lesson/what-is-a-stakeholder-in-business-definition-examples-quiz.html accessed 28/06/18

Anthony, R.N. and Young D.W. (1999) Management Control in Non-profit Organisation. 6th Ed. McGraw-Hill

Lumen Financial Accounting Chapter 4 ‘Cash and Internal Controls’

https://courses.lumenlearning.com/sac-finaccounting/chapter/cash-receipts-and-disbursements/ accessed 28/06/18

Chartered Institute of Internal Auditors (2018) ‘What is internal audit’

https://www.iia.org.uk/about-us/what-is-internal-audit/ accessed 28/06/18

International Federation of Accountants, Corporate governance in the public sector: a governing body perspective, 2000

Institute of Internal Auditors (UK) Standards and guidelines for the professional practice of internal auditing, 1998.

International Organisation of Supreme Audit Institutions Guidelines for internal control standards, 1992.

International Organisation of Supreme Audit Institutions Internal control: providing a foundation for accountability in government, 2001

Blackbaud (October 2011) ‘Financial Management of Not-for-Profit Organizations’

https://www.blackbaud.co.uk/files/resources/downloads/WhitePaper_FinancialManagementForNPO.pdf accessed 28/06/18

Corporate Finance Institute (2018) ‘Balance Sheet’

https://corporatefinanceinstitute.com/resources/knowledge/accounting/balance-sheet/ accessed 28/06/18

BMA (Apr 2018) ‘Understanding the reforms.. Monitor and Regulations’ https://www.bma.org.uk

Monitor https://www.gov.uk/government/organisations/monitor/about accessed 03/07/18

Companies House ‘What Companies House Does’

https://www.gov.uk/government/organisations/companies-house accessed 03/07/18

FRC (Feb, 2018) ‘Who we are’

https://www.frc.org.uk/getattachment/931ad43d-62f1-4726-8ca3-d665e7e9824e/The-FRC-About-Us-Leaflet-February-2018.pdf accessed 04/07/18

Management Mania ‘Financial resources’ https://managementmania.com/en/financial-resources-finance accessed 11/07/18

Accounting Tools (Dec. 19 2017) ‘Budget Definition’ https://www.accountingtools.com/articles/what-is-a-budget.html accessed 11/07/18

eFinance Management (July 2018) ‘Master Budget’

https://efinancemanagement.com/budgeting/master-budget accessed 15/07/18

Investopedia (2018) ‘ Definition of Shortfall ’ https://www.investopedia.com/terms/s/shortfall.asp

Accessed 03/08/18

The King’s Fund (13 Dec, 2017) ‘Brexit: The implications for health and social’

https://www.kingsfund.org.uk/publications/articles/brexit-implications-health-social-care#funding-and-finance accessed 03/08/18

The balance small business ‘ How to define cash flow management and solve cashflow problems’

https://www.thebalancesmb.com/cash-flow-management-2947138 accessed 03/08/18

Business Dictionary (2018) ‘Fraud’ http://www.businessdictionary.com/definition/fraud.html accessed 03/08/18

Adrian Waite (Dec 2010) Briefing Paper ‘Budgetary Control and Monitoring’ pg 7

Business Management Ideas ‘Top 3 types of financial decisions’

http://www.businessmanagementideas.com/financial-management/top-3-types-of-financial-decisions/3776 accessed 03/08/18

Investopedia (2018) ‘Non-executive directors’

https://www.investopedia.com/terms/n/non-executive-director.asp accessed 03/08/18

Investopedia (2018) ‘Independent Outside Directors’

https://www.investopedia.com/terms/i/independent-outside-director.asp accessed 03/08/18

Ned on Board ‘ non-executive director vs executive director what’s the difference?’

https://www.nedonboard.com/what-are-the-key-differences-between-executive-and-non-executive-directors/ accessed 01/08/18

Investopedia (2018) ‘Executive Director’

https://www.investopedia.com/terms/e/executive-director.asp accessed 03/08/18

Gurusamy, S. (2008). Financial Services and Systems 2nd edition, p.3. Tata McGraw-Hill Education.

ISBN 0-07-015335-3

Kings Fund (2013) ‘Future payment system in the NHS’

https://www.kingsfund.org.uk/blog/2013/08/future-payment-systems-nhs accessed 03/08/18

Cite This Work

To export a reference to this article please select a referencing stye below:

Related Services

View allRelated Content

All TagsContent relating to: "Health and Social Care"

Health and Social Care is the term used to describe care given to vulnerable people and those with medical conditions or suffering from ill health. Health and Social Care can be provided within the community, hospitals, and other related settings such as health centres.

Related Articles

DMCA / Removal Request

If you are the original writer of this dissertation and no longer wish to have your work published on the UKDiss.com website then please: