The Impact of Pricing Strategies on Product Demand

Info: 9849 words (39 pages) Dissertation

Published: 30th Nov 2021

Tagged: BusinessBusiness Strategy

ABSTRACT

This study analyzes the impact of pricing strategies on product demand. If practiced properly, Prices plays significant role in generating product demand. Odd pricing, Premium Pricing and Deceptive pricing were being considered to check their impact on product demand and a positive relation have been assumed between Odd and Premium pricing strategies and product demand. Whereas, a negative relation have been assumed between deceptive pricing and product demand. A total of two hundred and fifty respondents were surveyed to study the impact of odd, premium and deceptive pricing strategies on product’s demand. A regression model was developed andthe results were significant and supported the hypotheses that there is a significant impact of pricing strategies on product demand.

Table of Contents

CHAPTER 1: INTRODUCTION

1.1 Overview

1.2 Problem statement

1.3 Hypothesis

1.4 Outline of the study

CHAPTER 2: LITERATURE REVIEW

CHAPTER 3: RESEARCH METHODS

3.1 Methods of data collections

3.2 Sampling Technique

3.3 Sample Size

3.4 Instrument of data collection

3.5 Research method deployed

3.6 Statistical Technique

CHAPTER 6: RESULTS

4.1 Findings and interpretation of the results

4.2 Hypotheses Assessment summary

CHAPTER 5: CONCLUSION, DISCUSSION, IMPLICATION AND FUTURE RESEARCH

5.1 Conclusion and Discussions

5.2 Implications

5.3 Future Research

References

Appendix

CHAPTER 1: INTRODUCTION

1.1. Overview

In today’s rigid competition, where number of alternatives are available to fulfill one needs, in such kind of environment, when so many alternatives are available for customer, it is very difficult to create sense of brand loyalty among customers when brands having more or less same characteristics, in this scenario, pricing is one of the factor that can create differentiation or might create a window of opportunity when it comes to purchasing.

Pricing is about capturing value. But generally pricing technique centered mainly on information and process, sales force discounts, win-loss analyses, and so on instead of considering what customers value the most. Many consumer and business-to-business companies are struggling with a pricing problem that is tricky, but not new. In fact, numerous proportions are well understood, although very complicated to manage. The pricing dilemma set up when decisions concerning list prices and promotions are made by different, sometimes competing companies (Davey, Markowitz & Jonnalagadda, 2006).

Various strategies have been developed and exercised to somehow create product demand by attracting customer from price perspective but the core subject regarding what customers’ value above all, what they will really pay for as contrasting to what they say they’ll pay for. Products such as electronic items, considered as high involvement product because of customer involvement. These items are not bought regularly. Purchaser spends a lot of time evaluating and comparing the features of the products, their prices, warrantees, and so on and this is where sometimes marketer’s evaluation differs from customer. What marketers assume their customer’s value most is often dissimilar from what the customers actually do value (Davey, Markowitz & Jonnalagadda, 2006)

The practice of odd pricing strategies in retailing is so established that its effectiveness is generally taken for granted. However, there is slight reported indication to maintained the essential belief of odd pricing; namely, that prices set just below the nearest round figure produce higher than expected demand at that level (Gendall, Holdershaw & Garland, 1996).

There is no general conformity on the meaning of odd prices, and they are also sometimes referred to as magic prices, charm prices, psychological prices or rule-of-thumb prices. As the name suggest, it has been exercised to produce magical response and it is not something theoretically new, there is very little evidence regarding origin and existence of odd pricing but one can be traced back more than 100 years (Schindler,1989).

Premium pricing is also an important pricing strategy use to create and accelerate higher than expected product demand. Especially in case of high involvement products such as electronics, apparel etc. With some added advantage or attribute of product in comparison of competitor, price premium have been charged by advertising the product as bigger, distinctive and something with high value. But whether consumer values it as unique premium characteristic or not is something to look upon. Arnold et al. (1989) also projected a premium service pricing approach which add in into the firm’s pricing strategy recognition of the capability to differentiate the firm’s competitive advantages from those of competitors (Tung, Capella & Tat, 1997)

Deceptive pricing is actually the endorsement of quoted prices on a product which are in reality, not actually a regular deal prices. Arguments are common that deceptive pricing are usually mislead the customer because a retailer uses a pricing trick to make customers believe that they are receiving a negotiated deal when actually they are not. (H. Rubin, 1999)

1.2. Problem Statement

To study the impact of pricing strategies (odd pricing, premium pricing and deceptive pricing) on product demand

1.3. Hypothesis

Based on the arguments above the following hypotheses were developed;

H1: There is a significant impact of odd pricing on product demand.

H2: There is a significant impact of premium pricing on product demand.

H3: There is a significant impact of deceptive pricing on product demand.

1.4. Outline of the Study

The objective of this paper is to measure the impact of pricing strategies on product demand. This research outline provides an overview of the five main chapters that are part of this research report. Ongoing chapter 1 is the introduction of all the important elements of the thesis. This chapter plays an important role as it provides the reader with the understanding about the research aim and the entire research process. The sub components in this chapter include the overview of the thesis, problem statement, research hypothesis and outline of the study.

Chapter two of this research report provides the literature that is relevant to the selected research variables. This chapter provides a critical literature review of the work by the past researchers. The works of famous academicians on the identified variables of this thesis are compared in this chapter. Journal articles and books on the research topic are used in the literature review of this thesis.

Chapter three of this research report presents the research methods that are adopted for this research. Methods along with research tools that are adopted by the researcher for data collection are explained in this chapter of dissertation. The main components of this chapter includes methods of collection of data, sample size, sampling technique, instrument used for data collection and research model.

Chapter four of this research report is about the research findings and interpretation of the data findings. These findings are obtained using the research instrument designed for the thesis. In the later part of this chapter, a comprehensive analysis of the research findings is presented.

Chapter five of the research report presents the conclusion to the thesis. Recommendations are also presented in this chapter based on research findings. Further research implication and limitations of the study are also part of this chapter.

CHAPTER 2: LITERATURE REVIEW

Customer buy product on basis of its image, brand name, price and benefits exposed, whereas, in after consumption behavior, customer finally consumes the product and then makes evaluation on quality achieved (Kim, Vettera & Lee, 2006). When the post-purchase behavior succeeds, customers are likely to repurchase that product and thus, customer becomes loyal to a certain brand. Although, it is not necessary that customers repeat their purchasing behavior even if they are satisfied with the product.

In today’s stiff competition, there are numerous product fulfilling one need, it is becoming very difficult to create brand loyalty among brands having more or less same attributes, pricing is one of the factor that can create differentiation or might create a window of opportunity when it comes to purchasing. The case is more complex when high involvement products like electronic, automobiles etc. are involved. Product price is the crucial factor specially when the new product is launching. Rogers, 1995 explained that Price is an important factor at the time of launch as obstacle to acceptance may exist: the new product is incompatible with the buyer’s experiences or values, is supposed to be excessively complex or offers no relative advantage. Furthermore, the pricing decision is not limited to the skim versus penetration decision. The firm must also think about demand sensitivity to price, and obtainable cost-volume-profit relationships, to establish the net profit impact of dropping price and stimulating demand (Calantone & Benedetto, 2007)

Price is the gauge by which industrial customers judge the value of an offering and it strongly impacts brand choice among competing alternatives (Indounas and Avlonitis, 2011). Price is also important in relationships with customers. Price represents the significance at which a seller is equipped to trade and the value at which the customer is prepared to participate in that trade. Something of value, usually buying power, is exchanged for satisfaction or utility. Often that something of value is money, but other commodities of value to both parties may also be exchanged, such as other goods, time or commitment. (Rowley1997)

Shipley and Jobber (2001) suggested that price management is a decisive factor in marketing and competitive strategy and a key determinant of performance. Price is the gauge by which industrial customers evaluate the worth of an offering and it muscularly impacts brand choice among competing alternative. In the same way, Forman and Hunt (2005) argue that pricing strategy should occupy a fundamental place in strategic development due to its direct impact on the company’s revenue. (Indounas & Avloniti, 2011).

Price is such a crucial factor and it takes thorough research of market, product and its demand to set the best price for desired outcome. Many pricing tactics were introduced to help this cause. Premium pricing and odd (Psychological) pricing are often known as the most widely practiced pricing strategies. Information regarding price sensitivity is tricky to obtain, but, since measuring price sensitivity frequently requires authentic buying experience in a test market or a controlled experiment. Thus, both managers and consumer theorists would like to gauge price sensitivity amongst customers as an individual differentiation variable so that they could use this construct to explain consumers along with other information such as demographics, lifestyle, and attitudes (Ronald E., and Stephen J.,1997)

Cooper (1979) explained that launching a product enabling unique degree of benefit not previously accessible, the level to which customer requirements are better fulfilled , the product’s relative quality and innovativeness, and the degree to which the new product solves customer problems better are they key factor that could generate higher demand(Hultink and Hart,1998)

Odd Pricing

The term “odd pricing” is used in several ways. It can refer to the practice of ending prices in odd numbers (1, 3, 5, 7 and 9) that of ending prices in a number other than zero; or that of pricing just below a zero (Gendall, Fox & Wilton, 1998). Rogers (1990) explained that there is no general agreement on the definition of odd prices. Conversely, its general characteristic is that it is set just below the nearest round figure (Gendall, Holdershaw & Garland, 1996).

The practice of odd pricing in retailing is so prevalent that its efficacy is generally taken for granted. However, there is little reported evidence to support the underlying assumption of odd pricing The noticeable characteristic of odd pricing is the sheer prevalence of this practice in comparison to even pricing, and in particular, the dominance of prices ending in the digit 9 (Gendall, Holdershaw & Garland, 1996).

Brenner and Brenner (1982) suggest that this phenomenon is the result of a biological constraint, namely, consumers’ limited capacity for storing directly accessible information. They suppose that consumers exposed to price information store only the more valuable parts of the message they receive, the first digits of a number. For example, when a price is $299, the digit 2 is more significant as information than the first 9, which in turn is more significant than the next 9. Thus consumers will recall that the price is $200, then maybe that it is $290, but rarely that it is $299. The reason offered for not rounding the three digits up to $300 is based on memory processing time (Gendall, Holdershaw and Garland, 1996).

However, the actuality of a price idea is a authentic explanation for the effect of odd pricing, there is little proof to support it. A study by Georgoff (1971) found that, although a price illusion may take place for certain products among certain groups of consumers, any net consequences on sales was weak or confounded by situational and overruling variables. (Gendall, Holdershaw and Garland, 1996)

A later study by Lambert (1975) suggested that lower price illusions were connected with odd prices under some circumstances, but Dodds and Monroe (1985) found no evidence of differences in consumers’ opinion of quality, value, or willingness to purchase products priced at odd and even prices. (Harper, 1966), consumers have become accustomed by retailers to expect odd prices. A study by Gabor and Granger (1964) provides some support for the later rationalization. For one of two products tested in this study, consumers’ purchase intent were higher when presented with an odd price than with the next lowest price point. (Gendall, Holdershaw and Garlan, 1996)

Subrahmanyan, (2000) suggested that unbeaten price setting is one of the most critical challenges for retailers. Despite the substantial body of intellectual research and all models related to pricing decisions, rules of thumb are still predominant in contemporary retail practice (Wagner & Beinke, 2006).

Schindler and Kibarian, (1996) suggested that Investigations of the price-endings impact have yielded conflicting results. Experimental switching from even price to odd-price endings led to dramatic gains in a women’s mail- order clothing catalogue, while odd prices have also been found to have no effect on stated preferences (Wagner & Beinke, 2006)

In spite of the notoriety and the methodical use of nine-ending prices, it is still difficult to say whether this type of pricing actually persuade the behavior patterns of the consumer. This is because only a few studies on nine-ending prices were carried out empirically under normal sales circumstances. The complexity of assessing the effectiveness of such pricing is also reinforced by methodological problems experiential in the majority of the studies: lack of a direct test of effectiveness of these prices due to the introduction of additional independent variables, the presence of non-controlled parasitic variables and the absence of comparative variables or data. (Guen & Legoher, 2004)

Historically, Ginzberg (1936) was the first to provide a comparison of various price endings His study was carried out within the direct mail sector, but produced inconsistent results. Indeed, nine-ending prices occasionally outcome in an increase of sales when compared with zero ending, while no variation was observed with other pricing systems. It is still difficult to draw any conclusions on the real effectiveness of this type of pricing (Guen & Legoher, 2004).

Schindler and Kirby (1997) indeed observed a higher amount of nine-ending prices in the commercial used throughout a sale than at other periods. Although the association’s illumination is founded on viable and advertising practice, it is based on a simple connection, so it remains vague whether nine-ending prices or bargain sales can explain the increase in items sold. (Guen & Legoher, 2004)

Premium Pricing

Premium pricing narrates as an elevated early price in order to conquer maximum immediate results. Its fundamental rule is to achieve the maximum potential value from each market segment, start with the premier value allotment and moving on the lower value ones. This approach is appropriate in the case of an pioneering, luxury, differentiated service, which conveys a prominent illustration and gives the customer the image of superiority (Indounas and Avlonitis, 2011)

Price premiums may be viewed as reimbursement to merchant for endorsing trust by reducing business risks in an uncertain atmosphere. On the other hand, price discounts are viewed as compensation to buyers for demeanor higher than usual risk. Therefore, transactions concerning riskier products should result in superior price premiums for reputable sellers (Ba and Pavlou, 2002)

It is basically narrates that indicting the maximum potential charge that consumers will pay. The advantage of premium price is that expansion costs can be covered comparatively quickly, and demand can be kept steady with production capacity (Rowley, 1997). Berry, (1986) suggested that Marketing writers frequently intimate that a continuous spotlight on low prices can harm store credibility and devalue store images (McGoldrick, Betts & Keeling, 2000). The Benefits of premium pricing product, such as higher quality are pleasing to both high knowledge and low knowledge buyer. Therefore, the impact shown in purchase behavior of high knowledge buyer than the one has low knowledge about premium factor of product Gerald (2000).

Court et al. (1996) examined 27 case studies with over 5,000 customer interviewsed in the USA, Asia and Europe. They institute price premiums for the strongest brands of 5 percent over the second brand and 19 percent over the weakest. Those premiums varied significantly by product. For example, the price advantages for the strongest brands in food/beverage were just 0.69 percent over the second brand and 0.95 percent over the weakest brands. For two strong brands of computers, the price premiums from consumers were 2 percent and 24 percent over the next brands and 55 percent and 52 percent over the weakest. (Jensen &Drozdenko, 2008)

Where time is at a premium, brand loyalty is one method of falling the pressure (Jacoby et al., 1976). Roselius (1971) ranked risk lessening methods and establish that brand loyalty was significantly more constructive for reducing time-loss risk than any other relievers. Myers (1967) found brand reliability significantly more often amongst working women than among women who stay at home, a finding self-sufficient of household income differences. (Jensen & Drozdenko, 2008)

Consumers are usually complexes the relation between dedication to pay and the value judgment. Believes is that a product is worth, it is not somewhat the same as inquiring whether or not he would buy it at that price”. The intend of that game is to be able to identify premium buyers, because this is where the assumed return will be attained (Carricano, Trinquecoste and Antonio Mondejar, 2010)

Premium pricing seems an approach have a propensity to attract customer who wants to enjoy the feeling of uniqueness and superiority but Premium factors are very difficult to evaluate objectively with a monetary term. In contrast to cost-oriented pricing strategies, a premium pricing strategy replicates market competition. Price setting set up from the market (competitors’ prices) and is accustomed by a service differentiation quality. On the other hand, this approach has some limitations. First, service premium is complex to evaluate; second, the approach is further complex than the conventional cost-oriented technique. Third, using competitors’ prices to position a firm’s own price may not reflect on a firm’s demand (sales) effectively at that particular price level. (Tung, Capella and Tat, 1997)

Deceptive Pricing

‘Deceptive pricing’ is the publicity of reference prices which are not actually ordinary transaction prices. Ads like ‘regularly $100, now $75’ or ‘$100 somewhere else, here $75’, where $100 is the reference price and $75 is the transactions price, are occasionally measured misleading except there have been ‘sufficient’ sales at the $100 cited value, where sufficient can be defined in different manner. If a product typically sells for $75 and the firm advertises it as being normally $100, on sale for $75, this ad will have no instantaneous return. That is, consumers are not given any new choice, since $75 is the ordinary price. So, such ads are at times challenged as being deceptive. (H. Rubin, 1999)

Another argument regarding deceptive pricing is that consumers may be misled about quality if they distinguish price as a signal of quality. Firms have been structured to reduce advertising of sales and specials for this reason. There are two problems with cases based on this argument. First, there is no convincing evidence that consumers are deceived by these ads. Second, there are large social costs from preventing this type of advertising, even if there is deception. (H. Rubin, 1999)

CHAPTER 3: RESEARCH METHODS

3.1. Method of Data Collection

In this research study, the main required data were primary data and there are various data sources to obtain primary data. Primary data is the one, which the researcher collects on first hand basis. This data is accessed from the selected sample of the targeted population. For the purpose of data collection, Primary data requires time along with resources. These factors play a critical role while collecting data that meets the need of the research. A well-designed questionnaire, which incorporated all the selected variables, is used to collect data for this research study by means of a questionnaire survey.

3.2. Sampling Technique

Population for this study includes university students, teachers and general public. Every respondent did not get equal chance to become the part of this research. Convenient sampling method was used. Questionnaires were distributed among students and people living in Karachi.

3.3. Sample Size

Sampling is the process, which is of great importance especially in case the nature of research is quantitative, and data is required for statistical results. This makes the selection of sample size to be appropriate for the research study to be the critical component of the research. The sample size needs to serve the entire targeted population and the results obtained from the study should be representative of the research population. For this research study, a sample size of 250 respondents has been taken into consideration.

3.4. Instrument of Data Collection

A self-explanatory questionnaire was used to collect the data. After questioning about personal information, a total of 09 questions were asked in the questionnaire in which question 9 divided into 3 parts (price wise product demand). To measure the variables a five point Likert Scale was used.

3.4.1. Reliability Analysis

| Reliability Statistics | |

| Cronbach’s Alpha | N of Items |

| .799 | 9 |

Table: 4.0: Reliability Statistics

Reliability test is used to check the reliability and validity of data collected through questionnaires. It checks the consistency and accurateness in answers collected. The value of Cronbach’s alpha is 0.799; it means the generated scale is highly reliable. The scale is acceptable as reliability value is greater than 0.7 and it has higher internal consistency.

Research Model Developed

(Pricing Strategies)

- Odd Pricing

- Premium Pricing

- Deceptive pricing

Product Demand

Model based on hypothesis indicates that product demand is dependent variable and pricing strategies (odd pricing, premium pricing and deceptive pricing) are independent variable and has a positive relationship. In this research study, regression analysis is the tool that is used in order to analyze the relationship that exists between pricing strategies and product demand. The use of regression as the statistical tool allows the researcher the advantage to predict the relationship that exists between independent variables and the dependent variables selected in a research. The reason for which regression analysis is selected for this research study is to get a proper understanding about the existing relationship between the identified independent and dependent variables.

Chapter 4: RESULTS

4.1. Findings and Interpretation of the Results

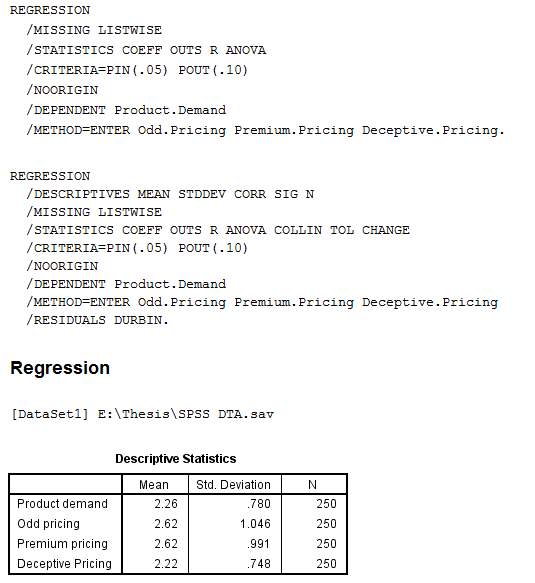

This chapter discusses the analysis of the results obtained from the collected data. Moreover, the data s interpreted obtained from the Regression Analysis Technique which was used to check the impact of pricing strategies on product demand. There are certain factors which were considered important for evaluating the pricing strategies and product demand. Following is the critical analysis and interpretation of the results:

| Table 4.1 Correlations | |||||

| Product demand | Odd pricing | Premium pricing | Deceptive Pricing | ||

| Pearson Correlation | Product demand | 1.000 | .354 | .499 | .452 |

| Odd pricing | .354 | 1.000 | .336 | .144 | |

| Premium pricing | .499 | .336 | 1.000 | .287 | |

| Deceptive Pricing | .452 | .144 | .287 | 1.000 | |

| Sig. (1-tailed) | Product demand | . | .000 | .000 | .000 |

| Odd pricing | .000 | . | .000 | .011 | |

| Premium pricing | .000 | .000 | . | .000 | |

| Deceptive Pricing | .000 | .011 | .000 | . | |

| N | Product demand | 250 | 250 | 250 | 250 |

| Odd pricing | 250 | 250 | 250 | 250 | |

| Premium pricing | 250 | 250 | 250 | 250 | |

| Deceptive Pricing | 250 | 250 | 250 | 250 | |

Table 4.1 Correlation between Pricing strategies (odd pricing, Premium Pricing & Deceptive Pricing) and product demand

The above table shows the Pearson correlation values of the variables. Correlation is a technique which is used for identifying intensity and to determine the direction in which the relationship is going among two quantitative variables. The range of the value of Pearson correlation is from -1 to +1. Positive value of Pearson correlation shows that there is a strong and direct relationship between the variables. It means, when one variable increases by 1 unit, other variable also increase by 1 percent. On the other hand, negative value of Pearson correlation shows a weak and reciprocal relationship between the variable. It means, when one variable increase by I unit, other variable decrease by 1 percent. The correlation between odd pricing strategies and product demand is strong, positive, and direct as the value of Pearson correlation is 0.354. The value is positive and indicates that with good odd pricing strategy, product demand will also increase. The movement of both the variables is positive. Moreover, the relationship between premium pricing and product demand is also positive, strong, and direct as the Pearson correlation value is 0.499 which indicates that with good premium pricing strategy, the product demand will even more increase as compare to first strategy. Lastly, the relationship between deceptive pricing is strong, negative, and direct. The value of Pearson correlation is 0.452 which indicates that deceptive pricing strategy misleads the customers which have negative impact on product demand.

The significance values obtained from 1-tailed test indicates that the relationship between odd pricing and product demand is highly significant as p has the value of 0.000 and the value is less than 0.05. Hence, the hypothesis that is odd pricing strategies has a significant impact on product demand is accepted. In addition, the results show that p value being 0.000 and less than 0.05 clearly determines that pricing strategies plays a significant role while determining the relation between the product demand and odd pricing. Secondly, the significance values obtained from 1-tailed test indicates that the relationship between premium pricing and product demand is also highly significant as p has the value of 0.000 and the value is less than 0.05. Hence, the hypothesis that is premium pricing strategies has a significant impact on product demand is accepted. Lastly, while analyzing the relationship between product demand and deceptive pricing, the results show that relationship is also highly significant as p has the value of 0.000 and the value is less than 0.05. So, the third alternative hypothesis that is deceptive pricing, has a significant effect on product demand is accepted.

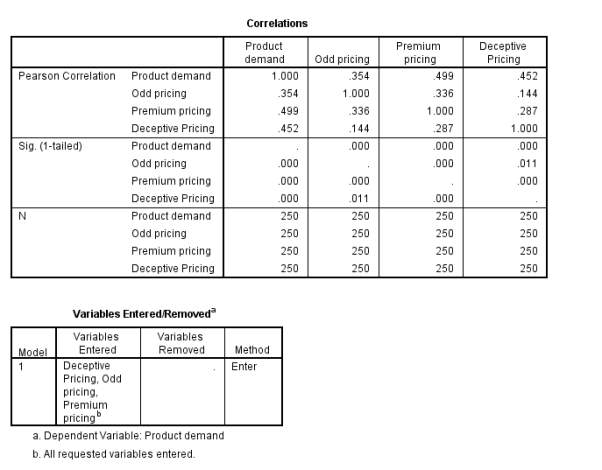

Regression Analysis

| Table 4.2 Model Summary | |||||

| Model | R | R Square | Adjusted R Square | Std. Error of the Estimate | |

| 1 | .621a | .385 | .378 | .615 | |

| a. Predictors: (Constant), Deceptive Pricing, Odd pricing, Premium pricing | |||||

| b. Dependent Variable: Product demand | |||||

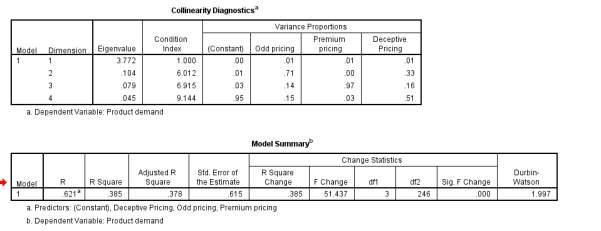

Model summary shows the best fit model. The R value is coefficient of determination that is the explanatory power of the model is 62.1 percent. The variation that is explained by the model is 62.1 percent; however, the remaining variation is unexplained. The model is strong as the explanatory power of the model is above 0.5. R square shows the dependent variable variance explained in context independent variable. 0.385 is the value of R square, which means that 38.5% variation in product demand being the dependent variable is explained by the independent variables (Odd pricing, Premium pricing and Deceptive Pricing). The difference between R square and adjusted R square is only .007, which means that there is no sample error.

| Table 4.3 ANOVAa | ||||||

| Model | Sum of Squares | df | Mean Square | F | Sig. | |

| 1 | Regression | 58.445 | 3 | 19.482 | 51.437 | .000b |

| Residual | 93.171 | 246 | .379 | |||

| Total | 151.616 | 249 | ||||

| a. Dependent Variable: Product demand | ||||||

| b. Predictors: (Constant), Deceptive Pricing, Odd pricing, Premium pricing | ||||||

The table shows a significance value of F is 0.00, which shows that the variables are highly significant. This shows that there is significant impact of the selected independent variable on the dependent variables of the research. Moreover, the significance value of F helps in acceptance or rejection of null hypothesis. If the significance value of F is less than the alpha (0.05), it means the independent variables impact on the dependent variable and brings changes. In this research, the significance value of F (0.00) is less than (0.05), thus the null hypothesis that pricing strategies (odd pricing, premium pricing and deceptive pricing) has no significant impact on product demand is rejected is rejected. Whereas, an alternative hypothesis are accepted

H1: There is a significant impact of odd pricing on product demand.

H2: There is a significant impact of premium pricing on product demand.

H3: There is a significant impact of deceptive pricing on product demand.

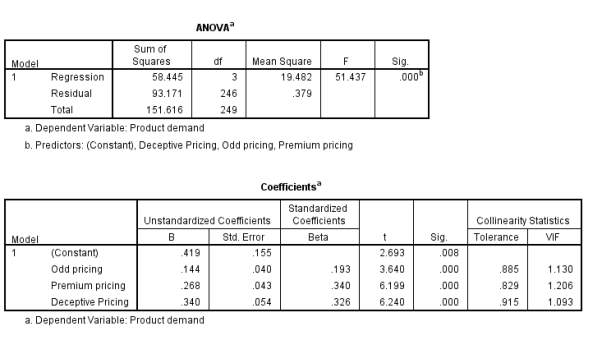

| Table 4.4 Coefficientsa | ||||||||

| Model | Unstandardized Coefficients | Standardized Coefficients | t | Sig. | Collinearity Statistics | |||

| B | Std. Error | Beta | Tolerance | VIF | ||||

| 1 | (Constant) | .419 | .155 | 2.693 | .008 | |||

| Odd pricing | .144 | .040 | .193 | 3.640 | .000 | .885 | 1.130 | |

| Premium pricing | .268 | .043 | .340 | 6.199 | .000 | .829 | 1.206 | |

| Deceptive Pricing | .340 | .054 | .326 | 6.240 | .000 | .915 | 1.093 | |

| a. Dependent Variable: Product demand | ||||||||

α is the constant that is dependent variable and β is the independent variables. The significance value of t of odd pricing is 0.00 which is less than 0.05, hence, the first alternative hypothesis is accepted which is, odd pricing has a significant impact on product demand. The significant value of t of premium pricing is also 0.00 which is less than 0.05 hence, the second alternative hypothesis i.e. premium pricing has a significant impact on product demand is also accepted, lastly third alternative hypothesis i.e. deceptive pricing has a significant impact on product demand is also accepted because the significant value of t of deceptive pricing is 0.00, which is less than alpha 0.05.

T and VIF are the indicators of multi co-linearity. VIF value of all the variables is higher which shows that multi co-linearity is high in independent variables. . The T value that of all the variables are closer to 1, it means that multi co-linearity among the independent variables is high. Deceptive pricing hold high co-linearity as its value is 0.915 which is highest than the T values of other independent variables.

Beta coefficient explains the direction in which the relationship exists between the selected variables. In this research, +0.193 is the value of beta coefficient for odd pricing which means that the direction of relationship between odd pricing and product demand is positive. The beta coefficient value of premium pricing is 0.340, which also indicates that a direction of relationship exists between Premium pricing and product demand is positive. Similarly, 0.326 is the beta coefficient value of deceptive pricing which also indicates positive direction of relationship between deceptive pricing and product demand which will be analyze as it has negatively affect on product demand.

Following is the regression equation obtained from regression analysis:

Ŷ= 0.419 + 0.144 (odd pricing) + 0.268 (Premium Pricing) +0.340 (Deceptive Pricing)

The above equation is interpreted as: 1 percent of the product demand increase, if the odd pricing is increased by 0.268 percent. Secondly, the product demand increases by 1 percent, if the Premium Pricing is increased by 0.268 percent. Lastly, the product demand decreases by 1 percent, if the deceptive pricing increase by 0.340

4.2. Hypothesis Assessment Summary

| Research Hypothesis | Beta | T | Sign | Empirical

conclusion |

| H1: Odd pricing has a significant impact on product demand. | 0.193 | 3.640 | .000 | Accepted |

| H2: Premium pricing has a significant impact on product demand. | 0.340 | 6.199 | .000 | Accepted |

| H3: Deceptive pricing has a significant impact on product demand. | 0.326 | 6.240 | .000 | Accepted |

Chapter 5: Conclusions, Discussions, Implications and Future Research

5.1. Conclusion

According to the results obtained from the collected data, it is interpreted that product demand shares a direct relationship with odd pricing, premium pricing and deceptive pricing. According to Pearson correlation, the first alternative hypothesis that is accepted which shows that odd pricing has a significant impact on product demand. The second alternative hypothesis is also accepted which shows that premium pricing has a significant impact on product demand. Lastly, third alternative hypothesis is also accepted which indicates deceptive pricing has a significant impact on product demand. An ANOVA show that on the basis of f value, null hypothesis that is, pricing strategies has insignificant impact on product demand is rejected.

5.2. Discussion

Pricing strategies are the tactics to attract customer for purchase and increase product demand. It is one of the key factors that enables customer to choose one brand when equal alternatives are available in the market. In products like electronic items, clothing or vehicle, customer always involve and carefully make a purchase decision as compare to low involvement products or product where impulse buying behavior have been observed. So questions regarding electronic items were being asked to make respondent answers more precise, and the followed questions were inquiring about pricing strategies and product demand.

Prices are critical aspect and it takes methodical study to set the best price for preferred effect. An odd pricing and Premium pricing are often known as the largely practiced pricing strategies. Odd pricing is setting a pricing value just below zero i.e. 99 instead of 100 or 999 instead of 1000 to create superior product demand, is most practiced pricing strategy and it is also known as psychological pricing or bata pricing. Premium pricing is also widely use strategy to generate higher demand by setting high price particularly at the launch of product. It requires special promotion to let customer believe that high price means product have got special features and high quality as compare to the one their competitors have, it’s about generating a sense of superiority and sense of reputation a customer will enjoy post purchasing of subjected product. It is not as straight forward as odd pricing and requires intelligent marketing and promotion to achieve expected outcome. Deceptive pricing is the negative tactics in which fake promotions and discounts are usually offers by seller or retailer. It might generate higher demand initially but once customer understood of deceiving, the product demand will affected and brand reputation will damage as well.

5.3. Implications

It is recommended for companies to set pricing strategies that can generate positive image of product in the mind of customer, which will naturally followed by purchase behavior. As per this research, customer will attract to product having odd pricing as they will psychologically perceive it as less price than it is actually, we witnessed today, almost all brands small and big, following the tactic and setting price nearest to zero and it is unintentionally attracting customer, we have seen mobile ads, mentioning 6999 or 19999 to generate psychological perception of low price. Whereas, Premium pricing on other hand is also suitable for product have more benefits or have something special in comparison of its competitors, this special factor can be an added feature, brand image, or it may also be an attractive promotion strategy that make customer believe that the purchase is special. Deceptive pricing should not be one to consider when promoting a product, initially it might generate demand but eventually it will have negative impact on product demand and brand reputation will damage which will beyond repairing, if occur.

5.4. Future Research

Future research can be conducted by considering first numbers starts from left in odd pricing which has rarely been addressed in this study. Furthermore, different pricing strategies other than those researched in this thesis can be use to check the impact of product demand. Instead of electronic product, other products such as automobiles, insurance policies and other expensive products can be considered to understand the impact of pricing strategies.

REFERENCES

Ba, Sulin and Pavlou, Paul A. (2002) “Evidence of the effect of trust building technology in Electronic markets: price premiums and buyer behavior” MIS Quarterly Vol. 26 No. 3, pp 243-268

Calantone ,Roger J., and Di Benedetto, C. Anthony (2007) “Clustering product launches by price and launch strategy”, Journal of Business & Industrial Marketing volume 22 no. 1 pp. 4–19

Carricano, Manu, Trinquecoste, J.Francois, and Mondejar, J.Antonio ( 2010) “The rise of the pricing function: origins and perspectives”, Journal of Product & Brand Management Volume 19 Number 7 pp 468–476

Davey, Krishnakumar, Markowitz, Paul, Jonnalagadda, Nagi (2006) “The pricing opportunity: discovering what customers actually value”, Strategy & Leadership, Vol. 34 Issue: 3, pp.23-30

Gendall ,Philip. , Holdersha, Judith and Garland, Ron (1996), “The effect of odd pricing on demand”, European Journal of Marketing Vol. 31 Issue:11/12, pp.799-8133

Gendall, Philip, Fox, michael f., and wilton, priscilla (1998), “Estimating the effect of odd pricing”, Journal of product & brand management, vol. 7 no. 5, pp. 421-43

Goldsmith,Ronald E., and Newell, Stephen J.,(1997)“Innovativeness and price sensitivity: managerial, theoretical and methodological issues” Journal Of Product & Brand Management, VOL. 6 NO. 3 ,99 163-174

Gue,Nicolas and Legoherel , Patrick (2004)“Numerical encoding and odd-ending prices, The effect of a contrast in discount perception” European Journal of Marketing Vol. 38 No. 1/2, pp. 194-208

H., Kim & D.L. Vettera, J. Lee (2006) “ The influence of service quality factors on customer Satisfaction and Repurchase Intention in the Korean Profession Basketbal league”, International Journal of applied sciences, vol 8(1), pp 3-58.

Hultink, E. Jan, and Hart, Susan (1998) “The world’s path to the better mousetrap: myth or reality?”, European Journal of Innovation Management Volume 1 Number 3 pp. 106–122

Indounas, Kostis and Avlonitis, George J. (2011) “New industrial service pricing strategies and their antecedents”, Journal of Business & Industrial Marketing Volume 26 Number 1, pp. 26–33

Jensen, Marlene., Haven, Lock and Drozdenko, Ronald (2008) “Pricing strategy & practice, the changing price of brand loyalty under perceived time pressure”, Journal of Product & Brand Management volume 17 no, 2, pp. 115–120

McGoldrick , Peter J., Betts,Erica J. and Keeling, Kathy A. (2000) “High-low pricing: audit evidence and consumer preferences”, Journal of product & brand management, vol. 9 no. 5, pp. 316-324

Rowley, Jennifer (1997) “Principles of price and pricing policy for the information marketplace”,Library Review,Vol. 46 No. 3, pp. 179-189.

Rubin, Paul H., (2000) “Information Regulation, (Including Regulation of Advertising),” Encyclopedia of Law and Economics, the Regulation of Contracts Vol. III, pp 271-295

Schindler, Robert M. (1989) “Effects of odd pricing on price recall”, Journal of Business Research Volume 19, Issue 3, Pp 165-177

Smith, Gerald, E. (2000) “Search at different price level; impact of knowledge and search cost”, Journal of Product & Brand Management Volume 15 Number 5, pp. 341–351

Tung, Capella.M., and Tat,k. (1997) “Service pricing: a multi-step synthetic approach”, The journal of services marketing volume 11 no. 1, pp. 53-65

Wagner,Ralf. and Beinke, Kai-Stefan (2006) “Pricing strategy & practice, Identifying patterns of customer response to price endings”, Journal of Product & Brand Management Volume 15 Number 5, pp. 341–351

APPENDICES

1. Appendix I (Questionnaire)

| QUESTIONNAIRE

Dear Respondents: The questions given in this survey will be exclusively used for the research project. For each of the statements given below kindly specify your likelihood by putting a check mark in the appropriate box. (Tick only one for each statement) It would be very much appreciated if you would spend a few minutes of your precious time to answer the questions given below. Thank you for your cooperation |

||||||||||||||||||||||||||||||||||

|

Your education: (Tick only one)

|

|||||||||||||||||||||||||||||||||

|

Your household average income per month?

(Tick only one)

|

|||||||||||||||||||||||||||||||||

| How long since you purchased any electronic item

|

What are the key factor(s) you consider when purchasing electronic items?

|

|||||||||||||||||||||||||||||||||

|

||||||||||||||||||||||||||||||||||

| Strongly

Agree |

Agree | Neither Agree Nor Disagree | Disagree | Strongly

Disagree |

||||||||||||||||||||||||||||||

| 1.1. | Product ending in odd digits (e.g. 99 instead of 100) will more likely to grab your attention because it is considered as less expensive |

|

|

|

|

|

||||||||||||||||||||||||||||

| 1.2. | You would purchase a product having odd pricing (e.g. 99, 999etc.) because it conveys the manufacturer loyalty of charging the right amount |

|

|

|

|

|

||||||||||||||||||||||||||||

| | ||||||||||||||||||||||||||||||||||

|

||||||||||||||||||||||||||||||||||

| Strongly

Agree |

Agree | Neither Agree Nor Disagree | Disagree | Strongly

Disagree |

||||||||||||||||||||||||||||||

| 2.1. | You would purchase a product at high price because high price products perceived as high quality ones |

|

|

|

|

|

||||||||||||||||||||||||||||

| 2.2. | You would go for expensive product because it enjoys an exceptional reputation and represents superiority and distinction |

|

|

|

|

|

||||||||||||||||||||||||||||

|

||||||||||||||||||||||||||||||||||

| Strongly

Agree |

Agree | Neither Agree Nor Disagree | Disagree | Strongly

Disagree |

||||||||||||||||||||||||||||||

| 3.1. | You would not purchase a product having deceptive Pricing (e.g. false claim, hidden charges, fake sale etc.) because it is a gimmick to fool customer |

|

|

|

|

|

||||||||||||||||||||||||||||

| 3.2. | Deceptive Pricing negatively affects both your product purchase decision and brand preference |

|

|

|

|

|

||||||||||||||||||||||||||||

|

||||||||||||||||||||||||||||||||||

| Strongly

Agree |

Agree | Neither Agree Nor Disagree | Disagree | Strongly

Disagree |

||||||||||||||||||||||||||||||

| 4.1. | Odd pricing (e.g. 99, 999, 9,999 etc.) has a positive effect on product demand |

|

|

|

|

|

||||||||||||||||||||||||||||

| 4.2. | High Pricing products perceived as high quality products and have positive impression on product demand |

|

|

|

|

|

||||||||||||||||||||||||||||

| 4.3. | Deceptive pricing misleads the customer and it has negative impact not only on the product demand but it also damages brand loyalty |

|

|

|

|

|

||||||||||||||||||||||||||||

Appendix II (SPSS Output)

Cite This Work

To export a reference to this article please select a referencing stye below:

Related Services

View allRelated Content

All TagsContent relating to: "Business Strategy"

Business strategy is a set of guidelines that sets out how a business should operate and how decisions should be made with regards to achieving its goals. A business strategy should help to guide management and employees in their decision making.

Related Articles

DMCA / Removal Request

If you are the original writer of this dissertation and no longer wish to have your work published on the UKDiss.com website then please: