Liter of Light Environmental and Porter's Five Analysis

Info: 7850 words (31 pages) Dissertation

Published: 16th Dec 2019

Tagged: BusinessBusiness Analysis

Table of Contents

1.0 General Environment Analysis

1.4 Technological/infrastructure segment

2.4 Threat of substitutes: low

2.5 Rivalry among existing competitors: moderate

2.6 Industry attractiveness – a summary

3.0 Value chain mapping (Internal Analysis)

3.1 MyShelter Foundation’s resources

3.2 MyShelter Foundation’s Capabilities

3.3 MyShelter Foundation’s Core Competencies

3.4 MyShelter Foundation’s Market Competencies

3.5 Value Chain Mapping – MyShelter Foundation

4.2 Value Chain Mapping – Glow Energy

4.2 Value Chain Mapping – Nam Theun 2 Power Company

6.0 Current Liter of light strategy identification

The purpose of this report is to conduct a situational analysis to assess the environmental and contextual conditions that influence strategy formulation and implementation for Liter of Light, a product of the My Shelter Foundation, to determine whether or not it should enter the Laos People’s Democratic Republic to provide low-cost, easily accessible lighting solutions to the rural and disenfranchised communities that make up 73% of the population. A detailed competitor analysis to further understand the energy sector Liter of Light will be contributing to will also be undertaken.

Liter of Light – Background

This organization, in its purest form, was founded in 2011 in the Philippines by the My Shelter Foundation and Illac Diaz (Williams, 2015). At the time, the main purpose of the charity was to provide sustainable building solutions to storm-damaged communities in the country that had access to shelter, electricity and food destroyed by severe storms and floods in the country. In response to the shocking conditions that rural households were living under, Diaz made a call for action to light up these poor, storm-damaged communities by developing “a solar-powered light that is cheap and relatively easy to assemble and whose main feature is a plastic bottle… water and 10 ml of bleach that aids to refract light from the sun and prevent the buildup of algae” (Williams, 2015). From then on, Liter of Light pledged to create a million, green, off-the-power-grid lights. This idea has spawned many projects in similar underdeveloped nations such as Peru, Bangladesh and Colombia where plastic bottles are transformed into simple solar lights that power streets and villages. Volunteers associated with the foundation and locals in the communities being served assist in the development and manufacture of the bottle lights as minimal skills and resources are required to do so. Liter of Light has applied advances in solar technology and incorporated it to the bulbs to also provide light at night, an even bigger problem that face rural areas. The solar bottles need to be exposed to at least four hours of sunlight to be able to last all night – producing light at the equivalent of a 50-watt conventional light bulb (Meaker,2016). The open-source technology associated with this project has no carbon emissions and “can easily be replicated by the local governments using its more considerable resources” (Liter of Light, n.d.)

To avoid dependence on continued foreign aid in terms of lighting solutions in the communities served, Liter of Light sets itself apart by ensuring that locals are exposed to and enlightened about this cheap, locally maintainable energy solution.

1.0 General Environment Analysis

The Laos PDR is a country rich in natural resources, traditionally agrarian but is in transition to becoming a more modern, market-oriented economy increasingly integrated with neighboring countries in the Greater Mekong Sub region (GMS). To further understand the business environment Liter of Light will likely operate in in Laos, a thorough analysis of the general environment needs to be undertaken by looking into the politico-legal, economic, sociocultural, technological and demographic segments that make up Laos. My Shelter Foundation’s operating strategy, growth and profitability will be influenced by the findings on this PESTEL analysis.

1.1 Demographic segment

As of 2014, Laos had an estimated population of 6.8 million – an average growth of 1.1% from the last census conducted in 2007 by the UNDP (2013). Of the 6.8 million citizens of this sparsely inhabited nation, 67% make up the working age population of 15-64 years with limited skill sets. Nanthavong (2006) estimates that despite the population growth in Laos, the “average density of 24 persons per km2…. greatly affects the viability of energy projects because of the high investment costs incurred in reaching distant settlements.” The numerous ethnic groups that live in remote, mountainous regions within the country have very limited access to basic services such as electricity, and markets (Asian Development Bank, 2013). For not-for-profit organizations such as the My Shelter Foundation, these two factors (unskilled labor force and high costs of electrification) will work in their favor as these organizations aim to illuminate remote villages that deemed “sunset a non-negotiable curfew for businesses and families” (Meaker, 2016). Carrillo (2014) goes on to point out that “[this] project is another opportunity for villagers not only to earn extra income, but also to help other people especially those in the boondocks who have no electricity” by making use of the abundant labor available in these rural areas.

Urbanization and urban migration have been steadily increasing since 1995, growing at approximately 5% per year. This trend is likely to continue as the country’s urban areas are developing at a faster rate than the rural regions. According to the UNDP (2016), the main reason for this significant migration to urban centres is the widening disparities in livelihoods and access to healthcare and education between urban and rural areas. Poverty in the country is high and is concentrated in rural areas, making these zones less attractive for investors. Further, within the rural areas the socioeconomic divide is again quite different between the lower and higher lying areas – an important factor for would-be investors to consider with the products that they would introduce to the financially diverse countryside.

The average income in the Lao PDR is slightly over $1,200, and approximately 25% of the population lives below the poverty datum line, that is, less than $1 daily in purchasing power parity terms (ADB, 2013). Villagers with a flair for Liter of Light’s brand of entrepreneurialism are said to earn an estimated 50 cents per unit installed in their villages which with the aforementioned meagre incomes and access to jobs, may go a long way for this rural demographic that lives in 7 of the nation’s 17 provinces. Given the relatively low-income levels and limited access to sustainable, income-generating employment, this market demands alternative products that cater to their needs and pockets, that is, affordable lighting solutions that the government may not be able to immediately supply.

1.2 Sociocultural segment

The history of Laos is unique in that its national character is diverse, both in terms of customs and culture. Being a former French colony and member of the French Indochina empire, Laos is still heavily influenced by France, Vietnam, Thailand and China. With that said, Lao culture is closely intertwined with Buddhist principles and the corresponding cultural eccentricities synonymous with the various ethnic groupings (UNDP, 2016). This fact, to some degree, suggests that the Lao citizenry is not as collectivist as most East Asian countries, but rather, they believe that each person is responsible for their own fate in the grand scheme of things and do not interfere in the affairs of neighbors. Would-be investors need to pay particular attention to and familiarize themselves with the nuances associated with each ethnic tribe, especially the patriarchal structure of families and business interactions.

The Lao are known to be generally good-natured and tolerant, and have relaxed attitudes that value non-confrontation, modesty and simple speak. Laotians do not value demonstrative, aggressive nor loud expressions during conversations and perceived disagreements. Confidentiality is an important cultural value, but that said, relationships are mainly based on trust. Public body contact, especially between men and women is to be avoided at all costs as this can be seen as disrespectful. Lao people tend to be reserved in most social and business exchanges.

1.3 Economic segment

Between 2002 and 2012, the Lao PDR has experienced robust economic growth averaging 7%–8% annually which is the driving force behind the country modernizing and making attempts to alleviate poverty by creating sustainable employment for its citizenry. Because of these statistics, Laos is now considered to be among the fastest growing economies in the world (ADB, 2015). It should be noted however that economic progress and trade expansion in Laos will continue to be hampered by a shortage of workers with specific technical skills, inadequate education and healthcare systems, and poor – albeit improving – transportation infrastructure.

Laos has made significant progress in integrating its economy with the global trading system by becoming a member of the ASEAN economic community. The government continues to engage in regional and international economic cooperation to achieve sustainable economic growth and meet development targets. Since Laos is at the center of many economic and transport corridors in the GMS region, opportunities exist for market access under unilateral and reciprocal predilections (Vientiane Times, 2015). Laos’ increase in regional economic development is evident by the fact that trade flows through the country to neighboring countries from the electricity grid and the roads have been on the rise, involving in the case of roads connections between multiple countries forming regional transportation corridors (ADB, 2013). There has also been an increase in the flow of international development funds to the country.

1.4 Technological/infrastructure segment

Laos has underdeveloped infrastructure, including its road networks, and its public water and electricity systems. The country is currently undergoing development of its airport and aviation system, including provincial airports. Transportation projects such as these (and upgrading road networks) are currently in high demand as the country modernizes and opens its borders to foreign investment. Large-scale construction projects in the capital of Vientiane where shopping malls and business centres are mushrooming (ADB, 2013) are also a sign of Laos’ pledge to modernize and move away from the ‘least developed country’ status. Chinese, Vietnamese and Thai companies are the most active participants in infrastructure development in Laos. These infrastructure projects are heavily financed by donor funding and loans from developmental banks such as the ABD (ADB, 2013).

Laos is seeking to update and integrate its electrical grid in the next decade as it seeks to meet its goal of increasing electricity exports to Thailand and Vietnam, while at the same time providing electricity to 90 percent of the population by 2020. To do this it will need to invest in modern power distribution and power management equipment and expertise (UNDP, 2016).

According to Vientiane Times (2016), the Lao power sector is under a rapid process of development, which aims at realizing the country’s electrification program, and at the same time facilitate the export of electricity to neighboring countries. Around 10% of the total houses across the country will have to be electrified by 2020. The power sector has the potential to play a pivotal role in achieving the social and economic development objectives of the government by expanding the availability of low cost, reliable electricity within the country and earning revenue from export sales to the region (Xinhua, 2016). To date, Laos has 46 functional hydropower plants and has plans to construct more for export purposes. Solar power generation is a secondary aim of the government given that “Laos has a huge potential in hydropower, which can further drive economic growth” (Myanmar Business Today, 2018).

1.5 Political/legal segment

Despite its ranking as one of the poorest countries in the world, Laos has one advantage over most nations: a high degree of political stability that has facilitated real economic growth of at least 7% since the early 2000s (BBC, 2010). The Lao government actively promotes political, administrative, and economic centralization over the regionally dispersed and ideologically indifferent provinces.

Institutions, especially in the justice sector, remain highly underdeveloped and regulatory capacity is low. Investors report that corruption at all levels of the public sector and government administration remains a major concern (UNDP, 2016). Corruption, policy and regulatory ambiguity, and the uneven application of law are disincentives to further foreign investment in the country. The Lao government is however making efforts to improve and has a five-year plan that directs the government to” formulate policies that would attract investments” and to “begin to implement public investment and investment promotion laws” (UNDP, 2016). Investors, however, report that practice and implementation has not yet caught up with the spirit of new laws. Furthermore, the multiple ministries and three separate methods for foreign investment into Laos lead to confusion, with many potential investors engaging either local partners or law firms to navigate the often-confusing bureaucracy or turning their efforts entirely toward other countries in the region.

By opening its borders to international trade and aid, Laos continues to lift its profile in south-east Asia which aids its ability to implement many social and economic development goals such as poverty eradication, employment creation and an increase in foreign exchange reserves. By virtue of being open to outside investment, charitable organizations and major foreign energy sector companies are permitted to come into the country to assist the government with various projects because the country’s regulations and laws allow it – under the condition that the government has partial ownership of the new firm, at times with a minimum of a 30% stake ceded to the Lao authorities.

2.0 Energy sector analysis

2.1 Threat of entry: low

Hydropower projects are backed by ASEAN MOUs with neighboring countries that run into hundreds of millions of dollars for the construction of power plants and supply of electricity (BBC, 2010). The barriers to entry that exist in this industry, according to Porter (2008), include supply-side economies of scale relating to advanced technologies to harness exponential volume of power compared to Liter of Light; excessive capital requirements to set up a power plant whether it be solar, hydro or otherwise; and lastly, government advantages characterized by preferential access to favorable geographic locations, resources and external partner funding. As previously noted, aggressive government policy to foster and protect this industry is another factor that may deter entrants to this industry, even with regards to supplying solar energy to the rural masses as the noted priority is harnessing hydropower for internal and external use.

2.2 Power of suppliers: high

An industry is deemed near undesirable in cases where suppliers of a good or service can charge a premium for the product thereby gathering additional profit for themselves. Porter (2008) states that supplier power is higher in cases where the supplier group is “more concentrated than the industry it sells to… industry participants face switching costs in changing suppliers [and] the supplier group can credibly threaten to integrate forward into the industry” thereby inducing a major player to offer the competing product. In the case of the Lao government and the energy sector, supplier (government) power is substantial because the government closely monitors the expansion of this sector vis à vis the development of the nation and meeting agreed upon millennium development goals. An investor wanting to enter this lucrative industry by championing low-cost solar energy solutions will indeed experience some push back from the authorities who oversee the electrification of the country – both on and off grid.

2.3 Power of buyers: moderate

As previously noted, Laos is among the least developed and poorest nations in the world (UNDP, 2016). Poverty alleviation and finding solutions to increasing per capita consumption for citizens who survive on under $2 per day are leading reasons why energy consumers in Laos have limited bargaining power. Low income levels render the Lao rural citizenry significantly price sensitive which, according to Porter (2008), will force them to shop around for cheaper, more easily accessible alternatives of the product being peddled by dominant suppliers. Low-cost energy suppliers will greatly benefit from this limited buyer power as the product they seek to introduce to rural Laos will cost no more than $1 to develop. Green investors such as non-governmental organizations are primarily interested in ‘electrifying’ the rural public of developing nations where governmental rural electrification programs are hampered by either speed, resources and lower hanging fruits such as income generation (Liter of Light, 2015). Off-grid energy sources, especially those being manufactured and donated by up-and-coming charitable organizations, cost a fraction of the total service fee and “provide the equivalent brightness to a 50-watt conventional bulb in full daylight” (Williams, 2015).

Adding to the power of Laos energy consumers, Liter of Light’s bottom-up approach to energy solutions fosters the spirit of entrepreneurism, that is, consumers of this DIY solar lamp “can learn to make and install the devices and sell them on to their communities at a small profit, thus kick-starting grassroots green economies” (Williams, 2015). Alleviating their poverty plight and supplementing their incomes that are destroyed by hydropower plants and dams being built near their homes, the rural masses of Laos will learn to be self-sufficient and empowered because of the positive influence of the charitable foundations.

2.4 Threat of substitutes: low

Hydropower, solar-based energy solutions, as well as fire, coal and gas sources are competing products in the same electricity/energy industry which consumers can freely substitute for another in any market. With this in mind, the threat of substitution of electricity is very low in Laos. The entrance of Liter of Light will not be hampered by this factor as they can freely participate in the Lao economy by offering a cheaper, easily accessible energy alternative to that provided by the government. Porter (2008) corroborates this fact by stating that consumer switching costs from one product to another are quite low – this is true in the case of rural Laotians who may choose to support NGOs electrification programs that may be an income source if they so wish over waiting for the Department of Energy Business to reach their geographic location with higher priced electricity.

2.5 Rivalry among existing competitors: moderate

Given that the Lao energy sector is dominated by the government with few private players, rivalry in this industry is somewhat significant. Government-back institutions such as EDL and LHSE are of similar size and capacity owning a great majority of the power plants and projects in the country, all while driving industry growth and nation development through revenue generation. This level of commitment to employment creation, social development and foreign reserve build-ups greatly contribute to the competitiveness found in this industry as each major player’s goals can be assumed to “go beyond economic performance in the particular industry” (Porter, 2008).

2.6 Industry attractiveness – a summary

The energy sector in Laos, despite boasting of incremental annual growth and revenues, may prove to be very difficult for new entrants to get a foothold in because of the high supplier power and competitive nature of industry players. This fact, in conjunction with considerable setting up costs (capital), government policies monitoring and partly owning new investors, and preferential access to resources and land, ensures that the threat of entry remains low in Laos – all things constant. Despite buyer power being moderate due to consumer price sensitivity and relatively low switching costs between competing energy sources, this industry is still not attractive for new companies. Government and ASEASN-backed power companies will continue to reap the benefits and profits in this industry due to their large size, access and visibility.

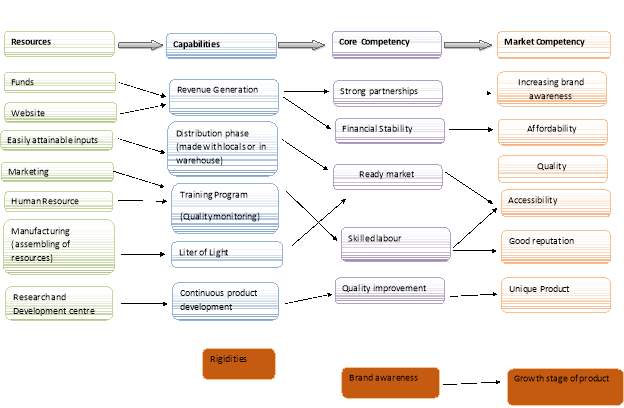

3.0 Value chain mapping (Internal Analysis)

This section highlights what MyShelter Foundation’s excels at in the industry and where they may seem to falter with the core view of recognizing the Foundation’s core strengths and market strategies that may serve as sources of sustainable competitive advantage. Using the value chain mapping tool, an analysis and grouping of the Foundation’s activities into primary and support groups will ensure ease of organizational input identification. Based on the identified resources, detailed outline of the firm’s capabilities will be presented to reveal the Foundation’s underlying strengths and competencies. Organizational weakness, referred to as rigidities will also be revealed.

3.1 MyShelter Foundation’s resources

In simple words, resources here refer to the basic inputs to the organization. Inputs could be tangible and intangible.

3.1.1 Tangible resources

Basic inputs used by the Liter of Light program to produce solar lighting solutions include recycled plastic bottles, water, bleach and small pieces of corrugated metal edged into the roofs of houses to produce the equivalent of a 55-watt bulb of clear light (Liter of Light, 2016). The nature of resources needed to produce a liter of light are easily attainable and therefore creates quick, cheap access to the product – which ensures continuous availability to meet requisite demand.

The foundation has also expanded the program to include battery powered LED lights that also make use of energy from the sun to create street lights.

Training programs across market segments to help in the mass production of the products is carried out from time to time with volunteers from the communities being served. Trained personnel from the Foundation are also on board to assist locals in the ‘manufacture’ of their light. This act of social responsibility and employment creation across market segments that educate the consuming public on how to create their own source of energy undoubtedly presents MyShelter in a favorable light, no pun intended.

3.1.2 Intangible Resources

The Foundation operates within a network of partnerships with the likes of the UNHRC and PepsiCo, as well as other global donor organizations. Liter of Light website creates a platform that enables volunteers and donors to participate in providing energy to developing countries. The organization endeavors to teach green skills to local entrepreneurs to help promote sustainable environments. The Foundation won the 2016 St. Andrews Prize for the Environment, the 2015 Zayed Future Energy Prize and the 2014-2015 World Habitat Award (PepsiCo, 2017) with the proceeds from these prizes used a funding for the various global Liter of Light projects. The Foundation’s sound activities across the globe have earned it a brand recognition in various markets. PepsiCo is a huge partner to MyShelter foundation and has a huge hand in the organization’s marketing and coordinating activities. With the aid of PepsiCo, the foundation has extended its activities across a number of developing countries and keeps attracting investors and partners alike.

3.2 MyShelter Foundation’s Capabilities

The foundation has a strong financial support base emanating from the aforementioned partnerships (Macleod, 2012). Ready access to labor for production and supply is another strong suit for the Foundation. Training programs being undertaken clearly widen the labor force available to the organization. Needless to say, the production of the solar bottles do not require skilled labor nor extensive capital investments, but rather a lay person can successfully be taught and introduced to the simple production process. The availability of funds to the organization creates a reliable base for a stable production of the goods to make them always available. An increasing donor and partnership base ensures continued financial stability for the organization that it can use to promote and distribute the lowly priced DIY solar bottles (Williams, 2015).

There is always room for improvement on the product and this speed up the research and development progress to further enhance the quality of the product.

3.3 MyShelter Foundation’s Core Competencies

The solar bottles are very easy to install, are affordable and are environmentally friendly (Meaker,2016). These attributes create an internal strength that will be recognized by an available market. With this, it can be assumed that the Foundation would be able to easily meet the mass demand from consumers. With incoming partnerships all over the world, MyShelter Foundation boasts of a trend of strong investors that further leverages production and supply capabilities. The DIY solar lights are able to meet the needs of low income earners that cannot afford the cost of traditional energy sources such as hydropower. As training schemes are never ending, labor is sharp and skilled in production. It also goes on to increase the level of quality in the product development. Liter of Light only began with used bottles and bleach but now has incorporated LED lights into manufacturing and production.

3.4 MyShelter Foundation’s Market Competencies

MyShelter Foundation has been able to provide energy at affordable prices to a number of developing countries. Based on price and market turnaround times, the Liter of Light program beats out competition on the market due to the low-cost nature of the solar bottles (Romeo, 2017). This is a valuable market competency to the organization which sets the Foundation apart from competitors. The notable partnerships the Foundation has managed to secure over the years also adds to their recognized market competencies as brand awareness and popularity duly increase.

The ease of manufacturing and assembly of the solar bottles is also a strong asset. Products are made at a faster rate and also on a large scale – while quality is maintained. Production also involves consumers and buyers in the cycle therefore creating ease of access to the product, as well as knowledge about the upkeep of the energy source being introduced to their homes. Liter of Light is regarded by some as a unique product that serves the disenfranchised masses favorably. Developing countries that struggle with energy greatly benefit from this low-priced product which is easily accessible to them. The organization has established a good reputation with its green skill endeavors, and the product is deemed unique on the market for its sole purpose.

3.5 Value Chain Mapping – MyShelter Foundation

3.6 Rigidities

The Foundation is still struggling to establish a competitive brand name in the broader market despite having introduced an efficient alternative to country-specific electrification programs. This slow pace to brand recognition highlights that the Foundation still has a long way to go in order to compete with established power companies.

4. Competitor Analysis

This section highlights the key strengths of major players in the energy sector in the Lao PDR. A closer look at these competitors’ weaknesses will also be revealed.

4.1 Key Competitors

Glow Energy and the Nam Theun 2 Power Company are the main competitors being examined.

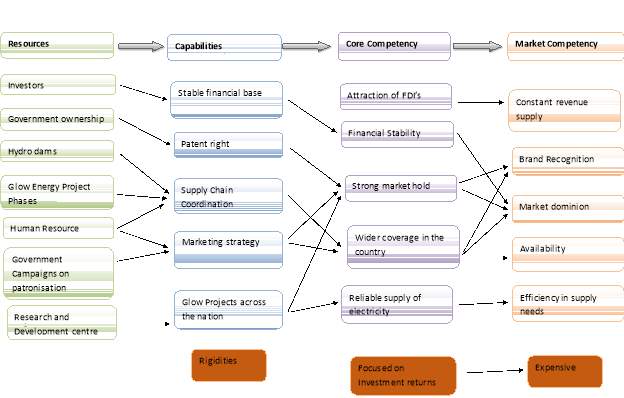

4.2 Value Chain Mapping – Glow Energy

Glow Energy is a member of the Glow Group comprising of both public and private investors and the government of Thailand (Engie Glow, 2017). Glow Energy is based in Lao and is also funded by the Lao government to provide energy to the country. This company currently provides hydroelectric power to most of Laos and is the largest noted source of energy in the country.

As previously noted, Glow Energy boasts of a sizeable group of investors from neighboring countries, a resource which creates a sound financial base for the firm in terms of manufacturing and supply. In addition to this, Glow Energy keeps expanding in Lao with project phases being scattered across the country. These projects have independently built dams serving designated sections of the country as apportioned by local power authorities, thereby increasing Glow’s market share (Engie Glow, 2017). The firm is already known by its brand reputation and dominance in the country’s energy sector.

Glow Energy has access to skilled personnel, and the government uses this human resource to push marketing campaigns. The firm’s established research and development teams ensure continuous supply of quality energy as improvements in service delivery are undertaken regularly.

Glow Energy is however keen on investment returns because of the majority of interest parties associated with the project. This makes them set a price a bit above the standard living of the citizens.

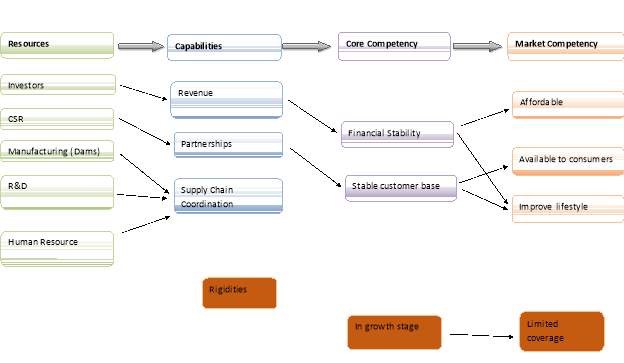

4.2 Value Chain Mapping – Nam Theun 2 Power Company

The Nam Theun 2 Power company is owned by private shareholders and the government of Lao. The company has strong ties with financial institutions such as the World Bank and the Asian Development Bank (NTPC, 2015). The sole aim of the Nam Theun project is to improve the living conditions of the people of Lao by providing affordable energy.

Nam Theun offers consumers affordable energy because the projects are financed by investors that bore huge portion of the expenses in manufacturing and production. The company is well known for its CSR activities in Lao. Nam Theun finances agricultural activities such as farming and fishing to help the citizens in creating income.

Nam Theun project is still in its developing stages and does not have full coverage across the country.

5.0 Competitive Analysis

| Market Competency | Our Firm | Glow Energy | Nam Theun | Competitive Advantage | Sustainable/Non-Sustainable/Not copyable |

| Brand | Low | High | Medium | Glow | Medium-Long term |

| Affordability | High | Low | Medium | Our firm | Sustainable |

| Quality | High | High | High | Glow Energy | Copyable |

| Accessibility | High | Medium | Low | Glow | Sustainable |

| Uniqueness | High | Medium | Low | Our firm | Sustainable |

Surely, Glow Energy has established a high brand name with its numerous project phases scattered all over the country. The company is well known by its citizens. Nam Theun recently began its activities in Lao and still has a lot to prove in the balance of energy power in the country. MyShelter Foundation will have a lot to prove in order to compete with the other brands. Glow Energy’s high brand awareness is quite sustainable within medium to long term period because of the increase in investment schemes at a rapid rate.

When it comes to affordability, our foundation purposefully seeks to provide energy at a very cheap rate. Liter of light solar bulbs are lowly priced and can be bought by any citizen in Lao to provide energy at home. On the other hand, Glow Energy sets its price above the standard living of citizens making it hard for low income earners to afford. Nam Theun falls within the mid-range when it comes to pricing. Our firm has the competitive advantage when it comes to affordability and this is sustainable in the foreseeable future.

All energy sources currently residing in Lao are of high quality because of intense quality monitoring programs undertaken by the government. Glow Energy is a subsidiary of the Lao government and definitely has internal quality checks as part of the project schemes. Nam Theun or any other energy provider that enters the country must also adhere to the energy policies under laid by the government to ensure conformity to quality. Glo Energy’s quality of service is therefore unquestionable, but it is also copyable in the long term.

Liter of Light bulbs are easily accessible by consumers. The foundation undertakes training programs that indulges citizens in the production of the solar bulbs. The finished goods are therefore available to all and sundry. Glow Energy and Nam Theun falls short when it comes to accessibility. Energy provisions by these two companies require official licenses and documents to be filled by users. MyShelter foundation has a strong competitive advantage when it comes to accessibility and it is sustainable into the long term.

Finally, we settled on uniqueness as the last competitive advantage to consider in our entry to Lao. Both Glow Energy and Nam Theun offer hydroelectric power across the country whereas with the entry of MyShelter Foundation, the creation of energy out of nothing stands out as a unique product. This competitive advantage is sustainable in the long run.

6.0 Current Liter of light strategy identification

Business Level Strategy

MyShelter Foundation and the Liter of light project use the differentiation strategy with a low-cost strategy. The Foundation uses throw-away materials such as easily accessible plastic bottles which corroborate the low-cost strategy as manufacture costs are greatly reduced. The basic idea of any business is to use a product or service and then once a new version of the product or service is available, the old one will be discarded. However, Liter of light on the other hand uses the old bottles to produce light bulbs that is cost effective for this they are using volunteers to collect the old bottles and turning empty plastic bottles into mud bricks and to build solar powered bottles. Consumers in the communities the Foundation assists attain an approximate $10 in power charges a month by making use of the DIY solar lights (World Habitat, 2014). According to World Habitat (2014), these same consumers can utilize their $10 savings to move up to the LED-enabled night lights which enables them to additionally save money on power bills. The potential savings realized from switching to the solar bottles ensures that inhabitants of these communities have extra cash to cover their basic necessities. Liter of Light is inspiring the personal satisfaction of thousands of ruined families in the Philippines and other such communities that have no access to the national power grid and who tend to make use of risky lamp fuel lights inside such as paraffin, which give poor light, contaminate the home, cause respiratory issues and may induce fires (World Habitat, 2014). With the sun-oriented lights, consumers of the Foundation’s lighting solutions are able to go about their daily activities and errands inside a brighter home. Having moderate lighting not only enhances the living condition of urban and rural families, but additionally enables children to do homework and play in well lit, safe surroundings. As the My Shelter Foundation follows a differentiation strategy and has to date succeeded with it, the Foundation should now be more concerned about competitors or imitators to their lighting project their technology is open source though, readily available online on their website and YouTube. Through social media and easy replication, the movement has spread to more than 160,000 households and inspired local initiatives around the world lighting up 360,000 homes in over 15 countries. The project has been replicated in 15 countries via partnerships with social enterprises that raise their own funds to run the project in their respective areas (World Habitat,2014). Since the organization makes use of recycled bottles to make light, and keep the cost of making the light lower, they have competitive advantage over potential rivals.

Corporate level Strategy

Liter of light uses stability strategy which ensures that the projects are carried out in a predictable environment. Liter of light uses the current strategy that is being used in other countries in Lao which has bought success with little or no change at all. The organization is also trying to help the community or neighborhood by upscaling it with low cost raw materials, turning empty plastic bottles into mud bricks that otherwise they would not have fund to build. With simple training and tools, local partners and grassroots entrepreneurs could easily replicate and install the solar bottle bulbs earning $0.50 from clients per bottle bulb installed. Products are available in micro-stores in neighborhoods and the project supplies kits to these stores. Liter of light could also partner up with local governments, other non-profit organizations and private companies which can help the organization replicate the project to other countries by raising funds.

References

Asian Development Bank. (2013). Sector assistance programme evaluation for the energy sector in Lao

People’s Democratic Republic. Retrieved from https://www.oecd.org/countries/laopeoplesdemocraticrepublic/47180387.pdf

BBC. (2010). Vietnamese, Lao officials discuss hydropower cooperation. BBC. Retrieved from

http://www.bbc.com/news/world-asia-pacific-15351898

Carrillo, C. (2014). PWDs in Davao eye new business venture. Business World.

Engie Glow. 2017. Retrieved from http://www.glow.co.th/index.php?op=about-about_contact

Liter of Light. (n.d.). About our journey of light. Retrieved from http://www.literoflightusa.org/

McLeod, D. 2012. Pepsi Liter of Light. Retrieved from

http://theinspirationroom.com/daily/2012/pepsi-liter-of-light/

Meaker, M. (2016). The developing world faces a silent killer. Could a $1 solar light help?

A Filipino social enterprise is bringing cheap solar lighting to more than 20 countries helping improve safety, reduce air pollution and cut energy costs. The Guardian. Retrieved from https://www.theguardian.com/sustainable-business/2016/mar/01/silent-killer-kerosene-air-pollution-solar-liter-of-light-india-pakistan-philippines

Myanmar Business Today. (2014). Laos to Sell Electricity to Myanmar. Myanmar Business Today.

Retrieved from https://www.mmbiztoday.com/articles/laos-sell-electricity-myanmar

NTPC. (n.d.). Retrieved from http://www.namtheun2.com/index.php/about-us/project-in-brief

PepsiCo. (n.d.). Liter of Light. Retrieved from

http://www.pepsico.com/live/story/liter-of-light051220141453

Porter, M. (2008). How competitive forces shape strategy. Harvard Business Review. Retrieved from

https://hbr.org/1979/03/how-competitive-forces-shape-strategy

Powering Progress. (2014). Department of Energy Business – Laos. Powering Progress – Laos PDR.

Retrieved from http://www.poweringprogress.org/new/power-sector/department-of-energy-business

Williams, L. (2015). Let there be light: A solar-powered, DIY lamp made from a plastic bottle is

transforming lives. So, who are the bright sparks behind it? The Independent. Retrieved from http://www.independent.co.uk/life-style/gadgets-and-tech/features/liter-of-lights-solar-powered-diy-lamp-made-from-a-plastic-bottle-is-transforming-lives-9993728.html

United Nations Development Programme. (2016). Nama for a renewable energy sector for Laos PDR.

Retrieved from http://www.undp.org/content/dam/LECB/docs/pubs-namas/undp-lecb-mdgc-LAOS-RE-NAMA-2016.pdf

Vientiane Times. (2016). Energy sector to be ‘big contributor to Laos’ GDP’. Vientiane Times. Retrieved

from http://www.vientianetimes.com/Headlines_Sep-Oct_2016.html

Xinhua. (2016). Energy sector to become major GDP contributor in Laos: minister. Xinhua. Retrieved

from http://www.xinhuanet.com/english/2016-10/27/c_135785771.htm

Golangco. (2011).A Liter of Light / Isang Litrong Liwanag: Making the World a Brighter Place, One Bottle

at a Time. Retrieved from

Oshima.(2011).Plastic bottles light up lives. Retrieved from

http://www.cnn.com/2011/WORLD/asiapcf/08/30/eco.philippines.bottle/index.html

World Habitat. (2014). Liter of Light. Retrieved from

Cite This Work

To export a reference to this article please select a referencing stye below:

Related Services

View allRelated Content

All TagsContent relating to: "Business Analysis"

Business Analysis is a research discipline that looks to identify business needs and recommend solutions to problems within a business. Providing solutions to identified problems enables change management and may include changes to things such as systems, process, organisational structure etc.

Related Articles

DMCA / Removal Request

If you are the original writer of this dissertation and no longer wish to have your work published on the UKDiss.com website then please: