Market Entry Strategy for BD’s GSD Product Range in the Korean Healthcare Market

Info: 7062 words (28 pages) Dissertation

Published: 2nd Mar 2022

Tagged: MarketingInternational Business

Executive summary

The case organization, Becton Dickinson Company (NYSE: BDX, also known as “BD”), is a global medical technology company engaged in the development, manufacture and sale of a broad range of medical devices and products used by healthcare institutions.

The organizations global footprint for the Gravity and Syringe Delivery (GSD) intravenous (IV) product range, within Central South Asia (CSA) and specifically the Korean market is seen as a growth opportunity.

The purpose of this research is to analyse a market entry for BD’s GSD product range in the Korean market. This paper will investigate the current business model BD has in Korea, assess current infusion therapy within the Korean market, analyse market entry issues, and present recommendations with respect to developing an appropriate market entry strategy, aligning with the organizations current resources and strategic vision.

The research methodology utilised a single case study research approach, with the analysis focused on the BD Gravity and Syringe Delivery (GSD) intravenous (IV) product range. Primary data has been researched through a literature search on medical device industry in Korea, secondary data was assessed from industry reports and qualitative / quantitative data was assessed from internal BD market research.

The findings of this research and review of the current Korean infusion market, Korean healthcare reimbursement and BD internal research data analysis, suggests that Korea has a strong potential to meet the expansion goals of the organisation. Furthermore to be competitive in this market BD local manufacturing would be a more viable path due to the unique specific products and introduction of advanced IV sets, that would be required to gain market share Korean market. Cost of entry of the export pathway although viable would not afford the same level of benefit. If there is a market shift BD is in the unique position to leverage the established distributor network and working knowledge of the Korean healthcare market.

This research will have a direct impact on the next steps in market based management strategies for Korea and the development of an offensive market plan to introduce a market specific GSD product range.

Table of contents

1. Introduction

2. Literature Review

2.1 Global Medical Device Market

2.2 Challenges and Considerations of Moving into a New Market

2.3 Korean Healthcare Market

2.4 Common Pitfalls

3. Research Methodology and Results

3.1 Data Gaps

3.2 Competitive Landscape

3.3 Pricing

4. Conclusions

References

Appendix 1

1. Introduction

The case organization, Becton Dickinson Company (NYSE: BDX, also known as “BD”), is a global medical technology company engaged in the development, manufacture and sale of a broad range of medical devices and products used by healthcare institutions. BD’s operations consist of two worldwide business segments: BD Medical and BD Life Sciences

(“BD Annual Report,” 2016). BD provides customer healthcare solutions that are focused on improving medication management and patient safety.

BD acquired CareFusion in 2015, and BARD in 2017, adding a complimentary portfolio of infusion products to the company, making BD one of the 5 largest healthcare companies in the world (“BD Annual Report,” 2016).

Since the BD and CareFusion merger, BD Medical has identified additional global expansion opportunities for the CareFusion products in regions beyond the US and Europe. In 2017, the team responsible for the Infusion Specialty Disposables (ISD) platform initiated a strategic plan to expand the ISD portfolio into the Central Asia region. The drivers being, to increase global sales and offer an infusion delivery solution (vial to vein) across all markets globally.

One of the largest opportunities for BD’s ISD portfolio has been identified as the introduction of the full Gravity and Syringe Delivery (GSD) product range into the Korean market, implementing a strategic “vial to vein” approach. Currently BD sells a limited range of products into this market and the CareFusion infusion product range has never been introduced.

The organization’s global footprint for the GSD intravenous (IV) product range within the CSA and specifically the Korean market is seen as a growth opportunity and entry is pivotal to developing future infusion device expansion both in Korea, and the CSA region (“BD Annual Report,” 2016).

South Korea’s rapid economic growth has fostered the development of a robust healthcare sector over the last few years. Rising incomes, growing elderly population and increased health insurance adoption are major drivers in this growing market. While the country has a sophisticated domestic manufacturing industry, a significant part of the market includes imports from the US, Japan and other Asian countries. An uncertain and difficult pricing and reimbursement environment may affect the export outlook for US based companies (Jong-Wha, 2015). Health spending as a share of GDP in Korea is climbing rapidly. Health spending (excluding investment expenditure in the health sector) accounted for 6.9% of GDP in Korea in 2013 (OECD, 2015).

BD has established global manufacturing and distribution capabilities including a reputable distribution network and a medium size manufacturing facility in South Korea. The current distribution channels and manufacturing facility have room for expansion of the manufacturing core including assembly of current “like product”. The plant has been qualified as an FDA certified manufacturing site and accredited to meet all ISO standards for global export. The purpose of the research is to investigate the current business model BD has in Korea, assess current infusion therapy within the Korean market, analyse market entry issues, and present recommendations with respect to developing an appropriate market entry strategy, aligning with the organizations current resources and strategic vision. A literature review of both primary and secondary data along with market qualitative and quantitative research and deliberations and discussions with numerous stakeholders across the healthcare chain have served as inputs for this paper. It should be noted that this paper will have limitations and will require further manufacturing and financial modelling, and a formal market analysis to fully assess viability as part of a business case proposal.

2. Literature Review

2.1 Global medical device market

The global medical device market is highly innovative and technology driven. Globally it is a rapidly advancing industry impacting and improving diagnosis, treatment and delivery (Stirling and Shehata, 2016).

Population size and market growth statistics don’t necessarily indicate that their business will succeed, three important questions need to be answered – What are its relevant segment dimensions? How big is it? Where is it? (Perreault and McCarthy, 2005). It is important to get the facts straight for good marketing decisions.

Country commercial guides have been a source of reference for BD in the past evaluating potential demand trends, market dynamics, size, import / export options, competition and distribution models. Once the decision has been made to enter an overseas market, companies need to identify how to best go about it and decide which entry strategy is right for the business.

As BD has experience in the Korean market data can be extrapolated from financial and internal data, but a thorough understanding of the market for the products being assessed needs to be reviewed. For this BD has an established process that assesses the topics identified in table 1. Marketing concepts state that marketing managers should meet the needs of customers. This presents as a challenge for the marketers located far away from the countries and the customers they are responsible for. This means that marketing managers rely on help from marketing research to develop and analyse new information (Perreault and McCarthy, 2005).

Table 1.

| Marketing Tool | Description |

| Revenue, cost, and profit relationships | Assess financial aspects of entry, growth and sustainability |

| Competitor analysis | Competitor analysis contributes to growth by helping an organization anticipate and outmanoeuvre the competition |

| Buying process | The Buying Process helps us understand where to intervene and how to drive the desired behaviours |

| Customer segmentation | Used to understand customer purchase behaviours and identify the most attractive customer and market opportunities |

| Implication map – future prediction | The Implication Map provides a picture of what could happen in the future if trends continue and what they might mean for the market, and more specifically, for BD |

| Portfolio Map | The Portfolio map visually articulates the key components of your portfolio. |

| Prioritized Customer Needs | Provides a discipline and framework for assessing and prioritizing unmet or underserved customer needs and benefits |

| Prioritized Market Trend Analysis | Market Trend Analysis will help transform BD into a customer and market-centric organization |

| The Stakeholder Mapping Tool | Provides a way to systematically identify relevant stakeholders, their relationships with each other and their role in the decision making and purchasing process. |

| The Strategic Priorities Tool | Summary of the platform (portfolio) goals, objectives and strategies that will enable the business to uniquely deliver customer value and achieve desired growth |

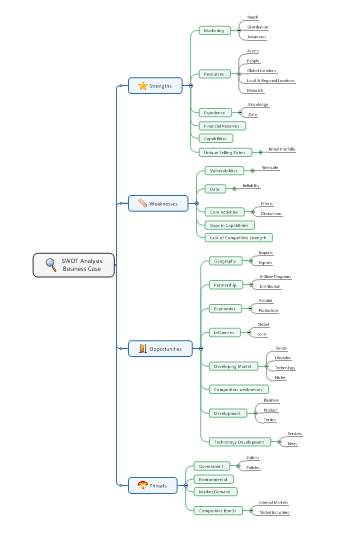

| The Strategic SWOT Tool | Used to understand the strategic choices based on external and internal factors and potential options to pursue |

Source: (“BD Way of Marketing,” 2015).

2.2 Challenges and Considerations of Moving into a New Market

When moving into any international market place there are many factors that must be assessed and overcome before deciding to operate in another country (Epstein, 2004).

All of the basic principles of internationalization would apply when entering into a market such as Korea.

As there are many factors to consider and compare in assessing a market entry opportunity for Korea, reviewing the marketing mix framework as a construct for this analysis focusing primarily on Porters five forces is necessary.

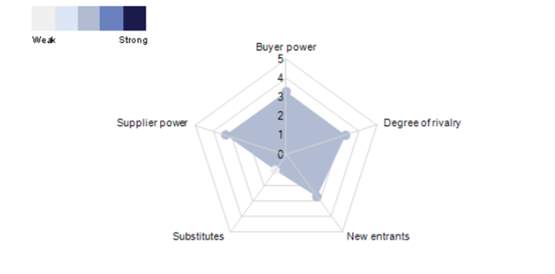

The five forces govern the profit structure of an industry by determining how the economic value it creates is apportioned. That value may be drained away through the rivalry among existing competitors, of course, but it can also be bargained away through the power of suppliers or the power of customers or be constrained by the threat of new entrants or the threat of substitutes. Strategy can be viewed as building defences against the competitive forces, or as finding a position in an industry where the forces are weaker. Changes in the strength of the forces signal changes in the competitive landscape critical to ongoing strategy formulation (“Porter’s five competitive forces,” 2005). Market segmentation The Asia-Pacific healthcare equipment & supplies market is characterized by the presence of large, international incumbents, which increases rivalry somewhat. The number of buyers present within the Asia-Pacific healthcare equipment & supplies market is limited, which serves to increase buyer power and the negotiating position. Market players are heavily dependent upon suppliers of raw materials; suppliers are typically large scale companies that can negotiate on price. Moreover, the quality of inputs is of paramount importance, which strengthens their position (iData, 2014).

There are high entry barriers in the market, often imposed by leading incumbents, but also due to the stringent hygiene and quality demands of buyers. A proven track record is highly advantageous.

Rivalry is alleviated slightly as the majority of key players have diversified operations. However, to succeed within this market, extensive research capabilities, strong distribution networks and partnerships, as well as the ability to meet rigorous government regulations are essential.

Figure 1. Forces driving competition in the healthcare equipment and supplies market in Asia Pacific 2017.

Source: (Marketline, 2017).

Other factors that should be considered would be motives. In this instance BD is looking to accelerate revenue growth broaden the product slate. Commercial logic – a business needs a specific type of self- knowledge. The business must understand how it appears not to itself but to the customers in the market in which it hopes to compete – careful adjustments will need to be made – meet needs not being met by incumbent competitors, shape the market away from local manufacturer competitors and raise the standards of care. (Best, 2012)

Direct and indirect costs, invest in time, developing relationships customers, suppliers, employees, distributors, and various government departments and officials who are essential for the success of the venture. Must be able to adapt accordingly and absorb losses until scale and learning how to compete in the new market (Lavin et al., 2011).

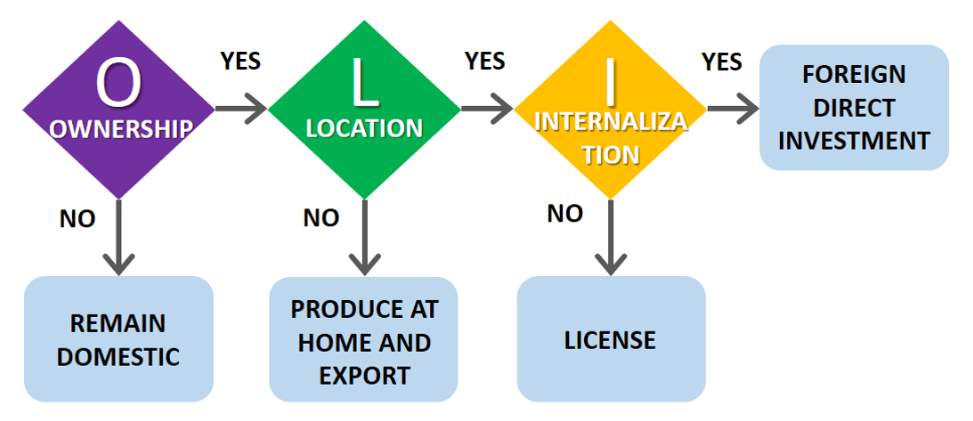

There are a wide range of entry-mode strategies to choose from and they all have unique pros and cons.

A well-used conceptual framework for investigation and analysis of international production has been Dunning’s OLI framework or eclectic paradigm. The “OLI” framework, represented as ownership (O) Location (L) and location (L), provides a helpful framework when evaluating multinational enterprises accounting for all the relevant variables the core factors linking to core competencies in the corporate strategy (Dunning, 2001). The eclectic theory paradigm is based on the assumption that institutions will avoid transactions in the open market when internal transactions carry lower costs.

Within this framework are many micro and macro theories of international production, it is important to understand the market and competitive landscape to identify clusters of variables relevant to the success or failure of the venture (Herrmann, 2008). It is the configuration of the OLI advantages that BD will face, and the strategic response to these that will aid in assessing the strategic response and determination of the quality, geographical composition and industrial structure of international production.

Figure 2. OLI framework

Source: (Dunning, 2001)

The framework considers 3 factors to determine if there is a comparative advantage to performing certain functions within a particular nation. Often, these considerations are fixed in nature; they apply to the availability and costs of resources when functioning in one location over another. Ownership advantages surround issues relating to the proprietary information and various ownership rights a company may hold. Internalization advantages are also considered. This concept focuses on determining if it is best for an organization to produce the particular product itself or consider a contract with a third party. Initial assessment and knowledge of BD’s current activities in Korea would indicate that further financial analysis and modeling should be commenced but would need to align with the assessment of the Korean healthcare landscape, clinical acceptance and a competitive SWOT ananlysis. (Appendix 1)

2.3 Korean Healthcare Market

The Korean medical device market is growing rapidly and presents excellent opportunities in the area of development and distribution of medical devices (Goldenberg, 2014). This growth is estimated at 13.5% and had a value of approximately 39 billion in 2012 making it the third largest medical device market in Asia (“Ministry of Government Legislation,” 2014)

Over the last few years the medical device industry in Korea has evolved and is a new phase of transition. The health sector is experiencing change at a policy and regulatory level from the government driving to support structural and operational transformation (SKP, 2017). Korean government initiatives, stimulus packages and low interest rates over the last few years have allowed Korea to recover well from the global recession, ushering the healthcare industry into an era of strong sustainable growth. In the IV infusion market more investments, modern technology and growing medical reach, an evolution toward affordability to cover a broader market, innovation to cater to demographic need and reputation of compliance and high ethical and regulatory standard is being realised (iData, 2017a).

Korea has been innovative in its approach to healthcare over the last few years. Internally new medical devices have been developed through input and ideas from local medical practitioners. Korean hospitals are identifying cost savings through the purchase of locally produced medical devices. The Korean Health Industry Development Institute (KHIDI) in a 2000 survey identified that most medical service personnel would use domestic medical devices and materials if the products could reach 80% of the quality standard of imported products. This along with government changes to the Medicare Prospective Payment System (PPS) and disease – relative groups (DRGs) would be expected to increase needs and pressures on the use of inexpensive medical devices and materials (Korea, 2014).

Although Korea has been portrayed as having a robust healthcare sector there is an underlying inequality paradox that requires discussion, namely Korea, a country responsible for impressive gains in healthcare and nutrition finds itself with nearly half its older citizens living in relative poverty this could be seen as a concern but knowing that in Korea healthcare is universal and treatment for the poor is paid for by the state makes entry into the infusion space viable (McCurry, 2017).

Another consideration is the impact of trade costs and export led growth which would require an examination of entry and exit patterns. Sooil 2010 examines how trade costs have affected entry, exit, productivity, and exporting in the Korean manufacturing sector. And concluded that large firms are less likely to exit and more likely to have an increase in total factor productivity (Kim et al., 2011). An assessment of both import and export trade future costs will need to be conducted to evaluate productivity and expansion. As BD is established in surrounding markets.

Korea also has a strong and entrenched traditional market history. There is a discordance where the traditional market is perceived, by consumers, to have poor quality and service, yet merchants and distributors perceived this as not being a problem. The emergence of new distribution channels in Korea has changed some perceptions one being the perception that traditional market sales represent poor or low quality (Park and Lee, 2015)

Government and regulatory process can be a barrier to market entry in a lot of international markets and without adequate research can result in costly mistakes. Fortunately the Korean government supports both export and import investments and offers support and guidance to navigate the device registration and licensing process with access to resources at the Korean Ministry of Food and Drug Safety (MFDS). Device approval requires establishing a license holder / distributor in Korea, testing at MFDS sanctioned laboratories submitting technical files to the MFDS or an authorized agent (South Korea, 2016)

As much as managers would like to make fast new market entry decisions they rarely have all the information they would like to have. A good analysis process and the inclusion of strong regulatory and government understanding, good market end user research and a well thought out market entry strategy, can remove a lot of the assumptions and support good business decisions than set the organization up for success.

2.4 Common pitfalls

The literature also identifies common pitfalls or mistakes; Defining the market too broadly or too narrowly, making lists instead of engaging in rigorous analysis, paying attention to all of the forces rather than focusing on the perceived important ones, confusing effect (price sensitivity) with cause (buyer economics) using analysis that ignores industry trends, confusing cyclical and structural change, and using the framework to declare an move as attractive or unattractive rather than using it to guide strategic choices. In other words don’t take shortcuts.

3.0 Research

More than other manufacturing sectors, medical devices have a special stake in innovation; the nature of the business requires companies to elevate their performance to offer better life- enhancing and life-saving technologies. Working to assess the Korean market will aid in optimizing a strategic marketing approach. Case research was chosen as the methodology as it presents a unique opportunity to explore the Korean IV set market in detail. The research analysis focused on the BD intravenous (IV) product range. The data includes a mix of data collected from primary and secondary sources Both primary sources (in-house experts, industry leaders and market players) and secondary sources (a host of paid and unpaid databases) data assessed from industry reports such Asia-Pacific Markets for Infusion Therapy Devices (iData, 2017b), Korean government medical device information (MOLEG, 2014), online statistical sources (OECD, 2017).

My position at BD affords me the advantage of access to recent and historical internal market research. Analysis of BD sponsored third party research, performed through companies such as IPSOS (IPSOS, 2017), and Simon Kutcher (Kucher, 2016) was be reviewed to identify market trends, barriers to market entry and market acceptance criteria From this review a clinical and strategic marketing assessment was formulated to be able to make a recommendation on how to best proceed into the Korean IV infusion market.

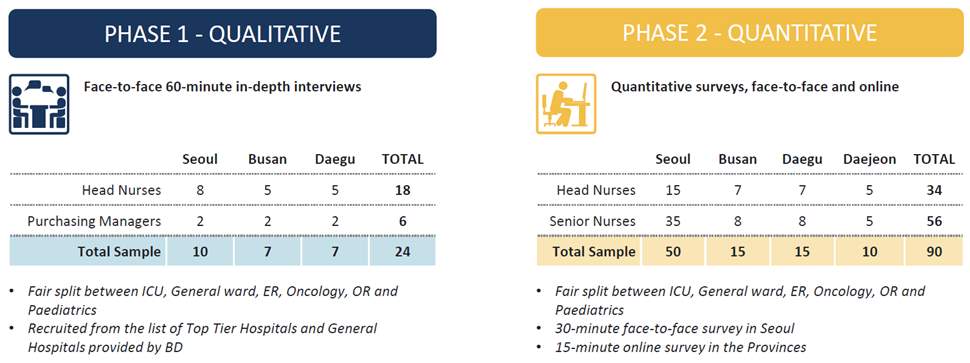

To best assess the IV landscape a review of IV sets currently in use in Korea had been conducted utilizing questionnaires, observation and interviews. These took place over a 12 week period in multiple regions and hospitals across Korea. A screening tool was used to select suitably experienced clinicians, those who did not have the desired clinical experience were not accepted into the research group. The pre-screening tool utilized had been successfully used in prior global IV set market research and facilitated the selection of a knowledgeable and experienced cohort from strategic clinical and business units within a hospital. This was important to ensure the highest quality data was solicited form the limited sample size.

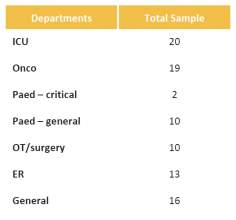

The sample size for the research was capped at 90 (Table 2). All interviews were conducted by profession facilitators in quiet distraction free environments. Contact details of all participants were collected and participants were asked if they would be willing to answer any follow up questions if clarity was required on the areas and topics being discussed.

Table 2 Qualitative and Quantitative sample groups.

Source: (IPSOS, 2017)

Questions used for both arms of the research were designed to answer key market questions (Table 3) and identify any IV infusion practices unique to Korean market. The questions used in the research had been previously used in other market research, adjustments were made to facilitate clinical understanding and adjust for regional variances in clinical practice to maximise the quality of the data. During both the qualitative and quantitative research arms, clinicians were asked to bring a sample of the most common IV set that they use in their practice/hospital. These IV sets were kept for further analysis, and feature mapping.

Table 3. Key market questions

|

Key Stakeholders: Identify key stakeholders involved in the selection of IV sets. Enable BD to target knowledgeable influencers with the health system |  |

Segment Attractiveness: Assess if different segments have differentiated traits / needs that present a niche opportunity |

|

SKU Selection: Understand the use of various configurations with regards to IV line features and rational, including the use of extension sets. Explore the potential for customisation Vs USPs of new advanced IV set |  |

Success Factors: Advise BD on the most appropriate approach to set itself apart from its competitors and how to execute successfully |

|

Market Opportunity: Identify the strategy to advance, appeal of BD IV sets in Korea, opportunity for advanced IV sets, and key success factors |

Source: (IPSOS, 2017)

Notes on the data:

- As the sample size for the individual department splits is small, the overall sample was used to assess and extract more meaningful statistical analysis. This data was also compared against other countries market data to assess for trends and inconsistencies.

- Analysis by department is considered to be directional only

- Throughout the report, volume/proportion of IV sets and absolute counts are reflective of the sample interviewed, not a reflection of the actual Korean market, and relative only to the configurations identified in the study.

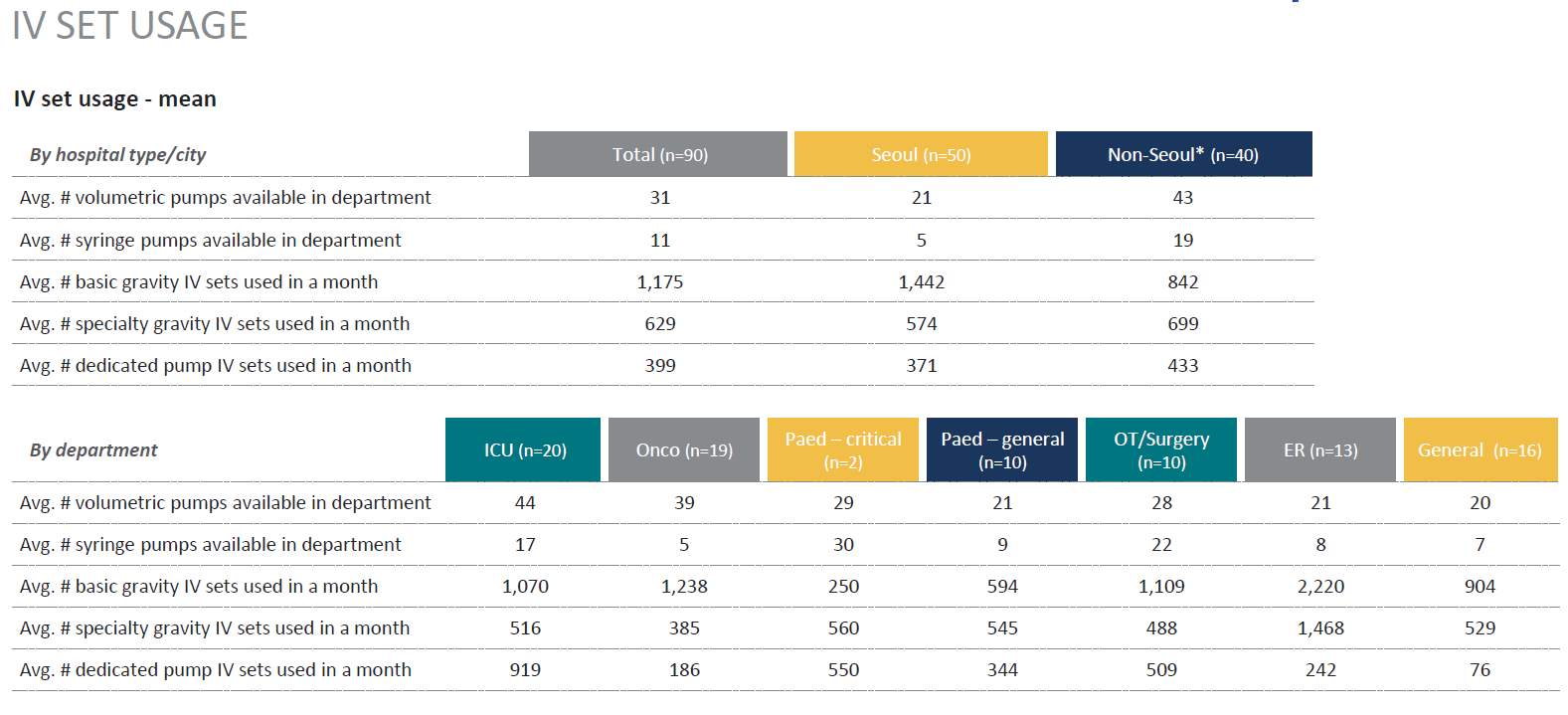

As there are variants in types of IV sets Gravity Vs IV infusion pumps sets questions were included that validated and differentiated the sets to ascertain market pump use Vs Gravity use. This was a key with the research as in prior research this area required additional assessment for clarification. (Table 4)

Table 4. IV Set Usage

Source: (IPSOS, 2017)

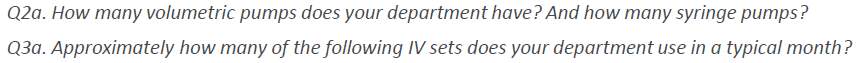

Another area of interest was secondary and extension sets, these are shorter IV sets that have a higher utilization as they are mainly used for intermittent IV infusions. (Table 5.)

Table 5. Secondary and Extension Set Usage

Source: (IPSOS, 2017)

Survey results identified the key findings listed below (Table 6) but also uncovered a unique market reimbursement factor that had not been previously identified around government reimbursement for IV sets with speciality filters and flow regulators. Furthermore upon review of the transcripts the data identified gaps in information regarding filters specifically filter selection, location and type of filter and filter acceptance.

Table 6. Key Findings Overview

|

Key Stakeholders

Department heads are an integral part of the product selection process. Products usually go through a clinical evaluation or trial. Department heads will determine if product meets needs and requirements in consultation with staff, and if acceptable will endorse for purchase. Top 3 key needs identified were convenience, performance and safety. |

|

SKU Selection

Although multiple of configurations of IV sets are used, specific configurations were identified as making up the bulk of the market. Customization was not perceived as important. Multiple manufacturers have most of the configurations required. Configuration in instances drove product selection over brand. |

|

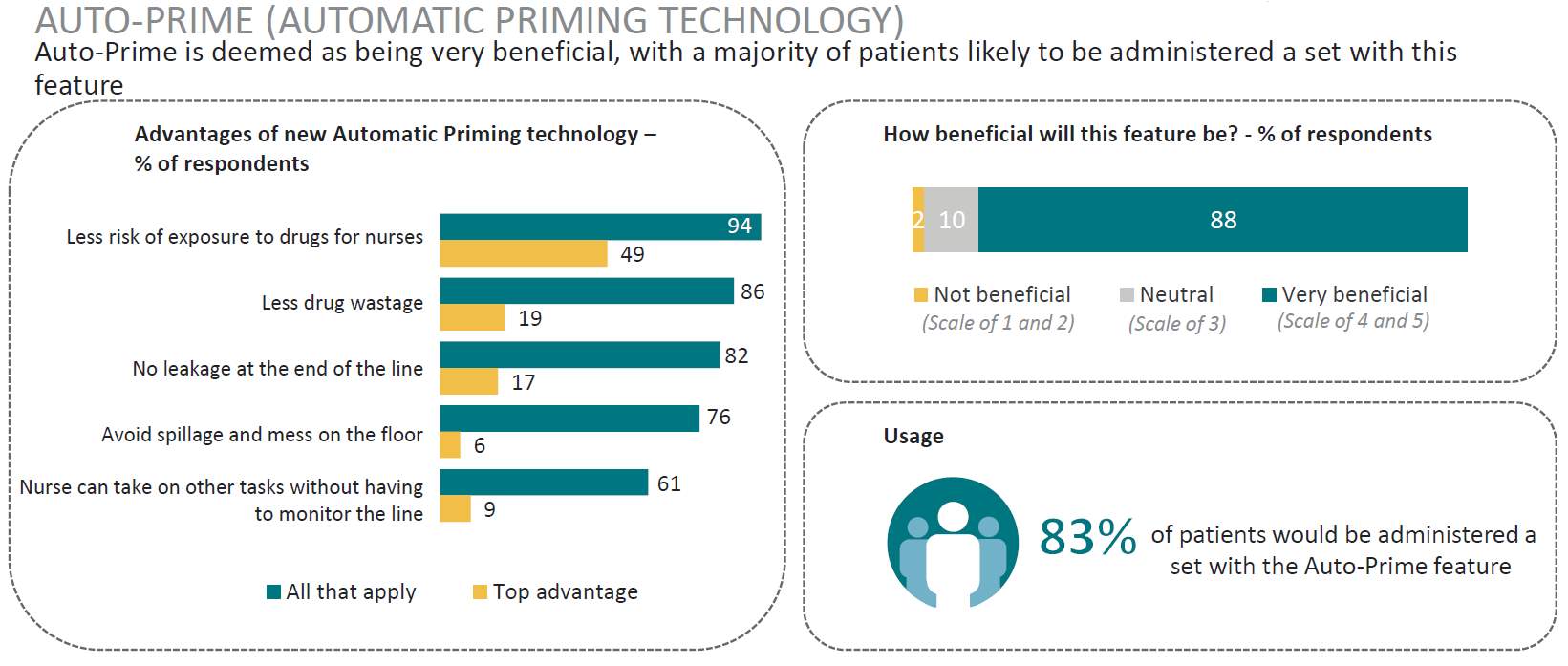

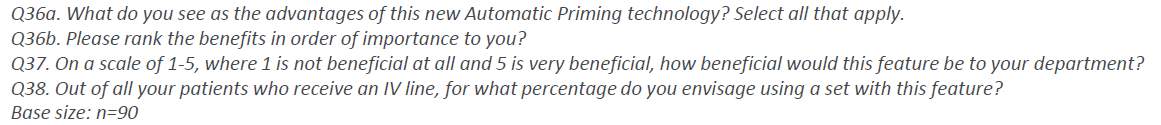

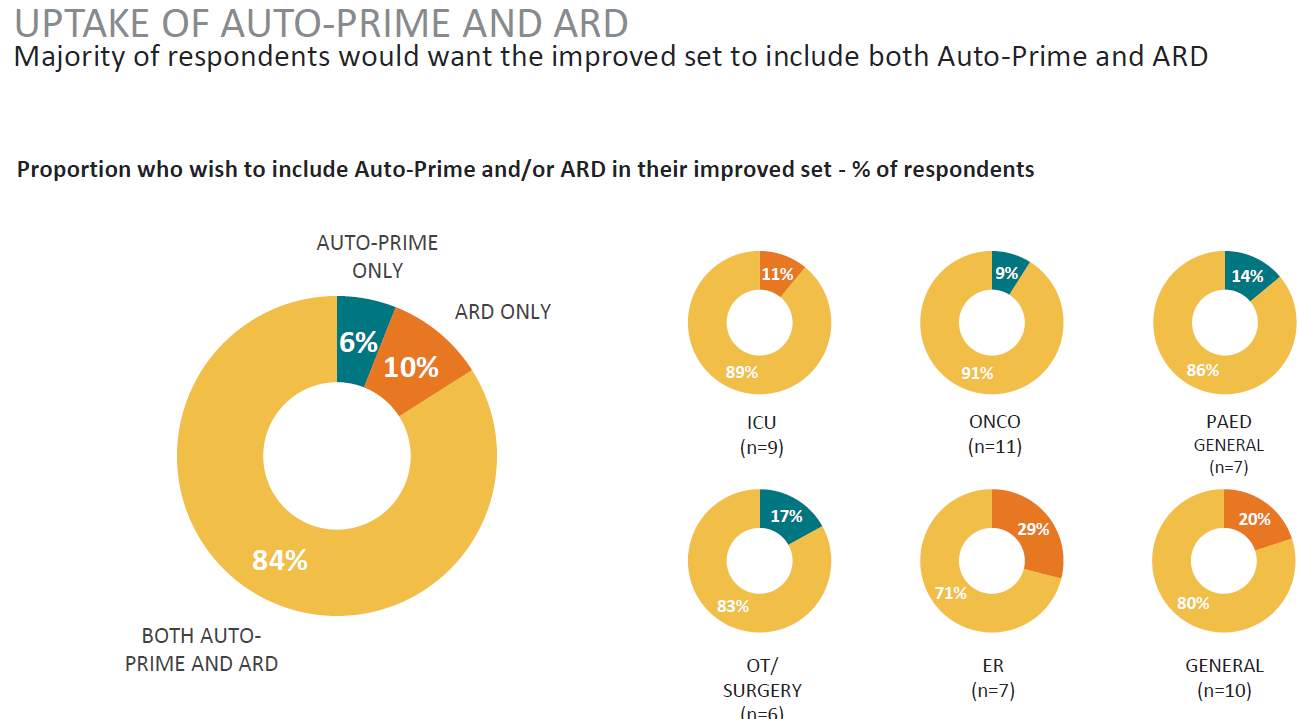

Market Opportunity: Gravity IV sets are an integral part of infusion practice in Korea, and are utilized on average twice as much as dedicated pump sets (669 vs 389). Specialized auto priming caps (hydrophobic) and anti-run dry (hydrophilic) membranes are not widely available in Korea and are perceived as a valuable addition to current IV sets: 84% of respondents responded that these are essential features. |

|

Segment Attractiveness: ER and OR departments tend to use the most sets per month, and are the most likely department to have 1 “go-to” SKU which presents as an attractive opportunity to enter and establish a position in the Korean market. |

|

Success Factors: In addition to the specialized auto priming caps (hydrophobic) and anti-run dry (hydrophilic) membranes, other features appeared to rise as important indicating that the current market IV sets may not be meeting clinical needs. Preferences for an improved IV set Non-PVC, rotating luers, multiple access ports matched other country market trends. Unique filter needs were identified and these appear to be reimbursement driven and specific to Korea. |

Source: (IPSOS, 2017)

After a full analysis of the data it was found that the survey results aligned with other markets that are established and considered to be advanced in healthcare practice, identifying little variation in clinical practice between markets. With regards to advanced IV sets these new features were considered essential by majority of clinicians. (Table 7)

Table 7. AutoPrime and Anti-Run Dry technology

Source: (IPSOS, 2017)

Table 8. Uptake of Advanced Features

Source: (IPSOS, 2017)

3.1 Data Gaps

There were two (2) data gaps identified from the analysis and the need for additional research was identified from the initial results regarding IV set filters and beads of air in line. It is essential that this component of the market is fully understood as reimbursement is currently a key decision in both the hospital purchasing and clinician product selection, and barriers to market acceptance such as “air beads” were considered critical to market success. A second research arm was designed and implemented to better understand the reimbursement and use of filters in the Korean market.

The objective was defined to understand the requirement of the Korean market for different filter sizes, and to establish market acceptance of their latest technology – an ARD filter membrane located at the base of an IV set drip chamber. (Table 9.)

- Feedback from the local market suggests that Korea requires IV sets to have 5µm filter for hospitals to pass costs onto patients. Other filter sizes in the IV lines might impact sales.

- There are also concerns that the Korean market will find it clinically unacceptable if there are air beads trapped under the ARD membrane since the membrane does not allow air to pass upwards and be removed from the IV line into the drip chamber.

Table 9. Overview of Additional Research

| KOREA | |

| Methodology | Face-to-face qualitative interviews |

| Duration | 20 minutes, conducted at venue of respondents’ convenience |

| City | Seoul |

| Target respondents | Head Nurses/Senior Nurses who participated in the previous study (From either the qualitative phase or the quantitative phase)* |

| Sample Size | 45 |

| Other recruitment criteria | Good mix of department/wards

Minimum of 5 years of experience |

(IPSOS, 2017)

The research identified that hospitals maintain active relationships with more than one distributor, quality and integrity were important to respondents. Although price was important manufacturer and distributor relations were seen as extremely important and an integral part of business in Korea. This aligns with the traditional business model that is a part of Korea’s culture. (Table 10)

Table 10. Manufacturer Relationship

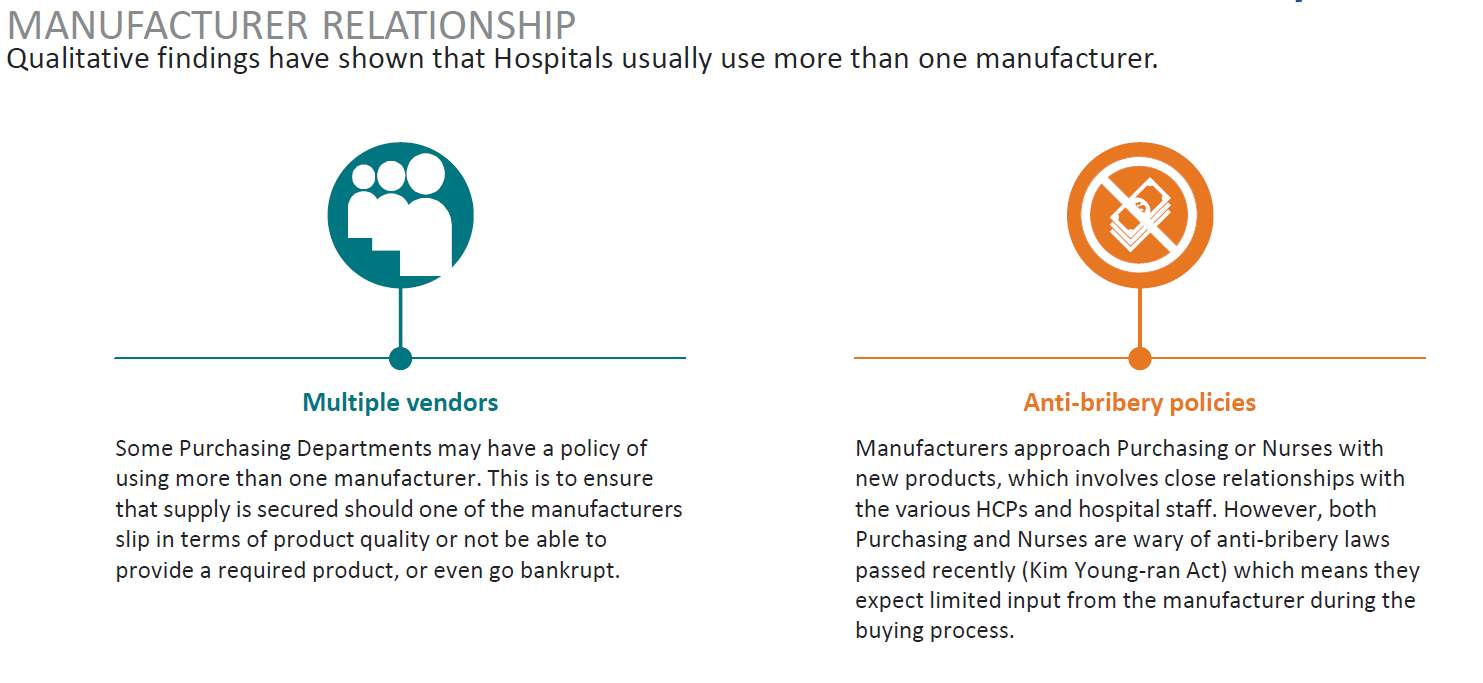

3.2 Competitive Landscape

Studying the competitors can yield insights into what it takes to compete in the foreign market. Specifically how the incumbent competitors perform critical activities – distribution, customer financing, manufacturing, marketing, sales, and addressing regulatory requirements (Lavin et al., 2011). It appears that the major competitors seen in the surrounding region do not have a presence in Korea, this would be seen as an advantage to the introduction

Table 11. Common Brands in Korean Market

(IPSOS, 2017)

3.3 Pricing assessment

Pricing the proposed IV infusion products is going to be critical to the success and adoption. Selling value over price will be key the marketing strategy, defining how to best enter the market and shape the market driving the market toward advanced IV sets, maintain a strong profit but remain competitive. Pricing data research completed in 2016 by Simon Kutcher (Kucher, 2016) suggested Korea is a high margin high volume market, recent country dynamics and feedback from the market research, has identified some market segments have seen price erosion as local players and Chinese imports have started a price war. The opportunity here still lies in the fact that these low cost IV sets with poor quality and poor or non-existent safety features are not well respected and hospitals tend to not be loyal to the low cost market. The Korean market believes multi-national companies and imported products have better quality and once a partnership is established they tend to maintain a loyal relationship.

4. Conclusion (or Recommendations and Conclusions)

This paper has assessed the opportunity to move into the Korean healthcare market with the BD GSD range of products. The development of an offensive marketing plan that capitalises on current market resources and local manufacturing offer market attractiveness and will provide a competitive advantage. Part of the offensive strategy will be to expand market demand and BD’s unique position will allow for a blend of Korean traditional IV sets along with market shaping activities promoting advanced IV sets improving competitive position and improving differentiation advantage. With the potential to export from Korea to other Asia markets with standardisation, improved marketing productivity. The ability to enter related markets and develop new markets will drive growth in the region and meet organisational objectives.

This paper provides a conceptual framework that links manufacturing to business unit strategy and focuses on developing the notion of ‘generic manufacturing strategies’ at the strategic business unit (SBU) level. Drawing on ideas and concepts from the business strategy literature and manufacturing literature the paper links Porter’s generic strategy framework to a complementary manufacturing structure framework that uses three dimensions: process structure complexity, product line complexity, and organizational scope. Beyond this review a full financial analysis will need to be conducted and a entry plan timeline developed.

Based on the information it would be

References

iData, 2014. Asia-Pacific Vascular Access Devices and Accessories Market 2014 – 2020. iData, Asia Pacific.

BD Annual Report [WWW Document], 2016. URL http://investors.bd.com/phoenix.zhtml?c=64106&p=irol-irhome (accessed 3.18.18).

BD Way of Marketing, 2015.

Best, R., 2012. Market-Based Management, 6 edition. Pearson, Boston.

Dunning, J.H., 2001. Eclectic (OLI) Paradigm of International Production: Past, Present and Future: Int. J.of the Econ. Bus., 8:2, pp. 173-190. D. Law (Module Leader).

Epstein, L., 2004. Streetwise Crash Course Mba. Adams Media, Avon, MA.

Goldenberg, S.J., 2014. The Medical Device Industry in Korea: Strategies for Market Entry 8.

Herrmann, A.M., 2008. On the Discrepancies between Macro and Micro Level Identification of Competitive Strategies. MPifG.

iData, 2017a. Asia Infusion Market Update.

iData, 2017b. Infusion Therapy Market Research.

IPSOS, 2017. IV Set Final Report: Korea.

Jong-Wha, L., 2015. How South Korea can sustain strong growth [WWW Document]. World Econ. Forum. URL https://www.weforum.org/agenda/2015/01/how-south-korea-can-sustain-strong-growth/ (accessed 4.26.18).

Kim, S., Reimer, J.J., Gopinath, M., 2011. The Impact of Trade Costs on Firm Entry, Exporting, and Survival in Korea. Econ. Inq. 49, 434–446. https://doi.org/10.1111/j.1465-7295.2009.00286.x

Korea, K.H.I.D.I. (South, 2014. KHIDI Health Industry Statistics Annual. 길잡이미디어.

Kucher, S., 2016. Portfolio and Pricing Strategy for BD IV access, Gravity IV Sets and IV Catheters Platforms. Singapore.

Lavin, F., Cohan, P., Locke, G., 2011. Export Now: Five Keys to Entering New Markets.

Marketline, 2017. Health Care Equipment & Supplies Global Industry Guide.

McCurry, J., 2017. South Korea’s inequality paradox: long life, good health and poverty inequality [WWW Document]. URL https://www.theguardian.com/inequality/2017/aug/02/south-koreas-inequality-paradox-long-life-good-health-and-poverty (accessed 4.26.18).

MOLEG, 2014. Ministry of Government Legislation [WWW Document]. URL http://www.moleg.go.kr/english/ (accessed 3.18.18).

OECD, 2017. OECD Health Statistics [WWW Document]. URL http://www.oecd.org/els/health-systems/health-data.htm (accessed 3.19.18).

OECD, 2015. Korea – OECD Health Statistics [WWW Document]. URL http://www.oecd.org/korea/ (accessed 3.19.18).

Park, M., Lee, M., 2015. The Rise and Fall of Traditional Market in Korea. JMT.

Porter’s five competitive forces, 2005. . Z Manag. Concepts Models 268–272.

SKP, 2017. Medical Device Monitor.

South Korea [WWW Document], n.d. URL http://www.healthdata.org/south-korea (accessed 3.19.18).

Stirling, C., Shehata, A., 2016. Collaboration – the future of innovation for the medical device industry [WWW Document]. KPMG Rep. URL (accessed 4.20.18).

Perreault, W., McCarthy, J., 2005. The McGraw-Hill/Irwin Series in Marketing: Basic Marketing : A Global-Managerial Approach, 15th ed.

Appendix 1 – Korea SWOT analysis

Cite This Work

To export a reference to this article please select a referencing stye below:

Related Services

View allRelated Content

All TagsContent relating to: "International Business"

International Business relates to business operations and trading that happen between two or more countries, across national borders. International Business transactions can consist of goods, services, money, and more.

Related Articles

DMCA / Removal Request

If you are the original writer of this dissertation and no longer wish to have your work published on the UKDiss.com website then please: