Analysis of the Northrop Grumman Corporation

Info: 9091 words (36 pages) Dissertation

Published: 22nd Oct 2021

Tagged: Business Analysis

Executive Summary

This analysis was conducted to formulate a strategic plan for the Northrop Grumman Corporation. Northrop’s history, finance, corporate governance, mission statement, vision statement, key strategies, strengths, weakness, opportunities, and threats were analyzed. Northrop’s history depicts the firm as a dynamic, evolving, and multifaceted global corporation; shaped into one of the leading U.S defense contractors through the strategic acquisition of other firms in its industry over the years. An analysis of Northrop’s finances shows the firm as financially strong with the ability to avoid financial distress in the long run. The firm’s corporate governance was found to be governed in a direction that fosters the long-term success of the company while maximizing the values of the stockholders. Northrop’s mission and vision statements are illustrative of the firm’s dedication to conducting their business in a manner that maintains integrity and upholds the company’s values.

Northrop’s key strategies were found to be supportive of the firm’s growth and stability through enabling the firm to be able to provide innovative, strategic, sophisticated, and differentiated products and services to its customers. Northrop’s unique sets of strengths, weaknesses, opportunities and threats were found to be supportive of the firm’s sustainability and potential growth into new and existing markets. The aggregated results of all the factors analyzed resulted in the recommendation that Northrop should continue to implement an acquisition growth strategy; as this would enable the firm to potentially gain market share, revenue, new areas of expertise, increased efficiencies, and cost controls. In addition, the implementation of this strategy will make Northrop a more diversified and competitive company in its industry.

Table of Contents

Executive Summary

History of the Northrop Grumman Corporation

Northrop’s Vision Statement

Northrop’s Mission

Financial Overview

Corporate Governance

Firm’s Global Challenges

Northrop’s Current Functional Level Strategies

Northrop’s Current Business Level Strategies

Northrop’s Current Corporate Level Strategy

Northrop’s Current Global Strategy

Northrop’s Opportunity and Threat Analysis

Northrop Grumman’s Strength and Weakness Analysis

Northrop Grumman’s Threat, Opportunity, Weakness, and Strength Analysis

Potential Strategies for the Firm

Conclusion

References

Analysis of the Northrop Grumman Corporation

History of the Northrop Grumman Corporation

Northrop Grumman Corporation had many predecessor companies that can be traced to having significant impact in aerospace history. In 1932 Jack Northrop created Northrop Corporation as a division of Douglas Aircraft. During this partnership, the Alpha was created; the first single shell aircraft made with metal instead of wood which inspired the creation of new generation aircrafts for the Douglas Aircraft company; namely, the DC-1, DC-2, and DC-3. In 1938 Northrop Corporation was absorbed into Douglas Aircraft, leading to Jack Northrop establishing the Northrop Aircraft Company. The Northrop Aircraft Company developed the flying wing bombers B-35 and B-49 when World War II erupted. The Northrop Aircraft Company changed its name to Northrop Corporation in 1958. Northrop Corporation handled a number of diversified subcontracting agreements, built numerous airplanes and missile parts, electronic control systems, and sometimes dabbled in construction (Northrop, 2017).

In 1994 Northrop successfully pursued and acquired Grumman Corporation; an aerospace and electronic surveillance manufacturer with ties to the U.S Navy. This acquisition did not only make Northrop third in its industry behind Lockheed Martin and McDonnell Douglass, it also made Northrop a more diversified company than both Lockheed Martin and McDonnell Douglass. The history of the Grumman Corporation is what truly explains why Northrop’s acquisition of Grumman made the company more diversified in its industry. Grumman Corporation was originally formed in long island in 1929 by Leroy Grumman and Leon Swirbul as the Grumman Aircraft Engineering Corporation. The company manufactured it first fighter jet the FF-1, for the navy in 1932. Later improvements of the design led to the development of the F4F wildcat, known as the first fighter jet with folding wings. The company also developed a line of flying boats called duck and goose. In 1960 Grumman delivered to the world the first business jet, the Gulfstream 1. Grumman’s subsidiary created in 1962 was known as Grumman Allied Industries; it handled all of the company’s non-aeronautical business, including its aerospace ventures. Grumman Allied Industries was responsible for manufacturing the Lunar Modules used during the Apollo programs which aimed to land a man on the moon before 1970 (Northrop, 2017).

The acquisition of Grumman in 1994 gave Northrop the electronic surveillance expertise and ties with the U.S Navy that were unique to Grumman; creating the newly name Northrop Grumman Corporation. In the years to follow, Northrop Grumman would partake in many other acquisitions aiding in its growth in the industry, while supporting the company’s shifting emphasis to focus on cutting edge areas of the defense industry; including electronic and systems integration. In 1999 Northrop Grumman purchased the information systems division of California Microwave Inn which worked with supporting communications and intelligence systems of the U.S Department of defense. Northrop Grumman also purchased Ryan Aeronautical, which manufactured pilotless aircrafts/drones. Further acquisitions through the year 2000 and 2001 led to Northrop Grumman becoming the world’s largest maker of naval ships and the number three defense contractor in the U.S. The period of 1994 to 2002 were marked with Northrop Grumman acquiring a total of 15 companies for $15 billion dollars. (Northrop, 2017).

Northrop’s Vision Statement

Our vision is to be the most trusted provider of systems and technologies

that ensure the security and freedom of our nation and its allies. As the

technology leader, we will define the future of defense – from undersea to

outer space, and in cyberspace. We will conduct ourselves with integrity and live our company Values. Deliver superior program performance. Foster an internal environment of innovation, collaboration, and trust. In so doing, Northrop Grumman will become our customers’ partner of choice, our industry’s employer of choice, and our shareholders’ investment of choice.”

Northrop’s vision statement is descriptive and centered around remaining relevant in the industry to their customers, industry employers, and their shareholders. Such a focus on customers, industry employers, and shareholders are good because these are the stakeholders that are currently sustaining the company and will be moving the company into the future. Northrop’s vision also highlights their goal to remain as the industry main provider for systems and technology; serving as their continuous commitment to supplying innovative products that will ensure the security and freedom of our nation and our nations allies that rely on their technologies. In addition, Northrop’s vision statement depicts their ethical views through emphasizing their dedication to conducting their business in a manner that maintains integrity and upholds the company’s values.

Northrop’s Mission

Our Corporate mission is to provide policy guidelines and strategic direction for the implementation and interpretation of the Federal government initiatives and public law mandates. In addition, we ensure consistent application of the prescribed Northrop Grumman initiatives, policies and procedures across the enterprise.

Northrop’s mission statement is short and vague. It makes mention of adhering to policy guidelines, and having a strategic direction, while ensuring that policies, initiatives, and procedures are followed. However, it does not fully reflect the core purpose, identity, values, and principal business aim of Northrop.

Financial Overview

Northrop Grumman Corp operates in a capital-intensive industry that requires a high level of investments in people, facilities, equipment, and infrastructure. Thus, a measurement of its finances based on the use of profitability ratios(return on asset, return on equity), liquidity ratios (quick ratio), debt management ratios (long term debt to equity, interest coverage), and asset management ratios (inventory turnover), is important to figuring out if the firm is able to turn its business activity into profit, pay its debts, measure its use of financial leverage and ability to avoid financial distress in the long run, and measure the firm’s success in managing its assets to generate sales (Thompson, 2018-2019).

Northrop’s current price per share is $342.86 as of February 1, 2018. Northrop has shown consistent increases in earnings per share from year 2013 to present, from $70.15 in March 1, 2013 to $342.86 on February 1, 2018. Northrop’s current price earnings ratio is $29.89 per dollar of earnings; meaning that investors are willing to pay $29.89 per dollar of the earnings. This is important when looking at the firm’s financials because it is a measure of how much value the firm is creating for its stakeholders, specifically the shareholders who stand to lose the most if the firm is unable to pay its debt. In addition, a PE ratio above 20 usually indicates strong investor confidence in a firm’s outlook and earnings growth, which overall aids the firm in its ability to raise capital (Noc, 2018).

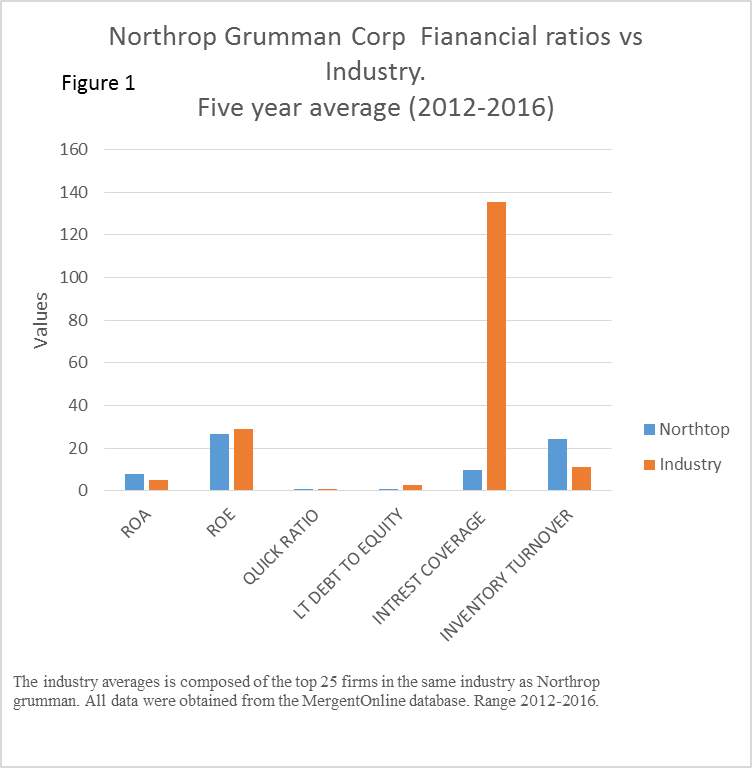

Northrop’s return on asset ratio (ROA) has increased over the years from 7.59% in 2012 to 8.76% in 2016. This is important because it shows that returns earned by stockholders on the firm’s total assets are increasing. Northrop’s average 5 year ROA is above the 5-year average of the top 25 firms in its industry as depicted in (Figure 1). This speaks positively about Northrop Grumman’s ability to efficiently turn its business activities into profits. Northrop’s average 5 year return on equity ratio (ROE) is slightly below the 5-year average of the top 25 firms in its industry as depicted in (Figure 1). However, Northrop’s ROE has shown an increase over the years, from 19.88% in 2012 to 40.7% in 2016. This is important because its shows the return stockholders are earning on their capital investments in the enterprise is increasing. In addition, a ROE of 12-15% is considered average; however, Northrop’s ROE is not only above the average but it is also very close to the average of the top 25 firms in its industry. This also hints positively at Northrop’s ability to efficiency turn its business activities into profits (Mergent, n.d.).

Northrop’s quick ratio has fluctuated over the years, from 1.11 in 2012 to 1.04 in 2016. However, its 5-year average value is slightly above the 5-year average of the top 25 firms in its industry as depicted in (Figure 1). This is important because a firm’s quick ratio is equated to its ability to pay current liabilities using assets that can be converted to cash in the near term. A ratio above 1.0 is considered good, and despite the fluctuations over the years, Northrop has managed to remain above a ratio of 1.0; and thus, is in a good position for paying its short-term debts. Northrop’s long term debt to equity ratio has increased over the years, from 0.41 in 2012 to 1.31 in 2016. However, its 5-year average values are below the 5-year average of the top 25 firms in its industry as depicted in (Figure 1). This is important because a firm’s long-term debt to equity ratio shows the balance between the long term debt and stockholders equity in the firm’s long term capital structure. A low ratio is considered good and Northrop’s being lower than the average of the top 25 firms in its industry shows that it has a greater capacity to borrow additional funds if needed, along with an ability to avoid financial distress in the long run (Thompson, 2018-2019).

Northrop’s interest coverage ratio 5-year average is below that of the industry’s top 25 firms’ 5-year average as depicted in Figure 1. Nonetheless, it has consistently increased from 14.76 in 2012 to 41.64 in 2016. The Interest coverage ratio measures the ability of the firm to pay annual interest charges. An interest ratio above 2 is considered good among lenders and Northrop’s being above this speaks positively of its ability to pay its annual interest charges and its ability to avoid financial distress in the long run. Northrop’s inventory turnover has fluctuated over the years from 23.5 in 2012 to 23.08 in 2016. Nonetheless, its 5-year average is above that of the industry’s top 25 firms’ 5-year average as depicted in Figure 1. This is important because it shows how well Northrop is managing its ability to sell or use its inventory in a time period such as a year as opposed to its peers in the industry. Also, it speaks well of Northrop’s ability to successfully manage its assets to generate sales (Mergent, n.d.).

Corporate Governance

Corporate governance is the system by which a company such as Northrop Grumman is guided and controlled. It encompasses the rules, practices and processes of facilitating effective management that can ensure the long term success of a company. The board of directors is responsible for the corporate governance of their company; which involves the balancing of the interest of the company’s stakeholders, namely, the shareholders, management, customers, suppliers, financiers, government, and the community. Issues of corporate governance in companies involve the potential conflict of interest between the board of directors and stakeholder groups like the shareholders and the employees. For example, the board of directors may want to boost the company’s performance in the short term to gain performance related rewards, while the shareholders whom are more interested in the long term performance may oppose this decision as they stand to lose if the company runs into financial problems. Corporate governance is essential in the decision making of a company and its management. Thus, the strength of the company depends on the balance of power between those who own the company and those who run it.

Northrop Grumman has 13 individuals on its board of directors; each with their own views, interests, and concerns. Serving as the Chairman and Chief Executive officer is Wes Bush. The dynamic within the board of directors group exist that certain individuals such as the Chief Executive Officer or the Chairman have more significant influence than others in the group which may influence the power dynamic in the group. However, the responsibilities of the board remains unified in that they are primarily responsible for fostering the long term success of the company and promoting the interest of the stockholders; as the board is elected by the stockholders to promote their interest by maximizing value through their decision making and oversight responsibilities (Northrop Grumman, n.d.). The officers of Northrop Grumman are 16 in total. The responsibilities of the officers remain unified along the common goal of managing the day to day business affairs of the company and the employees under the direction of the Chief Executive Officer and the oversight of the board. The company’s officers, the board of directors, and the employees are essential members of the corporate governance of the company (Northrop Grumman, n.d.).

Firm’s Global Challenges

Northrop is exposed to some of the challenges that affects firms operating across the globe, such as the need to comply with each country’s rules regarding products imported from other countries. At times, Northrop may need to customize their products or services to each culture or country; this includes the marketing materials, and pricing and packaging. Reaching these different cultures can require significant staff time and money. Northrop would be without a doubt exposed to currency fluctuations, as the relative strength of the U.S. dollar against the currencies in the countries they supply can make their products and services expensive or inexpensive. All these challenges will most likely impact Northrop’s operating profits or financials either positively or negatively.

Northrop’s Current Functional Level Strategies

Northrop’s Human Resource Strategy

Northrop’s human resource strategy is focused around attracting and retaining the best employees. They aim to accomplish this by providing their employees with an inclusive work environment where employees are receptive to diverse ideas, perspectives, and talents. This is done in hopes that attaining employees who possess such qualities would help the company address its biggest customer challenge; the provision of some of the most technically sophisticated products, programs, and services in the world. Northrop accomplishes their human resource strategy through multiple venues. The first is their commitment to providing a gold standard work environment, where its employees feel welcomed, challenged, and rewarded for their contributions to the organizations success (Northrop Grumman, n.d.).

The second is through several programs and initiatives throughout the company to help further diversity and inclusion. The programs and initiatives help Northrop to recognize and celebrate its diversity, while also supporting its employees through resource groups. Northrop currently has more than 19,000 employees coming together in 12 different employee resource groups. These resource groups compose 220 plus chapters, all with the common goal of offering opportunities to every member of the Northrop Grumman team, improving the company’s diversity efforts, and furthering the company’s partnership efforts with the community. Northrop’s belief in employing the human resource strategy of attracting and retaining the best employees is that their success in such a quest will allow the company to meet its goals of achieving superior financial performance, while delighting the customers, and rewarding their shareholders (Northrop Grumman, n.d.).

Northrop’s Marketing Strategies

Northrop’s marketing strategy is to boost stakeholders’ confidence and trust in their employees, and their capabilities as a company. Their strategy Involves shinning a spotlight on each segment of its business along with highlighting the efficiency and reliability of its employees and the technologies they develop. This is evident through various advertisements featured on Northrop’s website, through which Northrop communicates to their various stakeholders those values that are dear to them and how Northrop is addressing it. Through these advertisements, Northrop communicates to it employees that they have a voice, and everyone can and will be heard. Northrop communicated to the public and its customers to have confidence in them by stating that their workers are creative, they solve problems that people care about, and their talent and skills are impeccable to developing reliable technologies through using reliable resources. Through various Social Media sources (inclusive of Facebook, Twitter, and Instagram) and a news release tab featured on their website, Northrop communicates to its shareholders that increasing their values is their top priority through featuring various latest achievements and developments in their different business segments (Northrop Grumman, n.d.).

Northrop’s Current Business Level Strategies

Northrop’s Differentiation Strategy

Northrop’s industry environment has always been highly reliant on military spending. Over the years, this industry environment has become more structured on increasing competitive pressure, and a more budget conscious customer base. Moreover, the departments and ministries of defense have shifted some of their attention to vendors that aren’t part of the core defense industry, particularly technology firms. Northrop has not only paid attention to such changes but had also developed and adopted a differentiation strategy to adapt to the industry changes. A differentiation strategy means identifying the most important criteria used by buyers in your market and then designing product, service or other offerings in a way that best meets those criteria. Northrop accomplishes this strategy through its current business segments such as the Mission Systems segment, which features a differentiated C4ISR and cyber solutions to deliver timely, mission-enabling information, and provides superior situational awareness and understanding to protect the U.S. and its global allies. It also accomplished this strategy through several business ventures that the company is currently involved in (Northrop Grumman, n.d.).

Northrop’s business ventures afford the company the ability to provide strategic products, services, and focused development in key technology areas (Marx, 2016). Northrop’s current business ventures are 7 in total and are inclusive of the following: AOA Xinetics designs (develops and manufactures a wide variety of standard and custom electro-optic and opto-mechanical products), Astro Aerospace (pioneered the technology of space deployable structures with a 100% success rate for over 50 years), Cutting Edge Optronics (is a leading provider of high power diode laser components, DPSS pump modules, and lasers), SYNOPTICS (the world leader in the manufacture of advanced crystals, solid-state laser materials and components), Microelectronics Products Services (produces high-speed components for cellular and broadband wireless systems and aerospace applications), Scaled Composites (is a leader in specialty composite structure design, analysis and fabrication, and developmental flight tests), and Sonoma Photonics (develops advanced thin film technologies for optical, resistive, and magnetic products). All of Northup’s ventures are individually managed to maintain operational freedom, creativity, ingenuity, low costs and rapid response (Northrop Grumman, n.d.).

Northrop’s Current Corporate Level Strategy

Northrop’s Current Businesses Involvements

Northrop currently operates in three primary business sectors: Aerospace, Mission Systems, and Technology services. Northrop’s Mission Systems sector is a leading global provider, manufacturer and integrator of advanced, secure and agile software-defined systems and solutions. Northrop’s Technology Services is a global provider of innovative and cost-effective solutions. Northrop’s Aerospace Systems is a premier provider of military aircraft, autonomous and space systems and next-generation solutions to assisting their customers worldwide while preserving the freedoms and advancements of human discovery. All these sectors are operated in a manner that boosts their performance through Northrop engaging in differentiating its products, maintaining innovative and cost-effective measure in the creation of its product, and sustaining a modernized supply chain management, training, simulation, and high technology in the provision of its services (Northrop Grumman, n.d.).

Northrop’s Current Global Strategy

Northrop’s Global Strategy

According to Northrop’s website, they are a leading global security company, committed to being at the forefront of technology and innovation, while delivering superior capability in tandem with maximized cost efficiencies (Northrop Grumman, n.d.). This very statement depicts Northrop as having a global strategy where cost reduction is derived from economies of scale. Northrop has markets arounds the world, and continues to expand its international presence, strength, and partnerships globally. Northrop has a range of industry-leading capabilities for markets around the world and sells products and services to customers in 25 different nations. Northrop has a well-established international presence outside the United States, with global headquarter located in, Australia, Europe, Japan, Saudi Arabia, South Korea, and the United Arab Emirates (Northrop Grumman, n.d.).

Northrop’s Opportunity and Threat Analysis

Northrop Grumman Corporation currently operates in an industry with a positive outlook. Northrop also possesses a strong order backlog. Both these opportunities will afford Northrop a chance to grow in its existing markets and into new markets. Threats to such growths are Northrop’s exposure to liabilities from contract violations, liabilities from failure to comply with regulatory laws governing its business activities both domestic and international, and sturdy competition from other established firms in its industry, as these factors may adversely affect Northrop’s operations and finances.

Opportunity - Positive Outlook for the Aerospace & Defense Industry

The U.S. comprises the largest market for defense equipment, systems, and services in the world. Factors like increasing international market for weaponries, the use of innovative technologies in warfare, and an increased demand for cost-efficient production of innovative technologies are increasing revenue growth in the U.S. Aerospace and Defense industry. In addition, current and past situations like the North Korea situation as well as issues with Russia have prompted the administration to strengthen the country’s military capabilities. On Mar 16, 2017, President Trump unveiled the Pentagon’s fiscal 2018 (FY 2018) budget proposal, reflecting a total increase of $54 billion over the current FY 2017 level of $700 billion. All these factors combined means more investment in the industry, which equals more orders from defense contractors like Northrop. This opens the door for Northrop to increase its presence and profits through new and existing markets (Zack, 2017).

Opportunity - Strong Order Backlog

Northrop has a strong order backlog. A strong backlog is highly indicative of substantial demand for Northrop’s products and services in the market. This offers Northrop the possibility to improve its market position further as new investors and customers may see this as a sign that the company is experiencing a stable growth (Northrop Grumman Corp, n.d.). Northrop’s total backlog includes the funded backlog which represents firm orders that are authorized and appropriated; and unfunded backlog which represents orders that funding’s are not yet authorized and appropriated. Northrop’s total backlog as of Dec 31, 2016 is $45.3 billion, and $42.8 billion as of Dec 31, 2017 (Northrop Grumman proxy Statement, 2017).

Threat - Contract Compliance

Northrop primarily deals with government contracts, which are subject to several intricate procurement laws and regulations. Over the years, complying with the intricate procurement laws and regulations have left Northrop exposed to the liability of contract misconduct. Such liabilities are inclusive but not limited to administrative, civil, or criminal proceedings; with the ultimate outcomes being fines, penalties, or repayments that may cause damage to the company by negatively affecting its financial performance. Northrop has paid $862.2 million in fines over the span of 23 years for 40 occurrences of contract misconducts relating to fraud, labor law violations, environmental laws, and ethics (Northrop Grumman Corporation, 2017).

Threat - Environmental and Regulatory Obligations

As a global company that is involved in the development and operation of nuclear powered aircraft carriers, submarines, and other nuclear operations, Northrop is regulated by both domestic and international laws. This makes Northrop susceptible to liabilities related to harming the environment and human health because Northrop handles, stores, and disposes of radioactive materials in conducting its business. Failure to comply with the regulations that governs Northrop’s business either domestically or internationally could result in certain disciplinary actions. These disciplinary actions may be applicable to Northrop in the form of fines, penalties, debarment, or result in their inability to receive future contracts. It is in Northrop’s best interest to limit its exposure to such liabilities as best as it can to safeguard against the adverse effects of such disciplinary actions on its financial performance (Northrop Grumman Corporation, 2017).

Threat - Strong Competition from other Established Firms

Northrop operates in an extremely competitive market. Northrop’s competitive edge in such a market is derived from its product differentiation based on factors like technological superiority, reputation, pricing, past performance, and delivery schedules. Northrop’s major competitors are companies like BAE Systems plc, Booz Allen Hamilton Holding Corporation, and General Dynamics Corporations. As some of Northrop’s competitors have better engineering, manufacturing, or marketing capabilities, they serve as a competitive threat by means of being a substitute for the company’s product and services. Overall, such strong competition in Northrop’s industry could negatively affect its operations and financial conditions (Northrop Grumman, n.d.).

Northrop Grumman’s Strength and Weakness Analysis

Northrop Grumman Corporation is financially strong relative to other companies in its industry. Northrop’s focus on innovation and diverse products and services allows it to be able to reduce its business risks while also taking advantage of new and existing markets. Northrop’s weaknesses can be associated with its overdependence on a single contractor and its vulnerability to liabilities resulting from contract breaches.

Strength - Financial Performance

A financially strong company is very attractive to lenders and stockholders, which increases the ability of a firm to raise capital. Based on earlier analysis of Northrop financials, the firm has shown a positive trend in its ability to pay its current liabilities over the years. Northrop has also managed to surpass the industry’s average current ratio which is representative of the top 10 firms in the same industry. Thus, Northrop is financially strong, especially when compared to others in its industry (Northrop Grumman Corp, n.d.). Northrop’s operating profit margin has slightly decreased over the past years, however, compared to the average of the top 10 companies in the industry, Northrop has consistently realized more profits than those in its industry over the same period. Northrop’s ability to maintain its position above the average of the top 10 firms in its industry is supportive of Northrop’s financial performance as its strength and will surely aide the company in any future efforts to acquire additional needed funds (Northrop Grumman Corp, n.d.).

Strength - Focus on Innovation

Northrop’s success at innovation can be attributed to its method of recruiting partners that will help the firm meet its innovative needs. Northrop currently features several innovative challenges on its website. These challenges are tailored to Northrop’s need for innovations and to specific vendors such as organizations, small businesses and suppliers, and universities. The vendors can partner with Northrop by producing solutions for different innovative challenges listed on Northrop’s website. Innovative products are of value to Northrop’s customers, and Northrop’s focus on innovation has enabled it to produce innovative products that meets its customers’ expectations (“Calls for Innovation”, n.d.).

Strength - Diverse Products and Services

Northrop operates through three business segments: Aerospace systems, Mission systems, and Technology Services. The Aerospace Systems segment designs and develops 6 other sub segments inclusive of manned aircrafts, autonomous systems, and space crafts. The Missions Systems segment is engaged in 14 other sub segments inclusive of radar, cyber solutions, and intelligence processing systems. The Technology Services segment is the provider of 7 other sub segments inclusive of fraud detection and compliance service, land force sustainment, and system and software modernization. Northrop’s diverse products and services helps the company serve a wide customer base; allowing the company to cover a diversified market and attract clients which could potentially boost its revenue and market share. In addition, having such diverse products and services protects Northrop against unfavorable market changes by distributing its business risks, all the while increasing the firm’s potential to gain from opportunities available in new and existing markets (Northrop Grumman Corporation SWOT Analysis, 2017).

Weakness - Overdependence on a Single Customer & Contract Breach

Northrop’s primary customer is the US Government and its agencies. This also means that a majority of the company’s revenue is derived from the US Government and its agencies. (Northrop Grumman, n.d.). This level of overdependence leaves Northrop vulnerable to unforeseen circumstances, such as the US government terminating contracts, changes in defense approvals, changes in congressional appropriations, and changes in government regulations which could unfavorably affect its business operations and profitability (Northrop Grumman, n.d.). In addition, Northrop’s image and customer confidence in its abilities could be impacted by a contract breach between the company and the government. The commonwealth IT department, called the Virginia Information Technologies Agency, as a representative of the government, accused Northrop of a breach of contract five times in year 2016. The government had contracted with the company since 2006 to operate and overhaul aging IT systems. Due to the accusations of such breach, the government withheld $10 million in payments to Northrop. In addition, Virginia leaders are seeking alternative vendors instead of renewing Northrop’s contract in year 2019. This leaves Northrop susceptible to losing market share and revenue in that segment of its business (“Corporation”, 2017).

Northrop Grumman’s Threat, Opportunity, Weakness, and Strength Analysis

Strengths and Opportunities

Northrop operates in the Aerospace and Defense industry. This industry is currently viewed as having a positive outlook, as changes in government policies and political relationships between different countries have resulted in increased investment in the industry. This translates to an increased demand for the products of defense contractors. Northrop also possesses diverse products and services; Northrop can leverage this to make itself readily available to meet the needs of the government and position itself as their preferred contractor through its ability to offer various products and services that they might have a need for. Another one of Northrop’s strength is the firm’s focus on innovation; this can be leveraged by Northrop to maintain their relevancy in the industry, while creating innovative products that would match or exceed the customers’ expectations; thus, making the firm more competitive and attractive to its customers during this period of increased demand. Northrop also currently has a good financial standing in its abilities to pay current liabilities, pay interest expenses and even pay dividends to shareholders. This puts the company in a great position to leverage its financial position to generate additional cash that might be needed to increase production and in meeting increased demands.

Northrop’s strong order backlog is indicative of a high demand for Northrop’s products and services in the market. As Northrop also has a strong focus on innovation, the firm can utilize this focus to take advantage of the high demand for its product in the market. It can accomplish this by not only introducing new products to new and existing markets, but by also using the demand to create greater exposure for its new and less popular products. This gives Northrop the ability to sell to the customer what they think they need, and what they didn’t know they needed. Northrop’s favorable financial position can also be utilized in taking advantage of the high demand for Northrop’s products. Having a favorable financial position would allow Northrop the flexibility to fund the research and development of current and new innovative products to feed into the markets and meet their customers increased demand.

Strengths and Threats

Over the years, complying with government contracts that are subject to intricate procurement laws and regulations have left Northrop exposed to the liability of contract misconduct. Such a liability can adversely affect its financial performance. Northrop’s focus on innovation will aide in avoiding contract misconduct through Northrop creating new products or services that are controlled by less restrictive guidelines and regulations such as products made for the commercial aviation sector. This would lessen the firm’s exposure to liability or the fines and penalties attributed to not adhering to them. These actions combined would allow Northrop to distribute and diminish the risk of contract misconduct by increasing their market share and revenue in a manner that would allow them to absorb any financial ramifications when they occur.

Northrop is involved in the development and operation of nuclear powered aircraft carriers, submarines, and other nuclear operations that require the firm to meet certain environmental and regulatory obligations. This makes Northrop susceptible to liabilities related to harming the environment and human health which can result in disciplinary actions that would negatively affect its current and future financial performance. Northrop’s focus on innovation can aide the firm in lessening such liabilities by allowing the firm to develop the use of an alternative source of energy like electricity to replace those of their nuclear operations. As an alternative, the firm could keep their nuclear operations but develop new and improved technologies that would reduce or prevent the risk of their nuclear operations harming the environment or human health; which also lessens their liability from such operations. Northrop’s widespread products and services will also allow the firm to reduce the liability from environmental and regulatory obligations through the firm building and increasing the contribution margins of it commercial aviation and health business sectors that are not governed or susceptible to the same environmental and regulatory obligations or the high risk and liabilities that accompany its nuclear operations.

Northrop’s competitors such as Lockheed Martin and Boeing have better engineering, manufacturing, or marketing capabilities. They also serve as a competitive threat by means of being a substitute for the company’s product and services. Such strong competition in Northrop’s industry could negatively affect its operations and financial conditions. Northrop’s focus on innovation is one of the ways that the firm can avoid this threat. It can use its innovative products to maintain a differentiation strategy that makes its services and the ingenuity of its products unparalleled to others in its industry. Northrop’s diverse products and services can also allow the firm to avoid this threat by distributing the firm’s risks. Namely, Northrop can alter the contribution margins of its products and services such as the Aerospace systems sector, Mission systems sector and the Technology services sector such that any one product or service will not substantially impact the company’s earnings negatively, if the associated contract was canceled.

Weaknesses and Opportunities

A majority of Northrop’s revenue can be traced to the U.S government. This level of overdependence on a single contractor makes Northrop vulnerable to factors such as contract terminations, changes in defense approvals, changes in congressional appropriations, and changes in government regulations. Northrop’s strong order backlog is indicative of a substantial demand for their products and services. Northrop can use this substantial demand for its products and services to bid for other non-government contracts that could complement or serve as a replacement for the U.S government contracts, thus decreasing their dependency on U.S government. The positive outlook for the Aerospace and Defense industry would also aide in Northrop being able to acquire these non-government contracts because they would be able to build and solidify new revenue sources from the increased demand in the industry. Lastly, the industry’s positive outlook puts Northrop in a secure position that mitigates the vulnerabilities of its dependency because the industry is currently investing more into defense contractors and the government needs Northrop’s to meet its current demands and may not take any adverse actions to jeopardize that.

Northrop is susceptible to losing market share and revenue in certain business segments because of contract breaches. This could also go on to affect Northrop’s image, customer confidence, and contractor confidence in its abilities to perform. Northrop is currently enjoying a positive industry outlook. This means that Northrop can increase its presence and profits through new civilian and existing military markets. Northrop can take advantage of this and diminish its susceptibility to contract breaches by branching into new markets that have less restrictive and manageable contracts. This would lessen the cost, and consequences of the firm maintaining such contracts or the possibility of violating its terms.

Weaknesses and Threats

Northrop’s dependence on a single contractor can be minimized by acquiring more contractors through diversifying the application of its products and services to be more inclusive of commercial and industrial sectors. This would also minimize Northrop’s weakness such as contract breaches, and Northrop’s threats such as the threat of contract compliance or environmental and regulatory obligations. This is because the industrial and commercial sectors are under different and less stringent laws, regulations and sanctions. The strong competition that the firm currently faces in its industry can be minimized through using the firm’s innovative focus to create unique products and services that are less likely to be replicated by its competitors. The firm can also minimize competition by acquiring other firms which would increase its engineering, manufacturing, and marketing capabilities to match or surpass its rivals.

Potential Strategies for the Firm

There are four potential strategies that Northrop can follow: a market expansion strategy, a product expansion strategy, a market penetration strategy, and an acquisition strategy (“Growth Strategies in Business”, n.d.). Northrop employing either of the following four strategies would allow the firm to increase market share and benefit from its strengths and opportunities while diminishing its weakness and threats. The market expansion strategy would require Northrop to sell its current products in a new market such as the commercial and industrial sectors. The acquisition strategy would entail Northrop purchasing another company to expand its operations. The product expansion strategy would involve Northrop continuing to expand its product line or add new features to increase its sales and profits. The market penetration strategy would necessitate Northrop to market existing products within the same market it has been using (“Growth Strategies in Business”, n.d.). All the above strategies would increase Northrop’s market share and bottom line in new or existing markets; which would leave Northrop in a better position to compensate for any weaknesses or threats that might face the firm.

Conclusion

Northrop operates in a capital-intensive industry that requires a high level of investment in people, facilities, equipment, and infrastructure. To stay competitive in its industry, Northrop has used an acquisition growth strategy over the years (Salamie, 2017). Beginning in 1994, Northrop pursued and acquired the Grumman Corporation. This acquisition made Northrop a more diversified company than its competitors by giving Northrop the electronic and surveillance expertise along with ties to the U.S Navy that were unique to Grumman. In the years to follow, Northrop partook in many other acquisitions that aided in its growth in the industry. Northrop acquired 15 companies for $15 billion dollars over the period of 1994 to 2002 (Northrop, 2017). These acquisitions made Northrop the second largest defense contractor in 2002 and most likely allowed Northrop to increase and improve its engineering, manufacturing, and marketing compared to most of its rivals in the industry.

Other strategies used by Northrop through the years have complemented the firm’s acquisition growth strategy. Northrop’s current functional level strategies (such as their human resource and marketing strategies) have aided in the firm’s growth through enabling Northrop to be able to provide technically sophisticated products, programs, and services to their global customers while also increasing the confidence of Northrop’s stakeholders in the firm and its employees. Northrop’s current business level strategies (such as their differentiation strategy) have aided in the firm’s growth through enabling the firm to provide strategic products, services, and focused developments in key technology areas. Northrop’s corporate level strategies (such as their business involvements) have aided in the firm’s growth through enabling Northrop to differentiate its products, sustain a modernized supply chain management, maintain innovative and cost-efficient measures in the creation of its products, and sustain high technology in the provision of its services. Lastly, Northrop’s global strategies have aided the firm’s growth by enabling the firm to develop a range of industry leading capabilities for markets around the world while selling products and services to customers in 25 different nations (Northrop, 2017).

In addition, other factors such as Northrop’s corporate governance and unique set of strengths and opportunities have and are currently supporting the firm’s viability. Northrop’s board of Directors have governed the firm in a direction that fosters the long-term success of the company while maximizing the values of the stockholders (Wesley, 2014). Northrop’s strengths (inclusive of its financial performance, focus on innovation, and diversified products and services) have increased the company’s appeal to its stakeholders, enabled the firm to produce innovative products that meet consumer demands, and protected the firm against unfavorable market changes by distributing its business risks. Northrop’s opportunities (inclusive of the Aerospace & Defense industry’s positive outlook and a strong order backlog) are giving the firm the potential to increase its presence and profits through new and existing markets (Northrop, 2017).

Northrop’s acquisition growth strategy has been effective for the firm’s survival in the past. Other strategies and factors mentioned above have also proven to be effective through making Northrop one of its industry’s leading U.S defense contractors (Salamie, 2017). Northrop’s current unique sets of strengths and opportunities are favorable for Northrop to continue its growth strategy of acquisition. Northrop should continue to use its acquisition growth strategy as it stands to gain market share, revenue, new areas of expertise, increased efficiencies, and cost controls from acquiring other firms in the industry (“Benefits of a Merger,” 2018). Overall, the continuation of Northrop’s growth strategy of acquisition along with the other strategies and factors listed above will continue to make Northrop a more diversified and competitive company in its industry.

References

Benefits of a Merger or Acquisition. (2018, January 17). Retrieved February 28, 2018, from https://www.mbda.gov/news/blog/2012/04/benefits-merger-or-acquisition

Calls for Innovation (CFIs). (n.d.). Retrieved February 13, 2018, from http://www.northropgrumman.com/AboutUs/InnovationNetwork/Pages/CallsForInnovation.aspx

Company Leadership. (n.d.). Retrieved February 03, 2018, from http://www.northropgrumman.com/AboutUs/CompanyLeadership/Pages/default.aspx

Corporation, N. G. (2017). Northrop Grumman Corporation- Financial and Strategic Analysis Review. GlobalData, 1-5. http://www.mergentonline.com/Company financials

Growth Strategies in Business. (n.d.). Retrieved March 06, 2018, from http://smallbusiness.chron.com/growth-strategies-business-4510.html

Marx, C., Starr, R., & Lay, W. (2016, March 11). 2016 Aerospace and defense industry trends. Retrieved February 07, 2018, from https://www.strategyand.pwc.com/trends/2016-aerospace-and-defense-industry-trends

NOC : Summary for Northrop Grumman Corporation. (2018, February 03). Retrieved February 03, 2018, from https://finance.yahoo.com/quote/noc?p=noc

Northrop Grumman Corporation. (2017). In J. P. Pederson (Ed.), International Directory of Company Histories (Vol. 189). Farmington Hills, MI: St. James Press. Retrieved from http://bi.galegroup.com.ezproxy.libproxy.db.erau.edu/essentials/article/GALE%7CI2501321503/29a537855f1ec09f11e22452a39a99e5?u=embry

Northrop Grumman Corporation – The Economist. (n.d.). Retrieved March 8, 2018, from http://www.bing.com/cr?IG=F7824B536489432C92B8EC97568D6477&CID=0FAF62BBDBF761EF1A806917DA586046&rd=1&h=dMWIYwhHjiOYREkDKkbWMHiDxcr4GRUayPrE1vqncNk&v=1&r=http%3a%2f%2fwww.economist.com%2ftopics%2fnorthrop-grumman%2findex.xml&p=DevEx,5056.1

Northrop Grumman Corp. (n.d.). Retrieved February 13, 2018, from http://www.mergentonline.com/Company financials

Northrop Grumman 2017 Proxy Statement. (n.d.). Retrieved February 15, 2018, from http://searching.northropgrumman.com/search?q=order%2Bbacklog%2B2018&btnG=Search&client=default_frontend&output=xml_no_dtd&proxystylesheet=default_frontend&ulang=en&sort=date%3AD%3AL%3Ad1&entqrm=0&wc=200&wc_mc=1&oe=UTF-8&ie=UTF-8&ud=1&exclude_apps=1&site=All_Northrop_Grumman

Salamie, D. E., Covell, J. L., & Ingram, F. C. (2017). Northrop Grumman Corporation. In J. P. Pederson (Ed.), International Directory of Company Histories (Vol. 189, pp. 316-327). Farmington Hills, MI: St. James Press. Retrieved from http://bi.galegroup.com.ezproxy.libproxy.db.erau.edu/essentials/article/GALE%7CCX3656500066?u=embry&sid=summon

Thompson, A. A. (2018). Strategy core concepts and analytical approaches. Barr Ridge, Illinos : McGraw Hill Education .

Wesley G. (wes) bush – chairman, president and CEO, northrop grumman corporation (2014). San Francisco: Boardroom Insiders, Inc. Retrieved from http://search.proquest.com.ezproxy.libproxy.db.erau.edu/docview/1656320822?accountid=27203

Zacks. (2017, November 16). Aerospace & Defense Industry Outlook – November 2017. Retrieved February 13, 2018, from https://www.nasdaq.com/article/aerospace-defense-industry-outlook-november-2017-cm878952

Cite This Work

To export a reference to this article please select a referencing stye below:

Related Services

View allRelated Content

All TagsContent relating to: "Business Analysis"

Business Analysis is a research discipline that looks to identify business needs and recommend solutions to problems within a business. Providing solutions to identified problems enables change management and may include changes to things such as systems, process, organisational structure etc.

Related Articles

DMCA / Removal Request

If you are the original writer of this dissertation and no longer wish to have your work published on the UKDiss.com website then please: